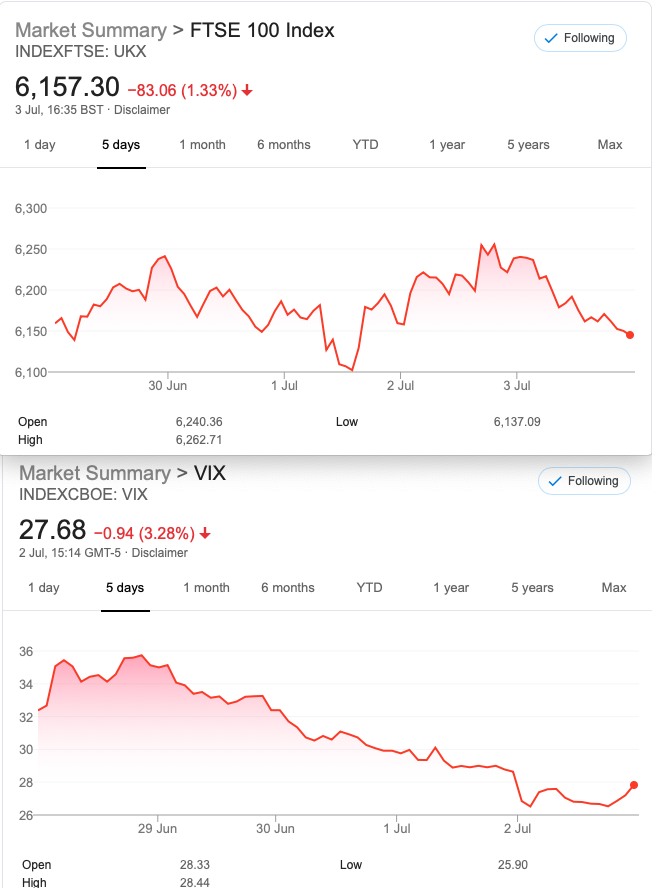

That Was The Week -Ups and Downs But Back To Square One

Without prompting, there appears a slightly worrying theme this week. Fakery. The link below alludes to the mysterious DAX tech issue. https://www.youtube.com/watch?v=s-GlT0LpYFI&list=LLQWrtPult3vXqZiq7BqMOAQ&index=2&t=455s

Then we have this, which personally I just find amusing!

https://smallcaps.com.au/china-counterfeit-gold-scandal-wuhan-kingold-jewelry-fake-bars-loans/

Then there’s the wonderful jobs data- about as solid as those gold bars: https://www.thestreet.com/mishtalk/economics/surprise-the-bls-admits-another-phony-jobs-report

Then we have this! Nasdaq futures

You cannot argue with price action and while the FAANGs have done the heavy lifting, if it looks like hysteria……

Trade Entries Exits and a Couple of Instruments

My first week of trying to trade EURUSD and DAX has proven quite successful basing these on different entry criteria, but failing to get a grasp of exits. Volatility, I understand is high for EURUSD, and we still have VDAX. Entry rules are a work in progress, but using one or two off the shelf indicators. This is still in the demo, or paper trading phase but without the guidance afforded by options, it’s a wide open field. I now think a good trade on EURUSD might yield 30 pips, while DAX you could expect 100 points or more.

So, the additional criteria, such as stop loss and exit are still fluid, but unlike options we cannot take much from underlying volatility. Certainly backtesting would be useful and stops could then be automatically adjusted but it seems vol is more flakey for forex than indexes, as you’d expect. Friday was a sleepy day due to the US holiday ( No idea about that-something about not paying taxes?)

One further point- these things trade overnight and DAX was a buy at 07:00 am (not around for that) on Thursday, no entry short on Wednesday, 100 point short on Tuesday, long on Monday for 100. EURUSD possible 80 pips on the week but trades making <30 pips, and a wide stop. Beginners luck and a long way from banking those profits.

Legacy Trades – Big Winner and that damned Strangle that refuses to lose!

