That Was The Week Panic buyers Piled In

So, on Tuesday and Friday we saw more desperate buying, the now familiar Melt Ups. Quite why the market cannot function normally and accept losses to this participant’s way of thinking, stinks! The continued overvaluation makes no sense, but it’s a symptom of a changed world. We must ‘suck it up’ in modern parlance. However it suits the political agenda in the US but in the UK we have the politics of envy and angry cries of ‘ tax the rich’. There’s a problem with that, called the Laffer Curve https://www.investopedia.com/terms/l/laffercurve.asp

The problem is that there is no optimum rate of tax and trickle down economics don’t seem to work. The divide between rich and poor is summed up with Elon Musk’s $1trillion pay award. A growing army of working people are eligible for benefits given terrible wages. There also seems to be a vast and burgeoning amount of people on disability benefits to add to the toxic mix. Quite why anyone would want to be a politician, given the variables are all bad, defies logic. So, Rachel from accounts has an unenviable task which will a) incur wrath b) have possible disastrous consequences c) Create more unpopularity for Labour. Anyone care to swap places with her?

In The Inbox

A couple of links straight to the content:

1. A very good watch though a few days old: https://youtu.be/MmMxeKTsiWU?si=RlAcXsfIc91rECwN Anthony Scaramucci seems to be a true Renaissance man, wise knowledgeable and altogether a successful man who has been on the wrong end of Trump’s ire.

2. Victor Hill, who always seems to be unduly anxious as his content is generally pretty decent: https://youtu.be/1z52AG3dJTo?si=GYCeI_vqqWD0txOb

3. CBOE – An Introduction to Risk Across Time. If you don’t know what LEAPS are this may well be enlightening. Currently you can trade FTSE options up to April 2036

4. Look away if you’re a perma bull! https://thepatientinvestor.com/index.php/2025/11/01/us-stock-pricing-at-new-high-2/

Distraction Trades

ADA was $0.6136 now $0.5781 ( a high of $1 recently)

XRP was $2.4914 now $2.3216 So, our chosen Cryptos get feisty, some big moves including up 8% on Friday

DAX : 2 no entries two losers 1 win 220 nett Another horrible week of indecision at the open by the Dax itself.

UK Gilts Were £16.17 now £16.11 This is based on the Vanguard ETF. Again, the ‘Safe’ haven getting some love.The yield is still 4.45% not too shabby.

Legacy Trades plus new trade 440

Trade 424 High Roller

PRECIS: We start from a losing trade as below. Short calls are rarely a good idea.

Rolling Oct to Nov. 8450 call 8650 at expiry 904 and 704×2= 500, Nov 8450 call 930, 736.5×2 gives us 543, so a CREDIT of 43. We continue to take in a credit

Giving us 266 or as legacy 147.5

Our rolling debit hits a catastrophic high: 1201.5 and 1004(x2) Gives us a whopping 606.5 Debit However we are NOT adjusting but for educational purposes, we keep on rolling.

Not again! This creeping barrage of buying is annoying. But, we’re demonstrating the principle. Now 8450 call 1268 8650 call 1069.5×2 gives us 871 debit

Now 8450call 1226 8650call 1027.5 gives us 829 (against our credit 266 or as legacy147.5 )

Trade 436 Who Knows What Next Week Will Bring?

So here’s the problem: The market tanked at the end of the day and ‘ looks like carrying on next week’. It’s a jumble sale and Friday’s closing prices may not mean too much.

Let’s go with a very spicy 3×1 using November prices. We buy the 9400 put for 124 and sell 3x 9000 put 38= 114. This is a bit spicy but we have a 400 point spread to protect us down to 8800

It still costs us 10 and spending money is annoying but the chances of the market rising and losing that 10 is minimal. It’d of course be no surprise if the market melts up, that has become the norm, after all.

Was 148.5 and 47.5 x3 = 142.5 = 6 Not sure where we go with this as the US as previously mentioned, could get really crazy

9400 put 31.5 9000put 10.5 (x3) Gives us…….. ZERO!

Was 26 and 9.5×3= 2,5 debit A sorry sight again.

Now 26 and 9 x3= minus1 Rinse and repeat the misery!

