That Was The Week, FTSE Wobbled, Interest Rates Going Nowhere

Again, FTSE rejected the 8000 price level. However FTSE showed an upwards trajectory and levels mean little. So, these 2 statements seem to contradict each other but both are true! We don’t know the future, and in this trader’s world, highs are troublesome. So, volatility drops, making options trading difficult and we are not inclined to assume that tomorrow will look like today. VIX has suddenly awoken and as we are all VIX watchers, we need to think this marks a change from overt optimism, to a degree of caution. VIX is the ultimate sentiment indicator as the smart money, not the herd is trading options. So when the options world sees a 16% rise in VIX maybe the underlying is frothy and needs to halt for a breather at the very least.

Exogenous events may also be conspiring en masse as so many conflicts are generating very strong views. However we believe in the rationality of national leaders and nations, though there are pariah states that care little for the rest of the world. So, is the market pricing in such events? In an election year in so many countries it does not sit well with the political status quo to have a big economic upheaval or market slump.

Thames Water, Boat Race, National Disgrace.

Pretty sure that everyone knows the parlous state of our water companies, but this is special: https://www.bbc.co.uk/news/business-68738410 Much as it gladdened the heart to see the win double for Cambridge, the river was most certainly toxic, though it’s not linked to Oxford‘s alleged ‘tummy bugs’. So what the heck is going on? Since privatisation our population has of course increased substantially. Habits have changed as front gardens became hard standing for parking the family cars, etc. More rain means more water run off, not more available water. We can also help out by limiting our consumption as water is a precious resource, and our bodies are comprised 60% water. You also have to think that the government of the day offloaded a dog of an investment when selling off our utilities. We need to do better, our utility companies, water, fuel, railways, telecoms, postal services need to do better.

Apology

-it’s not David it’s Robert Verkaik, author of ‘Why You Won’t Get Rich’. As mentioned in last week’s missive. A recommended though cheerless read. Britain needs to be doing better. While the solutions might be ugly and affecting a tiny privileged minority we have no choices as the poor inherit the debts of the rich. It’s not political, it’s pragmatic, that’s just the way it is, to quote. We can change, or stay the same and increase the wealth divide.

Distraction Trades

ADA was $0.6562 now $0.5798

XRP was $0.6275 now $0.58893 no longer lagging Cardano, both in the doldrums as gold and Bitcoin get spicy.

DAX 1 break even + 30, 1 loser -30, 2 no entries Not entirely sure this system is viable as it misses a lot of the big moves. Watch this space.

UK Gilts were £16.98. now £16.76 Yawn! I have no expectations other than a hedge against other stuff in my pension but yields went up as interest rates remain ‘high’ (not high, about right!)

Legacy trades from 355 and new Trade 360

Trade 355 SIC Short Iron Condor.

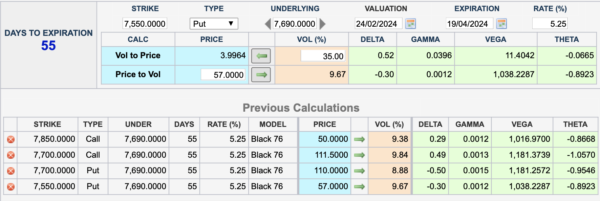

In a nod to another options website/blog, this is a curious trade as it should not work. The presenter claimed it had made more than a strangle or a calendar trade in a week. This is a short iron condor, so we are buying the ATM options and selling the outer wings. We choose April expiry which gives 55 days to be wrong. The trade shown was 49 days from expiry, and the strikes were a little different, but let’s give it a whirl. We buy the April 7700 call and put and sell the 7850 call and 7550 put. Those prices: 111.5+110= 221.5 minus 50+57=107, gives us a debit (ouch!) of 141.5. However, the prospects of this trade winning are not zero, but flippin’ close.

Caveat: people make a living trading normal iron condors.

APOLOGY! Typo- the cost was NOT 141.5 it was 114.5. .

The 7700 straddle 84.5, 115.5 = 200 7850 call is 33.5 7550 put 55.5 =89. Our trade is now 200-89= 111.

So, not the worst situation. However, with any trade you really don’t want to see that premium melting away. Thus we run, for fun and the unexpected.

Was- 112.5 -it’s never going to be profitable but we did not choose entry using any particular criteria.

WAS: 7850 call 133 7700 call 257 7700 put 15, 7550 put 7. So, we OWN the 7700 straddle 257+15= 272. We SOLD the wings 133+7 =140 gives us 132. Profit 17.5!

Quite what we do next is anyone’s guess, but we run it.

