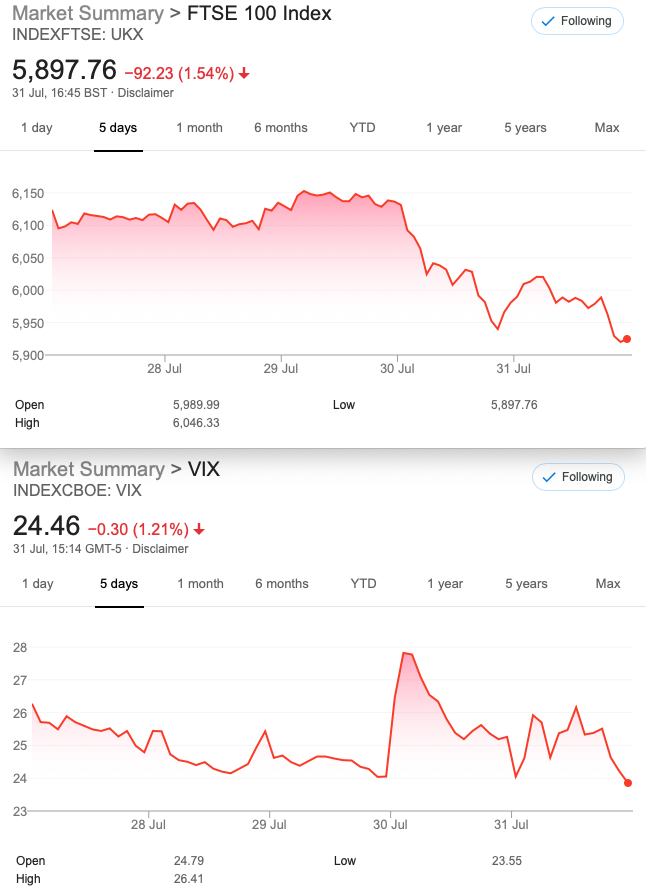

That Was The Week- Couple of Big Down Days Making a Weekly Drop of 3.69%

Forex ‘farmers’ noted that GBPUSD was up another 3¢ this week. We digested some mixed economic news, and got more confusing guidelines. Analysing current news output is fraught with difficulties, as biases seem to be dominating, pragmatism taking a poor second place. Thus I find it difficult to make sense of the week’s action as a barometer of overall conditions. Predictors of normality are by definition unreliable yet nobody sees a miracle occurring any time soon. So there’s a lot of talk about next year seeing a return to the perceived prosperity we have enjoyed/endured since 2009.

