That Was The Worst Expiry Shenanigans Ever!

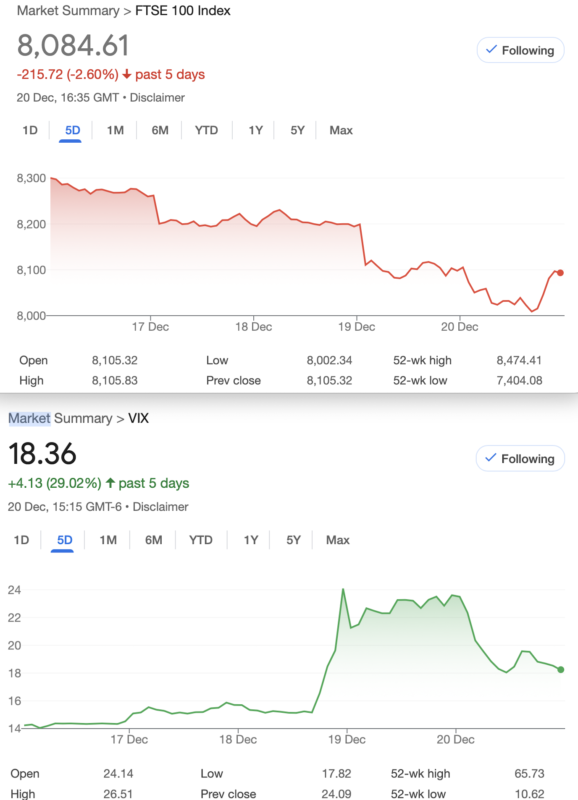

So I will willingly confess to a) being at best a variable trader and b) not practising what I preach. Yes, I ran some 8050 short Puts to expiry. This cost an unnecessary 20. Rarely do I run things as PIN risk can only be managed as described by the late Fisher Black thus: Put your head between your knees and hang on to your b*lls. OK this might sound like sour grapes and I wouldn’t mind except this is the most ludicrous manipulation ever. (Since the last massive one maybe 20 years ago) Here’s the one minute chart and if anyone suggests that a swing from 8105 to 7665 within those 60 seconds is normal I quit!

I hope you can see the massive wick and tail on that first candlestick. Now when I called my broker he said the provisional level was 8029.5 yet the price we had all watched came nowhere near to this. Equally bizarre, in all my years of options trading I have never seen the expiry index: https://yhoo.it/3P4cmGq

There is no yardstick as this is the only expiry listed, suggesting this is brand new. Should anyone know better please email to the address at the bottom of the page. A swing of 440 points in a few seconds is clearly not legitimate market action and when you look at the expiry explanation, the auction does not allow automated trades therefore this can only be something contrived in real time. Uncrossing is when the trades are settled and the index comprises of ± 100 stocks, so any explanations welcomed. I have asked theice.com if this will be investigated, but porcine aviation seems to be a real thing these days. FCA in the past have shown no interest in expiries and so likely this will stand.

Trust in Markets

With nett outflows from the UK Stockmarket it really does not help when expiry is now the Wild West, though you could argue it should have expired at 8045 so it’s not the end of the world. People will doubtless have been hurt, both put sellers and call owners . I note the LSEG’s salient sentence: Unless there are extensions, the auction for each share lasts between five and five-and-a-half minutes

and these are concluded more or less simultaneously. Each share will trade at the single price that executes the most volume. AGAIN:Each share will trade at the single price that executes the most volume. So who sold BP shares for 5p? My simple brain finds this hard to get to grips with.

Christmas Cheer

While I cannot complain as options chose me to be’ that guy’ and I love the journey it’s been a miserable year of ignoring the rules. Sometimes this worked ok whilst balancing Deltas, other times, letting the market meltup put me on the naughty step was a very low point. Trading is not easy and your best mate may be taking opposing positions to you. Friends and family will not understand and you will get zero sympathy for being part of ‘completely superfluous world’. So why do it? Because we can be wrong and win. We can make some smart trades and win. Options offer such an incredible array of tactical tools there is nothing that comes close for us retail traders. Morality is not at risk from our gentle endeavours which simply add to the running of the market. Stocks? Be lucky, and remember it can be a royal hassle trying to trade. Options- the market is fast, efficient and it functions well, we even get free live prices remember: https://www.ice.com/report/265

Distraction Trades

ADA was $1.0843 now $0.9608

XRP was $2.4080 now $2.3053 Buyers still have an appetite for crypto. Another Bitcoin scam this week- North Korea again?

DAX : 3 losers, 1 win 1 no entry nett: 40 Actually another royal pain to trade.

UK Gilts were £16.26, now£16.11. OUCH! This is based on the Vanguard ETF (not a recommendation)

Legacy Trades 389 unto 395

Trade 389 What Can We Do In Light of the US election? Get Back To Market Normality

The Xmas effect or Santa rally, is it on this time around? Most market watchers know about this and the markets generally rise as the numbers show the economies are doing ok. We will go with a CALL BUTTERFLY

Here’s the trade: We buy the( December) 8300 call for 40. We sell 2x the 8450 call 16 x2, and we buy the 8600 call for 6.5. Our cost therefore: 40+6.5 minus 32= 14.5

The ONLY risk here is our premium paid 14.5

Previous week: 30.5, 10.5(x2), 4. Gives us 13.5 Christmas is coming !