Trade 176 Butterfly Minus a Wing

The great British Leg-in. Our aim was to have a near- free trade, a call butterfly. We buy the 6200 call for 225.5 SELL 2 6400 calls 113.5 x2=227, we await a juicy price to leg in (currently 43) for the 6600 call. This was a buy at 14, making this a debit of 12.5. Closed for 44 Now ….44

Weekend Strangler put 5800 61.5 call 6400 57 total credit 118.5 Oh come on! Winner 78 to close, 40.5 gain*

* Tuesday’s closing prices

Trade 177 The Madness of the Crowd, We Bought into That

Ratio short iron butterfly- we buy the body(6150 call and put) sell the 5900,6300 wings x 2-all clear?

Risk at 5650 and 6450. Credit of 22

Now?….. WINNER -Bigly!

5900 puts 36.5×2, 6300calls 37.5×2.Total 148 6150 long straddle 109.5+99= 208.5 Can anyone do the maths? 208.5-148=60.5. Remember this trade PAID us 22 to enter, so we make 82.5 In beer vouchers that’s £800+ per strategy but of course you’d need margin.

Weekend Strangler

6400 call 74 and 5600 put 72 total 146

WE choose August expiry as premiums are a bit low for July but normally we would not breach the 45 DTE(days to expiry)rule. I hope to break this soon-honestly!

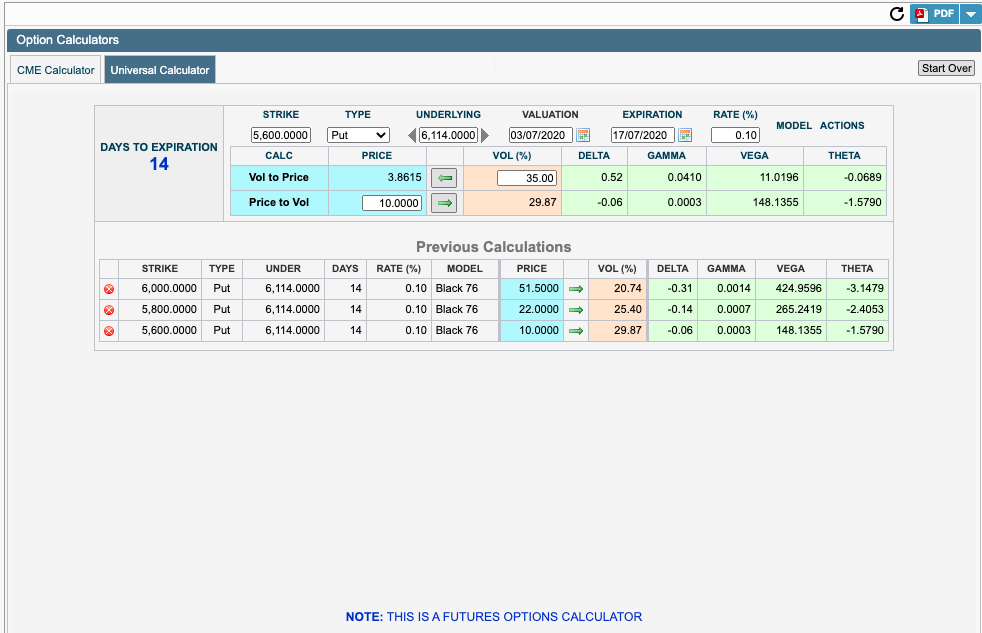

Trade 178 Playing Safe

While our incredible run of winners is fun, we learn little from wins. It looks like there may be some turmoil in the near term and theta becomes a monster in this near-to-expiry time, hence the PUT butterfly. We buy 6000 put, sell 5800 x2 and buy the 5600. Cost 17 max profit 183, max loss 17

While we may not see the index at 5800, we just need the 6000 put to be worth >17 at expiry or the whole strategy worth >40. ( a meaningful profit). should this look unlikely we may be able to pull in some credit using the 6000 as the lower leg of another butterfly.

Something for the weekend geeks https://vlab.stern.nyu.edu/analysis/VOL.UKX:IND-R.GARCH

FTSE vol but not as we know VIX.