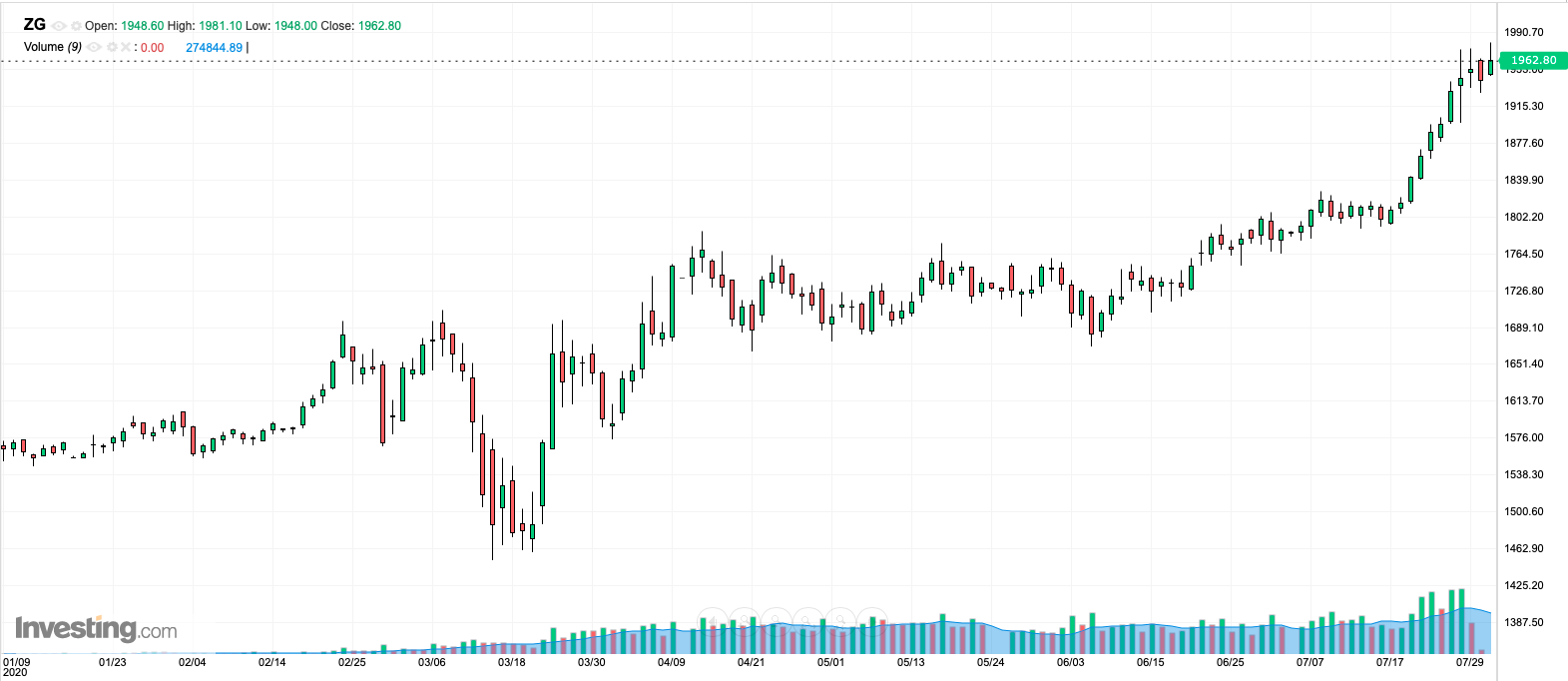

Hedges That Fail, All That Glisters

Yes, it used to be ‘glisters’ but in modern parlance it’s become ‘glitters’. The message of this aphorism is timeless however and needs no explanation. So what the heck is the purpose of gold?

Keen observers will note the similarity with the stock markets, and the inexorable rise linked to easy central bank spending. Thus you wouldn’t have found gold helpful, though its recent meteoric rise must be a comfort for goldbugs. Silver for me has always been the preferred metal- being more easily accessible in pricing, but subject to VAT when buying the physical. From its low, silver has doubled. I liked it at $14 an ounce now at $24 at least our ornaments and jewellry have gained.

Those Pesky DAX and EURUSD trades

Well, not much to say as it’s still early days but the system missed the yuuuuuuge drop as there was not a decent entry. That is a serious flaw and so some homework required. EUR rocketed this week and a trader I follow, stuck doggedly to his short positions, adding to them. Last time I did that was around the end of February and it did not go well. My personal approach would be to build up the trading account until one is trading the market’s money and then scale in. Which brings us neatly to:

The US continues to innovate- why cannot the UK do the same and make efforts to accommodate wannabe traders? Why not have options on the index at £1 a point? “Spreadbets!” You exclaim. But wide spreads make it impossible to create and feel your way around strategies. Thus enforcing trade with the big boys at £10 a point may put off a whole swathe of traders. The market needs participants. Innovators create growth.

Those Legacy Trades

Weekend Strangler

Last week C6300 48 P5750 52 Credit 100 Now 35.5 and 44=79.5

Winner 20.5– I really am trying to break this!!!

This week 5550 Put 37 and 6100 Call 35 total 72

Trade 180 A Revisit to a Curious Trade

Based on Futures price(cash expired at 6262 this week)

Our calendar(time spread) selling near month 6000 put, buying far month 6000, but…….selling a very far OTM 5500 put. Our cost is zero(margin req’d) and theta is onside bigly. Prices (short 106 and 66) 171.5 = -0.5 Unchanged.

This week 177.5 Aug) Sept 239.5 and 82, so a loss of 20

Trade 181 Far OTM

So, another theta play with a put ratio spread and zero cost. Selling 2×5550 put 59.5 and buying 5800put 31. Credit 2.5(Margin req’d) Logic of the trade? We are safe down to 5300 . Zero risk to the upside and if we go nowhere we might close out for a decent credit. >10 would be fine. Winner! Credit 14 We run it some more….

Trade 182 Trading the Noise

Yet again I claim no patent on this and I have never known the ideal conditions but let’s say we’ve had a large move down this week perhaps we will see more big moves next week.This has the potential to profit in a few days -or, to close out for modest loss. It’s the 3:2 ratio straddle. We BUY near month straddles x3 and sell far month x2. 5900 straddle gives us the following Aug prices: (115.5+125.5) x3= 723 Sept( 179 +192.5)x2= 743 Thus, we have to pay up, a debit of 20

Trade180 now 13.5 credit

Trade 181 poss 23

Trade 182-no change!- despite the huge move- this is purely a volatility play

Weekend strangler 72 credit to open- now 82.5