Was : the 7700 straddle 277.5. the 7850 call 138.5, and the 7550 put is 5.5. 277.5-144 =133.5 A little more profitable

This week: UGLY! The straddle is now 228, but the wings are 129.5 and 7= 91.5 Losing

Trade 357 The April Expiry Cycle Beckons

Despite the many winners we also like to show other trades in all their splendour. However nothing works as well as real prices in real time. So instead of cherry picking another winner we go with an old chestnut, the Butterfly. What’s the problem with the ‘fly? You have to be right in a narrow range, but there is of course a huge choice in risk/reward. We like quite a wide ‘fly and the strikes we choose for our Put butterfly 7800/7650/7500. Remember we sell the body and buy the wings. Our prices 7800 177.5, the 7650 is 91 (x2)and the 7500 is 43.5. 182- 177.5=4.5, deducted from the 43.5= 39. Max profit at 7650 is 150 -39= 111. However our risk is no more than the 39 premium paid.

We could reduce this and buy a lower wing as the 7450 put is 34. That would give us a broken wing butterfly with lower cost but risk increased by 50.

Max reward, ( the difference between 7800 and 7650) 150- 29.5 =120.5, max risk 84.

Was 32.5 – Don’t hold your breath!

Then, 7800 put is 28, 7650 puts are 11 the 7500 put is 6. Gives us 28+6= 34, minus 11×2 =22. Ouch! It’s only worth 12 and while we have never liked butterflies we run it.

So, last week 23.5, 8.5 x2, 4.5 =11. Ouch, again

This week 41- 212.5×2= 16. Horrible!

Trade 358 Bonkers Trade

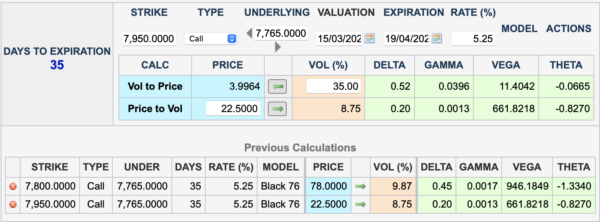

We’re going to do something totally wrong. This is the trade that destroyed a hedge fund. It’s a 3x 1. ( a three by one) not a recognised* trade. We sell 3 further OTM calls and buy one call OTM but nearer the money. Here’s what we have: We buy the 7800 call for 78 and sell 3 of the 7950 calls for 22.5 x3= 67.5. Thus our cost is 10.5 and we expect the theta to help us out in a big way.

In the event of FTSE hitting >7950(heaven forbid!) we have a lot of juice in the tank from our long 7800 call but it could get scary. (Calculator uses the Future price, note.)

The 7800 call is 170.5 and the 7950 calls are 74.5 x3= 223.5 We are nursing a loss of 53+ our cost 10.5 Ugggly!!!

We run it and hope( that’s not a strategy) that the market fades, while we are in our golden zone. Expiry this week would be peachy for this trade.

Last week: 177.5, and ……. 75×3 gives us 225-177.5 =47.5 LOSS We’ll run it and show how to repair such a lamentable trade!

This week 129.5 and 44.5 x 3, gives us minus 4

Trade 359 Come On, This High Looks Suspect. (Ignore my massive bias!)

While that might express my opinion that is not tradeable. I’m pretty rubbish most of the time, and definitely lost the plot + vat this week.

OK, let’s take a ‘punt’ here and do a synthetic short. We sell the 8000 call for 53.5 and buy the 7900 put for 58.

What could go wrong?

Last week the call is 52.5 and our put 49.5

This week 28.5 and 72.5 YAY! WIN 44-4.5=39.5 profit Or as they say in the share tippers world 877% ( It’ll pay for the bonkers stuff we tried this month)

Trade 360, are we calling the market’s bluff?

While the volatility is shockingly low it’s no fun to be selling puts So, in search of something to trade, let’s look at a strangle. Naked, yes, but playing Both sides of the market we sell 8100 call and 7800 put for 23 and 23.5 respectively. Our risk is now at 8146.5 and 7753.5 -logic of the trade? 15 days to expiry, and the downside does not seem to be under any pressure………. Yet!

This week 10 and 35= 45 we’re in credit for 1.5!

Trade 361 Something for May ( Aren’t we supposed to go gathering nuts?) No, apparently

This is a highly favoured trade and uses theta and the protection of a long spread. By now you are all familiar with the term ‘calendar spread’ whereby you sell the near month option and buy the far month. Here’s the twist: We buy a long spread in the far month, thus reducing our cost and perversely managing a little risk against the market flying upwards.

So, we sell the April 7750 put for 24.5 and we buy the May 7850/ 7750 put spread for 95-61.5= 33.5

Logic of the trade? If it goes wrong, ie a huge drop, it’s not hard to repair , and if the market smashes up we are unlikely to incur a loss

CAVEAT: When the near month option expires it becomes a new trade, be sensible.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.