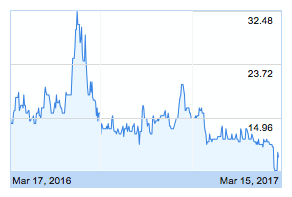

The recent, possibly ‘all time’ low, in FTSE Volatility

I’d like to say this is because of xy and z but frankly it is just a complete mystery. VFTSE’s low is the above quoted number-4.878. The chart shows 12 month’s history-averaging around 15.

$VIX is the biggie for tracking volatility based on near-the-money SPX options, and has been low- around 11.

There is of course a difference as individual US stocks can move big intra day. We seem to have comatose stocks(shares). But you can almost guarantee that the moment you buy, they plummet.

We Like The Index ,Why Look Further Afield?

I’m reminded of people who trade multiple asset classes-metals, soft commodities and individual shares(stocks). For our purposes FTSE100 remains our weapon of choice for 2 reasons. 1. It’s hard to’fiddle’ an entire index though intra day it may get moved to favour certain positions. 2. Exercise- it’s european style so there is no early exercise. The short leg of our trade cannot get hit in isolation. Shares have dividends, earnings releases, shock announcements, takeover bids. Then there are rumours, fines( banks ) fraud.

Option Trades should Produce a Credit- Give Me Money

In an ideal world we’d be selling options -strangles, iron condors,spreads -and buying some protection. With such low vol there is nothing worth selling given the potential risk, and concomitant(resulting) volatility. So, to sell a 7300 put at 10% vol for 41, in isolation, the risk reward is just not there. A 5% drop takes FTSE to 7050.

Trade of The Week

This started out as an idea we kicked around, just to give us some subject matter. It has now become a hard task. Each week we try to bring something, but please bear with us as we try things that don’t always win. The point is to understand the trade.