HUMBLE APOLOGIES BUT OPTIONS DATA REC’D TOO LATE WE WILL MAKE AMENDS NEXT WEEK

That Was The Week The Budget Hit Pensioners

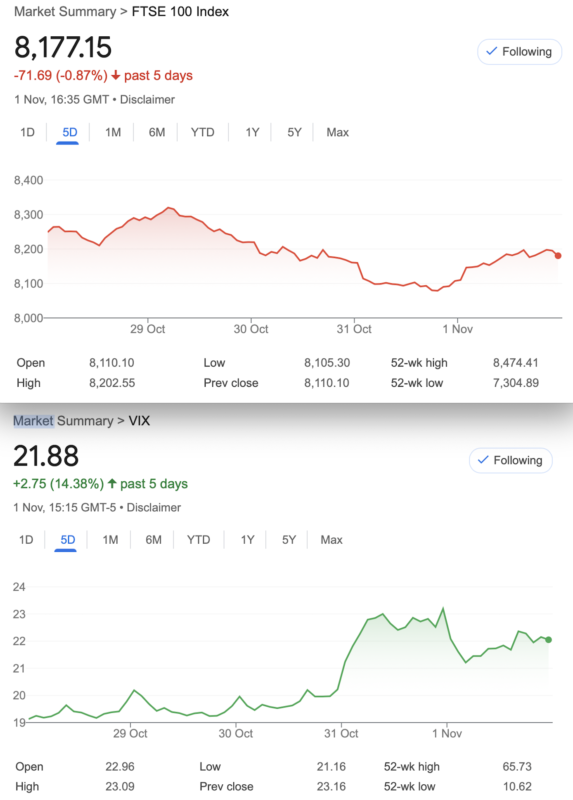

So, clearly the market is still in a bit of a downtrend but shook off the shackles of reality and had a Friday smash up. However, do we see resistance at successively lower strikes, as 8200 didn’t hold. While this is idle speculation, yours truly has expressed bewilderment widely met with agreement. So are we to believe a smooth election in the US? Regulars here, and indeed most Brits have only revulsion for Trump. We simply cannot understand the mindset of America right wingers. However, one issue again raised its head, that of getting out of deep ITM options. Those traders who saw LIFFE go through the transitions from EuroNextLiffe to NYEuronext Liffe may well remember RFQs. AKA Request for quotes. So as it implies, you request a quote and market makers were obliged to show a quote.

However, nowadays you’re likely to get a spread so wide it’s almost incomprehensible.*

So this brings me to, yet again, questioning the wisdom of trading FTSE. Sloth and indolence and fear of the unknown creep into the equation. However some years ago I did an evaluation of bang for buck with FTSE against S&P500. There was nothing in it aside from currency risk. Oh, and the epic confusion that is the US election. However those are only every 4 years, or never again, apparently.

Geopolitics

Was there ever a time when global events were so dominant in our minds? We have the Middle East in seemingly all out war, Russia and Ukraine, wild weather events, natural disasters an untested government. A lot to factor in, and yet volatility is nothing like fearful. Or are we looking in the wrong places? In actuality, VIX is now pretty spicy but as stated last week there is propensity for VIX to increase after an election. Weird or what, to quote the mighty William Shatner. This is a tad out of date but gives us some context with wars/market volatility https://www.msci.com/www/quick-take/how-modern-wars-affected-market/03183695513

So what raises volatility? Higher options prices, and those are predicated on how much people are prepared to pay for them. No buyers? No volatility. Likewise there’s no inflation if people refuse to pay higher prices. This suggests that financial markets make wiser choices than regular consumers who overpay consistently. Until they don’t, like the GFC!

In The Inbox

A quick look at something many of us don’t consider, as pure options traders. https://www.ivolatility.com/news/3028

Shockingly there were also some begging emails from Trump, which elicited a suitable response. Sometimes it’s good to vent one’s spleen.

*Events overtook me and I had meant to screenshot the paucity of quotes as we move further away from the ATM (at-the-money) strikes.

Distraction Trades

ADA was $0.3298 now $0.3547

XRP was $0.5136 now $0.5104 Cardano gets some love. Who knows what’s going on? Email us please!

DAX : Holy Moly! 620 points, from 4 wins 2 losers 1 break even. Again unexpected success. This is a really basic system as implemented using an Ma Xover.

UK Gilts were £16.59 now £16.30 The budget battered Gilts. About 1% drop, but that is huge in pension funds. Gilt yields are used to price mortgages, so maybe house prices will drop. AS IF!

Legacy Trades – 386, 387 and new kid 388

Humble Apology Department.

Sorry to say I had suggested that Trade 386 was using October options. That is not the case, so it’s not a loser it’s a running trade using November options.

Trade 386 November And The Ominous US Election Cloud

Sticking to the knitting, and regulars here know we love a put ratio spread. The choices are huge but trade selection comes down to: Do you want a big chunk of premium? Are you happy to place a low or zero cost trade that could give bigger rewards?. Where do you think is an acceptable level at which to have risk that needs to be managed.? This time it’s a low cost 8200/8000 put ratio spread and as it is long at 8200 and short x2 at 8000 this means risk is at 7800, currently about 6% below the futures price. We pay 85.5 for the 8200 put and collect 40.5 x2 for the short 8000 puts. Our cost is thus 4.5 with risk 6% below the market, zero risk from 7801 upwards. Should the market go very South, we’ll look at adjustments.

Previously stated: Surprisingly a LOSER We paid 4.5 so we could afford to lose one of these every month forever! (WRONG!)

Now: 71 and 25.5 x2 =20 (we paid 4.5 ) Yes, you could close out having made 300% but as a rule we run these to expiry

Trade387 What to Do With A legacy Trade

We will start from the position of using the spreads we own from trade 385.

8350/8400 calls (109 and 83.5) and 8200/8100 put spread (47 and 30.5)

OK here’s PLAN A. This requires that we sell the long call and long put for 109+47= 156. We BUY the Dec 8300/8400 call spread for 203-143= 60, and the 8200/8100 put spread for 84 -63.5=20.5. Now the short legs of our ratio trades ( effectively a strangle) are in November and the long spreads(effectively a long iron condor) are in December, we have, in addition, a credit of 156- (60+20.5)= 75.5.

Confused? I suggest reading through in stages. 1. Selling the Nov long call and long put and 2. Buying the protective spreads in December. We have risk at 8500 and 8000

Given that we have some mitigation with theta as these are spreads, we could look to time the put side better. Next week may be a very different proposition.

This week, we own the Dec 8300/8400 Call spread ( 88.5 and 55.5= 30) and the Dec 8200/8100 put spread (116 and 86= 30) We are short the 8400 call ( 34.5) and 8100 put (42)

NB: We have our credit from trade 385 of 75.5

Trade 388- The End of The World Strategy!

Ok, maybe an exaggeration but the good old butterfly is a solid trade where your risk is limited to your outlay. We want to buy a November put butterfly

We buy 7700 put 9.5

Sell 2x 7900 puts 17×2= 34

We buy the 8100 put 42

So for the princely sum 0f 17.5 we could, in an extreme drop make 200. Risk as explained is 17.5 as the strategy comprises a short spread and a long spread which, outside of 7700 and 8100 cancel each other out.(200 apiece) Sometimes at expiry the nearest the money strike, the 8100 here, can be closed out with very remote chance of the market dropping 200 points in the 0800-10.20 time period. Buckle up.

Trade 389 What Can We Do In Light of the US election?

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.