That Was The Week of Expiry and Massive Buying

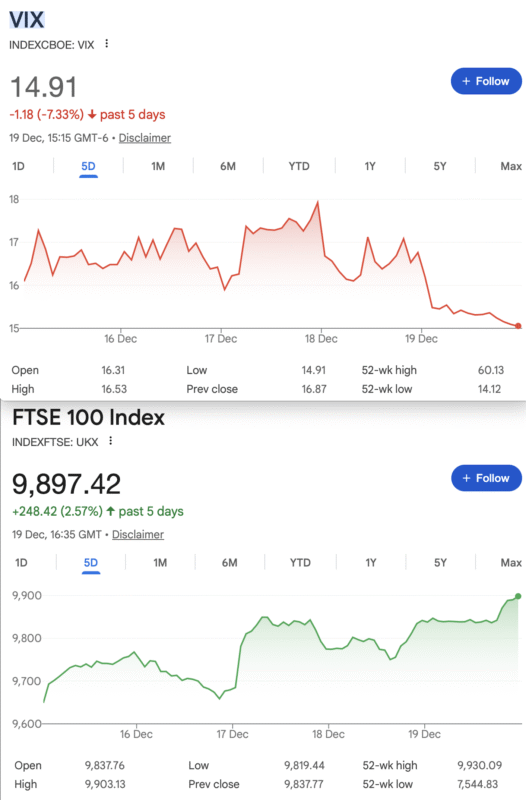

So, Russian funds remain in the murky depths of the financial world and FTSE rises 2.5%, purely a coincidence. However doom mongers like myself will have noticed the disproportionate number of up days v down days. that relationship is normally in the range of 51-52%. this years it is 60% up days to date( 147 up, 98 down). So, attributing this to anything other than excess money would be absurd IMHO. Earnings do not equate to this huge rise. Curiously asking Alexa produced a staggering p/e of 33 compare to a norm of 15. However according to Simply Wall st, we have a p/e of 20.3. So who is going to want their money back as dividend yields are a miserly 3% ? The 10 year gilt yield https://markets.ft.com/data/bonds/tearsheet/summary?s=UK10YG 4.54%

So while I’m a worse pundit than the bloke with the bells and horns whose name sounds like ‘flamer’ I am, surely on the right side of ‘concerned’. One of my pet hate expressions being’ time will tell’ I will just say that I do not relish the prospect of ruin for a lot of people, but caution is required. And who knows even Gilts may no longer be a safe haven.

3i Atlas

Well blow me down, aliens did not invade or even make a passing comment as this quirky interstellar object made a pass at roughly twice the distance of the Sun. It is on course, deliberately or otherwise for Jupiter. Whatever the speculation it has humbled a few scientists, angered others, but nobody has yet shown any inspiring research. It’s a mystery, not a plain old dirty snowball. Had it been headed for Earth we’d be dust by now, and that should give a sense of perspective. We are lucky to exist, never mind the trials of the stock market.

In the Inbox- Thin On The Ground This Week

Well, it’s that time of year everything is winding down. However it’s also that time when it’s good to do some research and the QuikStrike tool is excellent for those of us who trade UK options with a dearth of actual helpful sites. I believe it’s very important to understand your positions and aggregating such as Delta and Theta, so you can have some reasonable expectations.

I like the daily freebies from https://fullertreacymoney.substack.com/p/big-picture-long-term-outlook-cac?utm_source=podcast-email&publication_id=1289696&post_id=182134829&utm_campaign=email-play-on-substack&utm_content=watch_now_button&r=1fbdnd&triedRedirect=true&utm_medium=email

Along with a weekly summation. This was once FullerTreacy, but David Fuller sadly passed away a few years ago. Interesting, wise and often insightful.

Distraction Trades

ADA was $0.4118 now $0.3759

XRP was $2.0310 now $1.9225 Some speculation over Bitcoin and pals this week. How can we value them? Beats me.

DAX : 4 days no entry, one win +40, effectively break even -we missed several entries, but we have rules.