Last week 8300 call 88, 8450 calls x2 31.5, 8600 call 10 Gives us 88+10 =98, minus 63= 25 We’re in profit but it runs to expiry

Then: 8300 call 81.5, 8450 calls x2, 24, 8600 call, 5.5, gives us 39

Last week :8300 call 69, 8450 calls 14, 8600 call 2.5 Gives us 71.5 minus 14×2= 57 WIN Might be the sweet spot so we’d close out but run it….for fun. Remember it cost us 14.5 so this is BIG, though 150 is max possible

Last week: 37 Told you to close out!

This week a big fat ugly ZERO

Trade390 Can we use Legacy Positions again?

Trade 387 leaves us those two spreads that we own, so we have zero risk and could run them, with one, possibly both making no profit. Or……….

We leave the 8300/8400 call spread for the Santa rally, it’s only worth 15.5 and could make 100.However, the put spread… we sell the 8200 put that we own, for a massive 168.5 and be buy in January the following put spread 8250 216, 8100 137, for 79. So we have a handsome profit(168.5-79= 89.5) still and another spicy calendar ratio trade. Our risk is at 7950 and nothing is set in stone. Santa may not give us the rally this year.

In summary we are long: Dec 8300 call. We are short Dec 8400 call Dec 8100 put. Long Jan 8250 put, short 8100 put.

Here’s the graph of the position https://optioncreator.com/strt35v

Last week: The December call spread 88-46= 42 (Remember we inherited this and run it for zero cost). The short put Dec 8100 37.5 our LONG Jan put spread 101-61.5= 39.5. In credit for 2

Was : December call spread 81.5-37.5= 44. The short put Dec 22.5, our LONG Jan put spread 8250put, 82.5, 8100 put 47.5= 35=12.5 credit

Now: Dec call spread = 69-25=44. The short Dec 8100 put 10, the Jan put spread 60.5-32= 28.5. Overall a credit 18.5

Might be prudent to close out the call spread for 44. Remember the put spread owes us nothing as we took in a huge 89.5 credit

Run for fun? Why not.

OK we would have closed out but now 34,5 for the Dec call spread, Dec 8100 put 6 Jan put spread 61.5-30= 31.5 -6 gives us 25.5

TOLD YOU TO CLOSE OUT,RIGHT?

Now: The call spread was worth ZERO, Dec put at expiry minus 70, the January put spread that we own: 173.5-89.5= 84.5, minus 70= 14.5 so still a win (remember the initial credit 89.5)

Trade 391

So, currently we have a long call butterfly, a long call spread and a calendar put ratio spread, shall we try something nuts? Let’s go naked with a strangle.

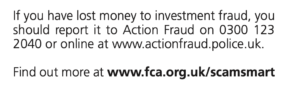

Here we SELL both a naked put and naked call. It’s not as bad as being naked in one direction and we have simple exit criteria in the event of a problem. IF the premium on one side trebles, we close out and create a new trade relative to the new market level. Tasty Trade have long been advocates of the 1 sigma strangle, which means using options with a Delta around 0.16. It’s simple, we have a plan we take in a credit of 45.5, so if the puts, for example, go to 73.5, we close out. Our loss is 18, we look to place another short put and possibly roll down the call.

Entry criteria? The levels are the most recent extremes of Bollinger bands, the Deltas are around .16, the premiums are decent and we are in the big time decay period <30 days to expiry.

Was 14 for the put and 15 for the call =31 We sold this for 46. So, we’re 15 to the good. Boring, predictable? Profitable? All three, mostly.

8000 put 6, 8500 call 7.5 WIN We’d close out and take the 32 nett profit We run for fun

8000 put now 3.5, the 8500 call 2 so still winning, giving an extra 8

TOLD YOU TO CLOSE OUT! Now the 8000 put and 8500 call expired worthless but the journey was ugly.

Trade392 November fades (but the Weather Gets Weirder)

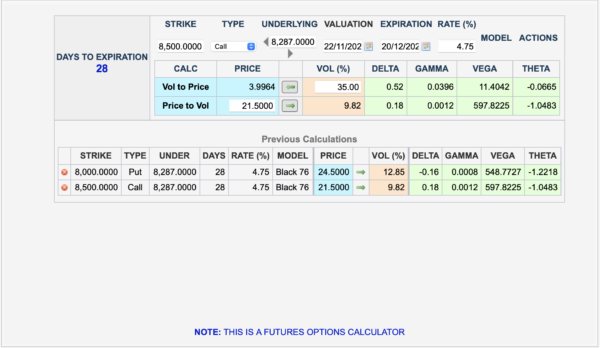

It’s now a choice between December and January expiries but with the holiday looming it’s 48 days away but only 32 trading days

This is NOT a recommended trade as entry criteria are not public domain AFAIK. Price Headley the acclaimed trader and author of many options books used to say the following: On occasion it is advantageous in a calendar spread to sell the far month IF volatility is skewed. A conventional calendar spread is simply buying the far month and selling the near month because of the time decay. Here we see higher volatility in the far month Jan (to be expected) and hefty theta in the near month. BUT, we have 2 front month(Dec) calls giving us an overall delta of 84-46= 38, or .38. In addition we have Gamma of 21×2 versus 12. This means if there’s a big intraday move in the next few weeks, the near month calls will move far more than the far month call. It needs a big rise.

