Following on,and for those Paying Attention!

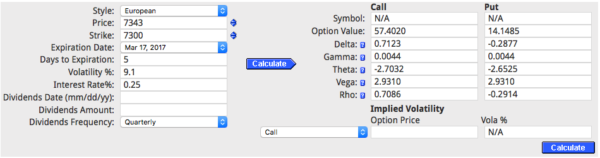

I gave a link to John Carter previously, and his thoughts on trading low vol. This brings us to the rather ugly scenario of buying an ITM call. The March expiry only gives us a few days but we pay almost no extrinsic premium(time value, or theta) as this decays big time. The April 7300 call is either about 85 or 105 depending on whose data you look at. I will get real prices on Monday.

So Why Take This Trade?

It seems the market is going up and if you look at the history of expiry weeks they usually see the market being bought. Some unkind folk might say this is manipulated to get the put sellers out of trouble. Check those charts,which you have certainly been keeping for a rainy day.

Speculation vs Risk Management

This is an expensive trade and if it goes wrong it will get ugly very quickly. It does not suit me personally as I’m not a directional trader. The logic goes like this: Delta is a proxy for the chances of an option expiring in the money. This call has a 71% chance, as opposed to buying say a 7450 call for a few pence with a 0.10 Delta or 10% chance of winning. Who or what is right? I don’t know, it’s about personal choice.

Options v Futures

In a directional scenario like this, you may think the future is a better trade. You’d probably pick the next(June) expiry as they expire quarterly. This week is triple witching:indexes,equity options,and futures expire. They get rolled over by many traders. Pick your poison.♠ We’ll watch this trade with interest when I update prices next week.

OK well I saw the price around 59 on Monday-let’s stick with that- it hit 73,but it’s got until 10 on Friday to come right

price hit 135- more than doubling our money.