UK Gilts Were £16.05 now £16.01 This is based on the Vanguard ETF. So interest rates are still relatively high but the yield is decent if you think little old sterling is going to hold its own in 2026

Legacy Trades plus new trade 445

Trade 424 High Roller

PRECIS: We start from a losing trade as below. Short calls are rarely a good idea.This is a ratio spread 8450/8650 calls

Last week: 8450call 1226 8650call 1027.5 x2 gives us 829 (against our credit 266 or as legacy147.5 )

Was 8450 call 1249.5 8650call 1050.5 x2 gives us: 851.5 -Expect a roll to December for credit ± 38

Rolling to December gives us 53 This was the average from 19-21 Nov. So our cumulative credit from Aug now 319 or from Oct, 147.5. We are in debit of 737 ( 1,125 minus 931×2 )

Now 8450 1297 and 8650 1098.5 x2 gives us -900 At least there’s another all due soon

8450 1236.5 8650 1037.5 x2 gives us: 838.5 Roll coming soon, or perhaps the market will get spicy.

Was : 8450 call 1207, 8650 calls 1007.5×2 now 808 –our next roll should see us take in 35 or more

Rolling gave us 33 but now the real horror ….. 8450c1479, 8650c 1281 x2 = 1083

In summary we have taken in 266 (legacy 147.5) and our rolling has given us 86 We’re a long way from home!

Trade 442 We Use 440’s Win For Further Credit

So we arrived at the happy position of owning a December 9500/9400 put spread worth 29.5. (125.5- 96).

Our possibilities: Keep the spread and run it to expiry for max 100. (a)

Sell the Dec 9500 put for 125.5 and buy a January 9500/9400 put spread( 166.5-135.5= 31) to protect the now naked 9400 put. Credit: 125.5-31= 94.5

Or…. We sell another Dec 9400 put for 96. This now gives us risk at 9300, but we have juicy credit

Previously 9500 put 34 9400 put 23.5 So had we gone with (a) we’d be disappointed, but (b) Credit 94.5 gave us Jan put spread: 9500 67, 9400 52 =15, short December 9400 put 23.5

(c) Credit 96, the put ratio spread now gives us a debit 13

(a) the 9500/9400put spread is now 22.5 and 14.5 = 8

(b) short Dec 9500put 22.5, the Jan 9500/9400put spread 60 and 44 = 16 smaller debit 6.5

(c) 9500/9400 put ratio spread now a smaller debit 6.5 (credit 96 remember) Close out?……..

This week;

(a) Dec 9500/9400 put spread 13, and 7= credit 6

(b) Dec 9500 put 13 January 9500/9400 put spread 56, 40.5, 2.5 credit

(c) Dec put ratio spread 13, 7×2, debit 1 Remember: we took in big Credit with each of these trades

Clearly the Dec Put expired worthless so while it’s done well, the Jan Put spread 20-16=4 WIN

Trade 443. Cannot Find A Put To Sell…….

Ok so I need to set aside my personal bias and support the long side. We are buying a ladder, selling more calls than we buy.

December prices: buy 9800 call 72.5, sell 9900 call 37, sell 9950 call 25.5 . Cost therefore: 10 How safe is this? Keen eyed readers will see there’s a long spread and an extra short call giving us risk at 9950+100= 10050.

Was 9800 call 25.5 9900 call 9.5, 9950 call 5.5 We have 10.5!

Now 7, 2, 1.5 gives us 3.5 Ugly trade but…..

Expiry was 9829 so the other calls expired worthless giving us 29 a profit of 19 or 190% ! WIN

Trade444

Strangle!!! Expiry on 19th December only 9.2 trading days 9900 call and 9275 put are both 9.5 = credit 19 We are making a huge assumption that this is a benign market and will not likely surprise either up or down. Prove me wrong!

Now 2 and 4.5=6.5 credit 19 gives us 12.5 WIN! ( we’d close out but run for fun)

It made all the money, 19 WIN!

Trade 445 Another Year -More of the Same?

9450/ 9200 Put ratio (January) 47 and 24×2. What is the logic of this trade? What, actually, is the trade? OK we buy one 9450 put and sell two 9200 puts. We thus have risk below 9000, at 8950. We speculate that support would be strong at 9000 and we don’t really want upside risk. Should 9000 be breached we’d look at buying the 8950 put and selling something 500 points lower.

Now 18 and 11.5×2= minus 5. Early doors.

Trade 446

Big ugly butterfly anyone? Looking at Calls at these strikes: 9500, 9750 and 10,000. giving us the prices: 447, 223.5(x2) and 65.5 That’s right it costs us 65.5 Logic of the trade, market may soften in the new year as events in the next few week may get crazy. You KNOW what I mean!. It’s a plodder of a trade but the reward is 250 if the market favours us.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com.

If there is anything you’d like help with, we all started somewhere and yes, it can be baffling. There are no stupid questions

All opinions expressed here are not to be taken too seriously and all of the trades are for educational purposes only.