The numbers here: 114.5 and 56.5 x2= 1.5 Credit

We have realistically a week or so for this to do anything and it’s purely for demonstration and NOT a trade I would take without more of Mr Headley’s knowledge. It may get ugly! ( I hope it does!)

Here’s how it went:

Mon: 59.5 x2 against 121

Tues:88.5 x2 ” 152

Wed:67.5 x2 ” 127.5

Thurs: 68 x2 ” 131

Fri: 43.5 x2 ” 105

Spot the winner? Tuesday! 88.8.5 x2= 177 minus 152, gives us 25 nett profit. CLOSE and be thankful! And yes, it got ugly by Friday. We’ll run it for fun. PURELY for fun.

Curiously we now have 88.5 for the Jan call and 24 x2 for Dec. Of course we closed out to avoid such ugliness.

Trade 393 End of Year Shenanigans

So, 9.2 trading days to December expiry, but it’s looking a bit ‘off ‘. Let’s speculate that expiry will be at 8300 and we honour our chums across the pond at Tasty Trade with a Jade Lizard. We sell a call spread and a naked put, BUT……. we should take in sufficient premium that if the market takes off we don’t lose anything. So it goes like this:

We buy the 8350 call 43.5, we SELL the 8300 call 69, and we SELL the 8200 put for 20.5. This gives us a nett credit of 46. Keen observers will note the short call spread can only cost us a maximum 50 (8350-8300) so the worst way to the upside we could lose 4. To the downside we have the credit 46, so risk at 8154. Not my favourite trade but so often we see these work out.

This week 46 and 24 for the call spread = 22, the 8200 put is 15.5. So, we owe a total of 37.5 against our credit of 46. Comfortable? Not so sure.

AND….. there it is -the put risk found us wanting. So our credit of 46against the expiry at 8030 made a thumping loss 170-46= 124

Further analysis shows this was never a good trade, as there was no real chance of a good exit with 50% profit LOSER!

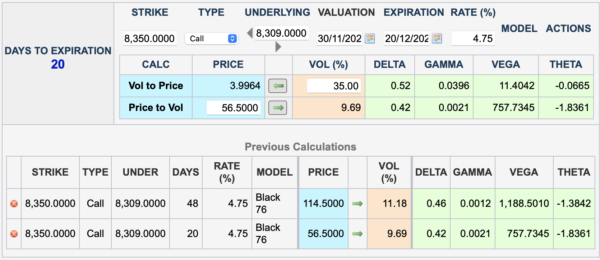

Trade394 Too Late for a Dec Position, so………

Risk ON! Let’s get spicy again and look at a very saucy 3×1. We sell 3 8050 puts and buy 1 8300 put. Risk at 7900-7950. Logic of the trade- well purely that the cost is 78.5 minus 24×3 =6.5. The reward is a maximum 250 and while volatility is low, after December expiry the juice will drop put of the Jan options, assuming no catastrophes.

I had wanted to demonstrate a classical Christmas Tree -buy one option, sell 3, missing a strike, then buy 2 further out but not as wide. Example buy 8300 put, sell 3x 8050 puts and buy 2 7850 puts. This would increase the cost by 13 x2,=26, which is ok, but a 500 point drop? We could, at a later date, get further protection that may be better value. We will run this hypothetical position alongside the 3×1

OK- how well did we do? 8300 put 211 and 8050 puts (71×3)= 213 Doubtful anyone saw this shocker of a week, and that ‘expiry’ but we run it. So minus tuppence and it cost us 6.5

The Christmas Tree? 7850 puts 30×2 = 60 -2 so it’s actually been ok. Initial cost 32.5 so we’re good

Trade395 Something For An Unfathomable Market

Well this goes against the grain but it’s legitimate strategy called a synthetic. We are emulating the underlying instrument with a short put and long call so exactly like the underlying we have a Delta of 1. We sold the 8100 put for 89.5 and bought the 8100 call for 103.5. Honestly this is the polar opposite of my way of trading but it’s Xmas and I have no idea what the immediate future holds. ( With the up day/down day count at 130 up, 118 down there’s still room for a few more up days) Time for a mince pie. HAPPY CHRISTMAS

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.

TRADE 395 HAS MADE AT BEST 60 THIS MORNING – COST 14, WE’D TAKE THAT ANY DAY.