That Was The Week Markets Dropped All Around

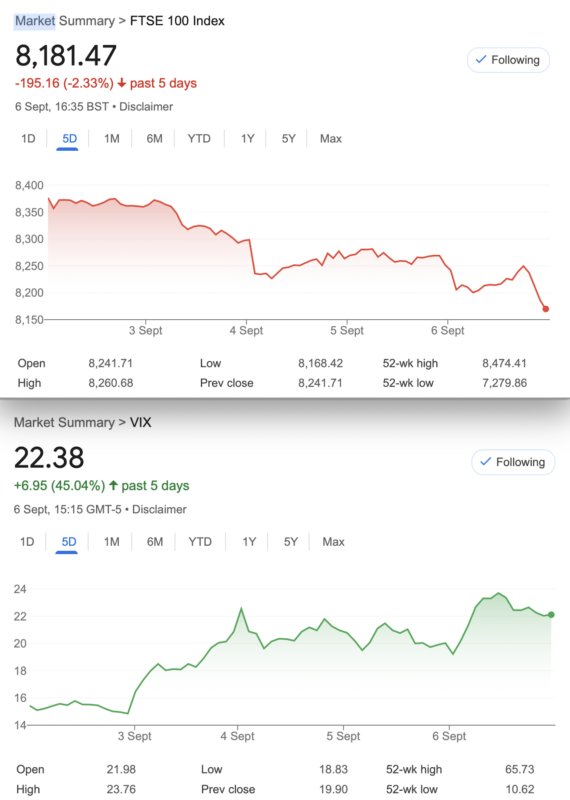

So, a week of weakness. However much political capital will be made of this in various contested territories. As oft mentioned I have been shorter than I would have liked but now the market comes to meet me 90% of the way. We eagerly anticipate more next week but hopefully not a global market meltdown. Japan was down 6.75% this week, and the S&P500 3.64%. It reminds us sometimes the plodding old FTSE is a kinder place to be. Rewards are more modest but then so are the risks. Central banks again have to balance so many factors against the common enemy, inflation. The eager anticipation of rate cuts in the US may disappoint, though as has also been noted a while ago a lot of regional US banks are underwater (financially). Stuff is still expensive as tackling inflation does not help much when prices are already high.

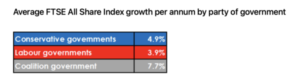

Should we be concerned about a Labour government?

It’s clear that a coalition works better for the stock market than our ludicrous party system. We would question any actions by governments as it seems that if there’s a bad financial choice to be made we can rely on our politicians to grasp it with the fervour of a teenager. OK so the stock market is not the big picture but we seem to have a problem with the Labour Party largesse and Conservative follies: HS2, Brexit, Liz Truss etc. We hope wise heads will prevail as the economy is much easier to sabotage than it is to build. You’d hope that many centuries of Parliament has honed the machinery to Swiss watch precision. OK, that’s a stretch. All in favour of a coalition say aye!

My Inbox

Some good stuff this week: https://www.ivolatility.com/news/3018 A good article about calendar spreads.

And for TA fans, this: https://mailchi.mp/technicalanalysts.com/sta-agm-papers-1299833?e=4e8dea4756

Aside from the core of our trading being the behaviour of options, having a rough idea of the underlying is crucial and the Society of Technical Analysts is a good resource. We make our own way with indicators and theories, but knowing what knowledge is available allows us incredible choices. No good blaming the market when there are strong indicators that can guide us in our trade choice. Moving averages, volume and a candlestick chart work for yours truly. We also like point and figure:

Distraction Trades

ADA was $0.3458 now $0.3232

XRP was $0.5686 now $0.5276 Ripple still ahead of our preferred Cardano but these are both looking rather weary. Has Crypto run its course?

DAX 1 break even 1 loser 3 wins Nett 200. A funny old week and clearly this strategy did not pick the big moves

UK Gilts were £16.89 now £17.10 A big week. The fund that I use, like actual gilts, pays dividends at around 3.8% too

Legacy Trades 378, 379, 380 and…..381

Trade 378 Cheap as Chips

Ugly trade, and honestly it’s not in my recommended playbook, but in this low vol market we need to be careful with risk. This trade is the iron butterfly, and ‘iron’ means you are using both puts and calls. A butterfly is either calls or puts.

Here we see the prices for September: 8200 put, 57.5, 8300 put 89.5, 8300 call 127, 8400 call 75.

How does it work? Typically you would buy the ‘wings’, the outer strikes, and sell the body- the at-the-money straddle. So the wings 57.5+75= 132.5. The body 89.5+127= 216.5.

Thus: 216.5-132.5= 84. This is a credit the trade pays us and worst way it can only be wrong on one side. Example, FTSE goes to 8000, the spread between the 8300 put you sold and the 8200 you bought, is 100. ( we took in 84, remember) We risk losing a maximum of 16 to get a maximum profit 84. We need the expiry at 8300 -what are the chances?

Previous week 121.5+69 = 190.5 minus 40.5+67.5= 108, give us 82.5 We took 84 credit so it’s not a disaster this week!

Last week 130+ 43, minus 68.5 and 23.5 gives us 81 of course we wouldn’t expect anything dramatic.

Now: 31.5+147.5 minus 12.5 +88=88.5 An ugly week for this trade

Trade 379, Let’s Do the Theta Challenge

We will compare using near month versus far month, but as you can see the premiums are of course much more juicy for October. We will place a strangle – short call and put in September and October. And, all things being unequal in our world, we will see how nothing in options is linear.

Here’s the trade, a bog standard strangle we sell the 8150 put 33 and the 8500 call 31.5. ( September prices ) and October: 72.5 and 59 for the same strike put and call

In 4 weeks the September strangle will expire, it’ll be interesting to see if in cash terms, the October trade does better.

Previously: Sept prices 18 for the put 30 for the call We took in 64.5, so a profit of 16.5

October prices 45.5 and 79.5 we took in 131.5 so a profit of 6.5 so clearly the theta effect in play giving the near month a big advantage. Sometimes, it’s good to confirm what we know.

Now: 66.5 (put) and 5 for Sept =71.5 – a loss of 7. October: 100.5(put) and 27 a small profit 4 (All a bit meaningless as theta will now pick up more quickly)

Trade 380 Disregard My 1 1 2 paragraph, we Already Have 2 Boring Trades

Well this is fun but looking at ropey prices and 3 weeks to expiry, this could be nuts, but we do a 3×1 ratio. ( What did I say about this? )

We buy the 8300 put for 43 and sell 3 of the 8100 puts at 14.5 x3 =43.5. Cost zero(margin required) Risk at 8000

Now 8300: 147.5, 8100: 50.5 x3 A tiny loss

Trade 381 Vol has increased, so……. We don’t do the obvious of selling the farm

A combo, (combination or risk reversal) This is a quick flip: We sell 8300 call for 31.5 and buy the 8000 put for 30. Keen eyed observers will note this is bearish and similar to a short future, but as we show the deltas add up to 0.49 whereas a future has a delta of 1. However options delta is not linear, and it’s also dynamic. So effectively we have a half portion of short futures. It’s not a long term trade, theta is brutal so holding on for a market turn in our favour is not a good idea.

This kind of trade can turn ugly so has to be watched and a decision made if it goes against us. Will the FTSE rebound or drop?

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.