Erratum: Humble apologies for any confusion

*please note the prices in Trade 181 were the wrong way round -lower strike puts are always cheaper

That Was The Week – Quietish Drift Lower

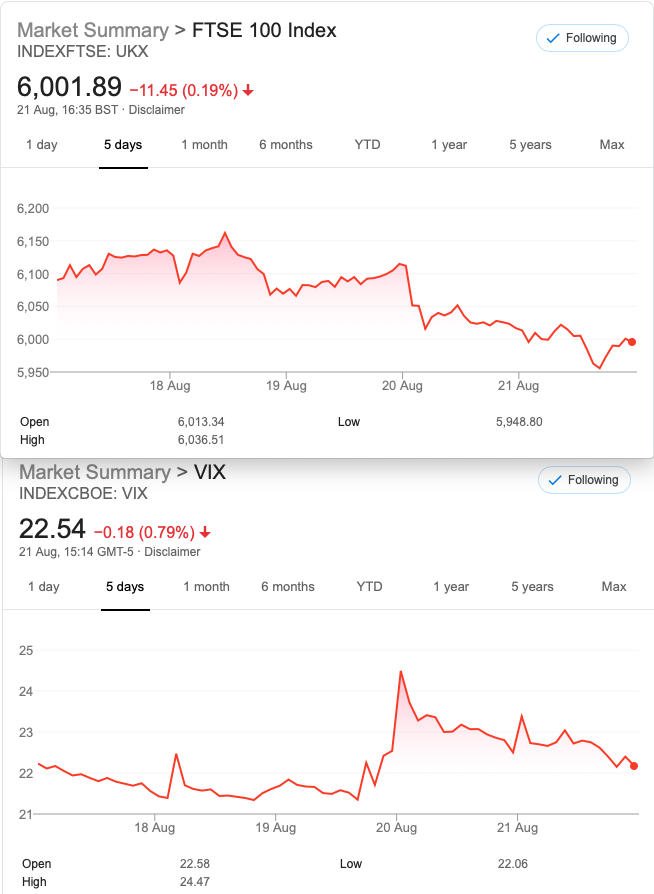

No news is good news so the saying goes, but we saw US politics cut and thrust, over 1 million signed on the ‘dole’ in the US despite all the froth about jobs being created. The UK saw retail sales back up against the backdrop of utter confusion re: Covid regulations and distancing. The mystery continues as to death rates in the UK and US compared to Asian nations. Various claims about vaccinations, but nothing earth shattering. Boozers are back in business and scarcely bothering with any kind of distancing, no fault of the pubs. So the second wave is the concern as it could exceed the first in magnitude. Traders like us need to keep a weather eye on another panic drop…. or panic melt up. Central bank largesse knows no bounds when they vote for QE after a big lunch!

Sympathy for those young people with variable exam results, but no better time to learn how to trade options, with dad’s or mum’s pension pot.

Tweet of The Week (My Chart- Their Tweet)

The Tweet alludes to Friday’s impending expiry and wondering who would be sweating most- those call buyers or sellers. We’ve seen some wild wild pricing in the FAANGs. We also saw ‘lumber’ rocket up too as the ETF reflected the shortage of wood for building construction. Other wood uses may have been a matter for consideration. Apple didn’t hit the $500 mark as shown, so Robin Hood long only call buyers dipped out. They’ve had a great run to date, so no tears for them!

Distraction Trades

DAX continues to amuse and the method gives good entries but exit is everything and there were some moves that generated 30 points, sometimes with an almost instant reversal. A few 100+ runs, but tricky as there was no clear bias. Options can be so much kinder, though our timeframes don’t suit most traders. Their problem.

Those Legacy Trades +

Weekend Strangler

Last Week Sept 6300 Call 53.5 and 5700 put 52.5 = 106 Monday’s close 59 and 40 = 99 Tiny win but would you?…

This week 6200 call 43 and 5650 put 48= 91 Oh! 96Loser ( However drop to 80 on Tuesday )

Trade 180 A Revisit to a Curious Trade

Our calendar(time spread) selling near month 6000 put, buying far month 6000, but…….selling a very far OTM 5500 put(Sept) Our cost is zero(margin req’d) and theta is onside bigly. Prices (short 106 and 66) 171.5 = -0.5 Unchanged.

Last week 177.5 (Aug) Sept 239.5 and 82, so a loss of 20, this swung back to 22 credit Now 51 BIIIIIG WIN!

Now massive win around 100 By chance FTSE expiry made the Aug put worth nothing

*Trade 181 Far OTM ERRATUM -Please SEE Prices were the wrong way round

So, another theta play with a put ratio spread and zero cost. Selling 2×5550 put [59.5] and buying 5800put [31]. Credit 2.5(Margin req’d) Logic of the trade? We are safe down to 5300 . Winner! Credit 14 Hit 23 last Monday. We’d run it some more, but not looking likely to win more than 23- As suspected 23 was the best we could do-why be greedy? NB cost was 59.5 minus 31×2 for the short 5550 puts Therefore a credit of 2.5

Trade 182 Trading the Noise loss of 28 CLOSED

Trade 183 It’s Getting Hard To Find Something Good

The trade: buy one 6000 put, sell 2×5850 puts for Aug expiry. Cost was 94-(46×2)=2 . Was about 10 Win, but not enough! We couldn’t improve on that much. Well, 14.5 on Wednesday WIN

Trade 184 Next, and Near Expiry Cycle

Here’s a mad thing -and not highly recommended but may be a bit of fun. Softies step aside, this is not for the faint hearted because it is ‘expensive’. It’s a bonkers calendar straddle, and assumes the market goes nowhere

We sold the August 6100 straddle call and put( 57 and 74) and bought the Sept 139.5 and 159. We pay (whilst wincing) therefore 167.5 Well, that was a bit of fun now …………. 165.5 Miserable effort, tiny loser. It drifted into a small profit on Thursday however.

Trade 185 New Month Clean Sheet

The calendar trade did extremely well and we like zero cost trades. However, it was serendipity that saw the near month short put go out worthless. For now we will rinse and repeat with a biiiig twist. We have the lower wing of a butterfly as the calendar element. Logic of the trade? That lower leg usually goes out worthless,andwe hate to lose money. Here’s the calculator:

Regular subscribers will know how to figure out the Greeks, but assuming the market doesn’t go the the Moon, this may give us a bit of an edge. The trade is not cheap, however at 186(Sep 6100put)+ 160.5(5900 Oct put), 2x 6000(Sept)put at 137.5=275. Gives us 346.5-275=71.5 This is new territory so wet finger in the wind time. Max profit 200(?) max loss <71.5

Caveat: This is too pricey for us but we’ll test it out.