New Government of the Left, While The World Goes Right

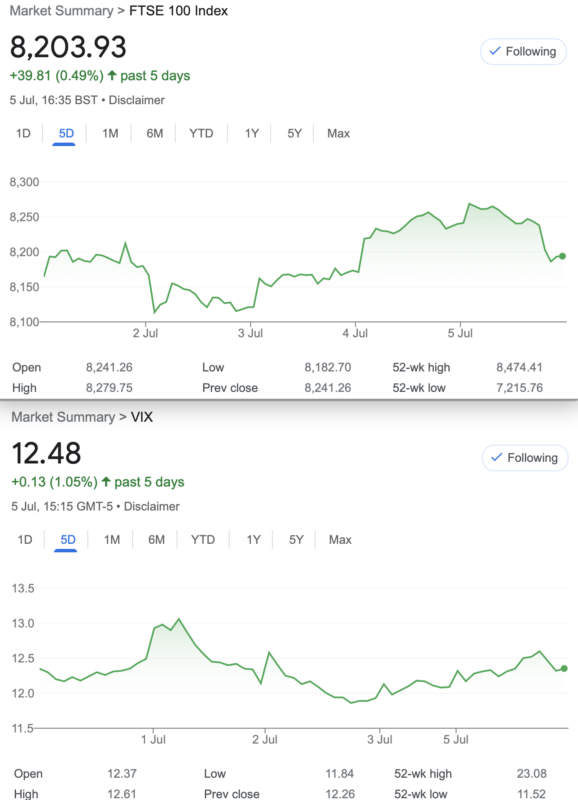

So, it would be churlish to imagine I can add anything to the media’s coverage, let’s just hope they don’t make a proper Horlicks of the job.Curiously, as you can see the election barely caused a wobble.It made no difference to £ Sterling either. It may be more prudent to look to the unfolding mayhem in the US. However this is not a prediction of disaster, which is why it was held back for a month, but it is clearly bubbling away in the bunker.

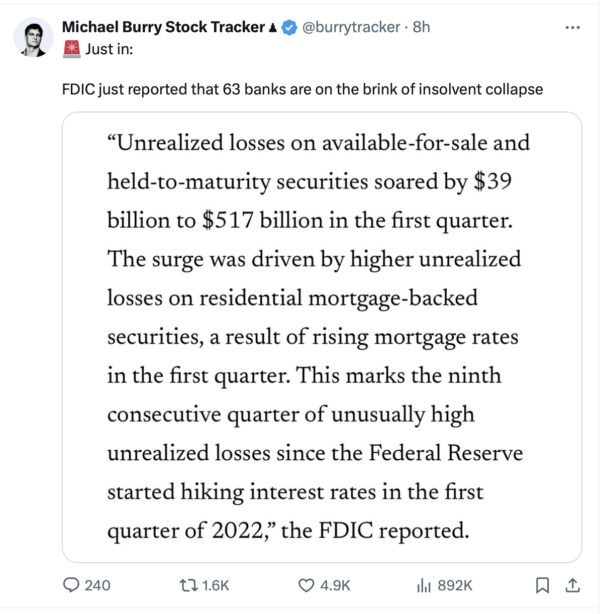

Hopefully you are a fan of the film’The Big Short’ which brilliantly chronicled the 2008/9 subprime disaster in the US. This time it’s different! This alludes to banks being stuck with low yield or negative yield mortgage backed securities. I should point out I’m just the messenger, the organ grinder’s money, I’m not an authority on such financial instruments. I’m not an authority on options either! However, the Biden/Trump saga has a few months to unfold into further division, as America grapples with disinformation and some very unpleasant people. We can only hope that common sense prevails. The much vaunted ‘soft landing’ may be fine for now until it hits an unidentified item in the bagging area. Couched in cosy terms, the debt mountains of most nations are a growing problem. This missive from last week is a very good read from the esteemed John Mauldin. https://www.mauldineconomics.com/frontlinethoughts/debtors-and-creditors

I Don’t Make Predictions and I Never Will

Sorry to steal ‘football manager speak’ but we cannot know the future but should keep a weather eye on what’s bubbling under, that’s obvious until we realise we have failed to notice. On a personal note I often feel about a month behind the market. Even worse, choosing ‘investments’ as yet another ‘hot tip’ died. Allied Minds, which I bought for 36p a few years ago was delisted, then officially went to zero this week. There is a pattern here, going back to the start of the century with my eager purchase of shares in Invensys. The day after my purchase they became ‘Troubled engineering group Invensys’ . We cannot know the future but we can know that if yours truly likes a stock, see if you can buy a ton of Puts

And THAT in a nutshell is why I trade Index options. Yes, expiry can be manipulated but overall the index is not very likely to become ‘troubled index FTSE’. That is my manifesto.

