What a Week – High Drama Low Expectations

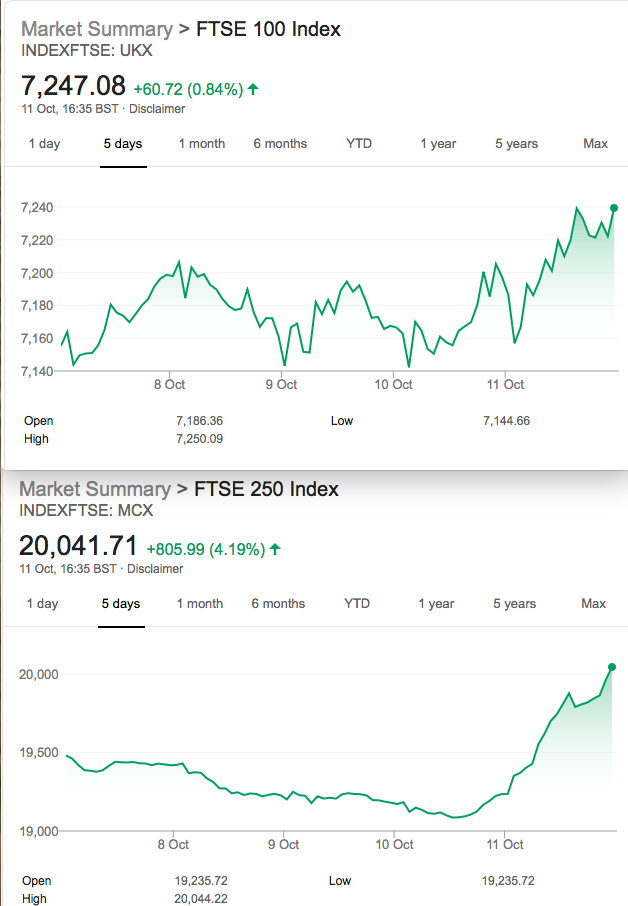

So, Brexit, China/US trade talks…. or the FED? You decide. Buyers of GBPUSD got excited, as we saw from 1.2227 to 1.2703. A 3.9% jump. Curiously FTSE100 up just over 1% from 7160 this week -normally it moves counter to sterling. FTSE250 -well, as you can see!

Some move! Imagine you got that wrong. I heard of a trader who went short 30 Dax contracts ( +2.86% on Fri). Fast way to the poorhouse. This is why we have a problem with directional trading -you have to pick the following: 1. Direction 2. Timing of the move 3. Size of the move. However, the FTSE250 does not have options. Though we are typically geared to a max 3.5% risk to the upside, we could have done ok with such a move. Options are thus very forgiving, we can be wrong on points 1, 2 and 3 and still make money.

A Gift from Tasty Trade

Our Chicago buddies are happy to see this on the site:

Master Mechanics Part Deux (2) (1) (1) (1)

I hope the link works, it’s a great little aide memoire and gives us options traders a head start. Of course we each have our own particular take on things as we are not one dimensional or binary. However, we do not take naked trades in isolation. We want volatility and time decay to work always in our favour. The market will do whatever it wants, that is beyond our control or reckoning. You would not buy a naked call in high volatility market, or sell puts in low vol. Unless we have a good reason. Though in isolation? Nope.

Those Legacy Trades, and a Real Wobble in the Week

Trade150

That Oct/Nov ratio calendar with 7250 puts .

We sold 2xOct expiry and bought 1xNov (88-(34.5×2) )= 19 Debit. I had commented during the week after the calamitous drop. However, it is now in credit 134.5- (60×2)= 14.5, so a small loss of 4.5 as we paid 19. Close out? What if we’d adjusted during the week?

I had written a couple of comments while I had a spare moment. Yikes! Tuesday, we saw prices: 134.5×2 and 203. How nasty is that? 66 points in the brown stuff plus…… our debit of 19.

OK……. panic? Vol was ‘uge so here’s what I could have done.

I’d have bought back the Oct puts (134.5×2) I’d have sold the Nov 7150 puts (152.5 x2). Thus we have a credit of 36, but we paid 19 remember? So now our credit is reduced to 17. How did this trade do? (94.5 x2)- 134.5. Hmm ugly but with a lot of time to run.

How if we convert this into a butterfly? We would need to buy the 7050 put, right? And that costs 65.5. But,you could sell 2 of the 6800 puts for (26×2)= 52. We’d now have a tiny credit (17-13.5)=3.5, a huge butterfly, and risk down at 6800– 0ver 6% below today’s close.

The variables are just too many to deal with, so the above is just one illustration.There are so many ways to adjust. We need to be thinking creatively about risk, money management, and what we are comfortable with. However we should not be too comfortable.

Trade151

We think volatility is still fairly high we should sell premium but limit our risk. Hence our iron condor, October expiry, as follows: sell 7300 call, buy 7350call (25-15) =10 Sell 7000put buy 6950 put (43-33)=10. Credit 20

Thus the logic of the trade- limited risk with break even at 7320 and 6980, max profit 20, max loss (50-20)=30

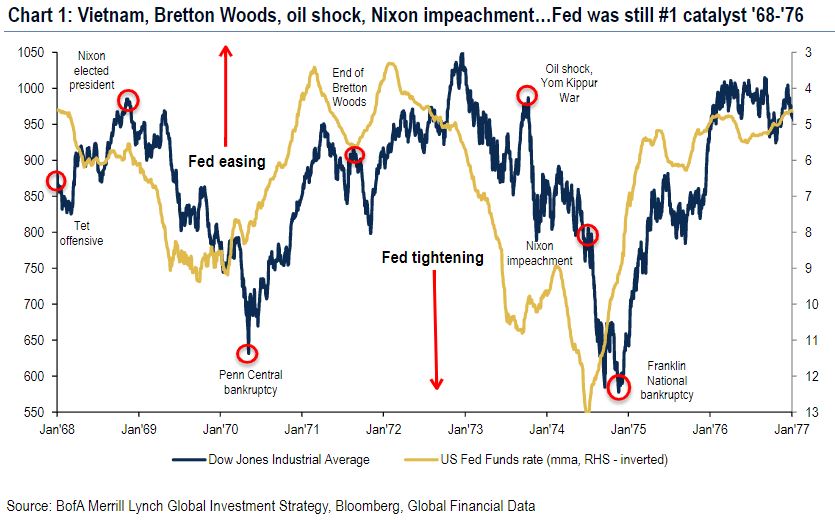

The basis of this is that the market will calm down a bit as the FED and the ECB will support the market, as usual*.

Currently 7300/7350 call spread =(25.5-11.5) = 14, 7000/6950 puts (7-5)=2. Total 16. We are in profit

Trade152

Double up on 151- say whaaaaat?

Some time ago there was a very smart iron condor trader who said “just add another iron condor when the market moves”. OK? Well he’s made his wedge but does this still hold good today? Imagine the trade is like a bridge over the index( river) where neither end of the bridge is touched by the market(river). We can juice up the put side here and sell the 7150/7100 spread(27.5-16.5) =11. Sell also the 7350/7400 call spread (11.5-4)= 7.5.

The original trade took in 20, we now have another 18.5. What could go wrong? Well, Huston, we have a problem at 7338,and 7112. This is starting to look a little crazy for my liking, but let’s put it in the mix.

Put some fizz in your week and watch those levels. And remember these trades are not recommendations,they are demonstrations

* The FED moves opposite to the market-allegedly. you decide.