Trade 437 Calling the Top is a Mug’s game

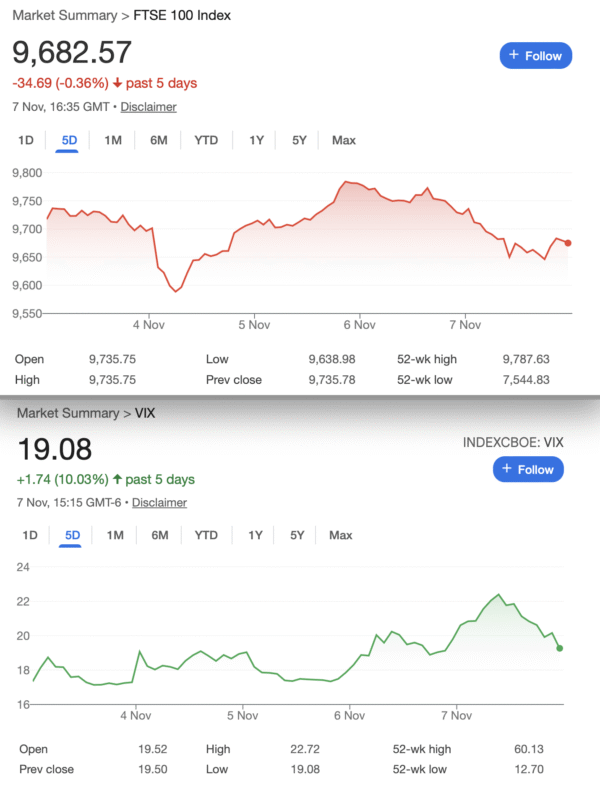

As volatility has bumped up a bit let’s do the higher vol trade- a Strangle: We sell the 9500 call and the 9150 put for 70 each. Gives us 140 credit. Risk at 9010 and 9640

It doesn’t get much simpler than this -too simple?……..

Well that couldn’t have gone worse. 9500 call 197.5. 9150 put 14.5 Here are some ideas.

- Do nothing -and this can often prove to be the right move

- Write another strangle –put premiums are too low.

- Roll up the call side from 9500 to 9650 at a cost of 197.5- 96.5= 101

- Close out for a loss of 72 -least favourable tactic. (You could close and then sell the 9650 call as a ‘Hail Mary’ )

- Last week it’s only slightly more catastrophic 9500 call 253.5 9150 put 12.5 a loss of 126 –sorry! ( We will consider all the above at expiry or sooner)

Now 213 and 12 -Yikes! Let’s adjust and roll up the 9500 call to 9650, for a cost of 109.5 and the put to 9500 gives us 39-12= 27. 82.5 Cost (our initial credit 140, is now 57.5)

Trade 438 a Nod to Tasty’s Liz &Jenny

We seem to get burned for having upside risk so we go the Jade Lizard route. We sell a call spread and a naked put with sufficient premium to cover the call spread if it goes wrong. So, we will sell the 9700 call 72 and buy the 9750 call 51.5, giving us the bear call spread.(max possible loss 50) A credit of 20.5. We also sell the 9400 put for 31.5, giving us 52 credit. Logic of the trade? We get 52 if this expires anywhere below 9700 and above 9400. No upside risk

The 9700/9750 call spread 107 and 80=27 , and for the 9400 put 26 A loss of 1

call spread now 75.5 and 53 =22.5 9400 put 26 =48.5 (our credit was 52 remember)

Trade 439 How To Keep Out of Harm’s Way?

Here’s a put condor: 9800, 141.5 9700, 90.5 9600, 57.5 9500, 37.5 So here’s how it works, we buy the expensive 9800, sell the 9700 and the 9600 and for protection we buy the 9500. So while we hate to spend money we will have to shell out 141.5+37.5= 179. Minus 90.5+57.5=148, giving us a cost of 31.

In the event of a market crash it’s safe as that is as likely as a UFO landing on the Loch Ness monster’s head. (We own a long spread and sold a short spread, it’s bulletproof) However there seems to be strong support at 9700. An expiry at that level would give us 100-37=61. Will the market ever give us a break? Or rather, could we do better?

Now, those prices in order, 161, 101.5, 62.5, 39 =35 ( it cost us 31 )

Trade 440 Let’s Go Time Travelling

We’re still in the November expiry cycle so theta(time decay) gets brutal for the near month. So we want to buy December options and sell November. Nov 9400 put, 26, Dec 9400put 73 for a cost of 47. Yes, we’re not going to do that, we’re going to buy a spread buying the Dec 9500 put for 94 selling the Dec 9400put for 73. Now we own the Dec 9500/9400 spread and sold the Nov9400 put for a small credit 5. This can, of course, make 100 assuming the Nov 9400 put expires for nothing, and the market takes a d*mp! No upside risk.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com.

If there is anything you’d like help with, we all started somewhere and yes, it can be baffling. There are no stupid questions

All opinions expressed here are not to be taken too seriously and all of the trades are for educational purposes only.