Distraction Trades

ADA was $0.3971 now $0.3563

XRP was $0.4764 now $0.4337 a small dip while neither cryptos gets a bit of love

DAX 4 wins 180, 30,30, 170, one loser -30. Profit 380. What the heck changed? All I did was change the timing of the entry from 08:00am onwards. We will run with this, but unless this can be automated, it’s a pain in the rear. However I have known this simple strategy to work for many years. If you want the secret sauce, let me know.

UK Gilts were £16.61 now £16.70 It’s not an attractive instrument but it will come in handy …….. some day !

Legacy Trades and 372 New Labour, Same As The Other Party?

Trade369 July Expiry

So, while we are utterly bereft of clues about the market should we try another strangle? Not the trade of choice but it’s hard to see what might work well and July expiry is only 34 days hence. Thus we go with the same strikes as Trade 368. Therefore we are saying we think/believe FTSE will find support higher than 7900 and resistance below 8500. We collect 39.5 for the put and 19.5 for the call We therefore collect 59 and sit on our hands for 33 and a bit days. Apologies if it’s a bit beige but we’ll try something a bit feisty next time.

With not a lot going on with volatility we now have prices: 15 and 20.5=35.5 we collected 59 a great outcome as theta took chunks out of premiums. Yes you could do this whilst lying shipwrecked and comatose drinking fresh mango juice. (Nod to Howard Goodall)

Last week: 14.5 for the 7900 put and 6.5 for the 8500 call Yowser! A very nice return as we sold for 59

This week: 5 for the Put and 3 for the Call Even better-59-8= 51. Honestly, close out go sit on the beach WIN!

Trade 370 Ladder Not Laddish

Let’s kick the beige into touch and sell a ton of premium and see where it leads us. We use July expiries: buy: 8500 put, 248 sell 2x 8300 puts 110.5×2= 221, buy 8150 put, 53.5, sell 2x 8000 puts 24.5×2= 49

Thus we have a cost of 248+53.5. – (221+49)= 31.5 Logic of the trade? We buy a juicy in the money put spread, we have no upside risk other than the cost 31.5 Downside is a tad skewed giving us a lot of wiggle room just below 8000

Last week: 316.5, 148.5×2, 67, 26.5×2 . We have 316.5+67= 383.5 long premium. Short premium: 148.5×2= 297, 26.5×2=53=350. We are in credit to the tune of 33.5(we paid 31.5)

Gives us: 280, 106.5(x2), 33.5 and 9.5(x2) 280+33.5= 313.5 minus 213+ 19= 232. We paid 31.5 thus 313.5 – 253.5= 60 (200% profit)

A real gift from a simple strategy, buying deep in the money WIN! OK- we run it ……for fun!

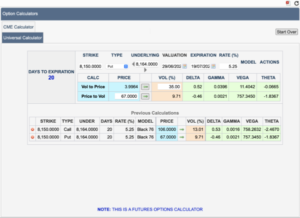

Trade371 A Trade for Election Week ( The US has some kind of holiday on 4th July)

This is disturbing, while not exactly at the money this straddle has call Vol at 13.01% and the put at 9.71% So what’s the take away? Nobody wants to buy puts? Everyone wants to pay too much for calls? It’s a very cheap straddle with an overpriced call. We choose a Tasty Trade Liz and Jennie ‘Big Lizard’. Sell the straddle buy an out of the money call. We buy the 8250 call for 55. Gives us 173-55=118.

Logic of the trade? However, we cannot lose to the upside, and downside is protected down to 8150-118= 8032 We like it!

How did we do? The 8150 straddle is now 105.5+33.5 our long call is 47.5, So: 139-47.5=91.5. We collected 118 in premium sold giving us a profit of 26.5 – I’d close out but we run it. So, why close out? We have max sensitivity at 8150 and a new government, just a thought…..

Trade 372 Cause for Optimism?

We’ll go very mildly optimistic with a call ratio spread, it ‘s simple carries some risk( ∞ ) yes theoretically the risk is infinite, and FTSE could go to 20,000 if the £ sterling dropped to $0.001. The strikes we chose are long 8200, short x2 at 8300, this then gives us risk at 8400 -figured out why? The prices 73,29×2 = 15 debit. And logic of the trade- we may see moderate rise, or we may see a lack of confidence in a yet untested chancellor, to the downside we can only lose max 15, to the upside we could make 100, the value of the spread, so effectively 85 nett. It’s a tad spicy and not altogether a peachy trade but we can adjust/close out any time.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.