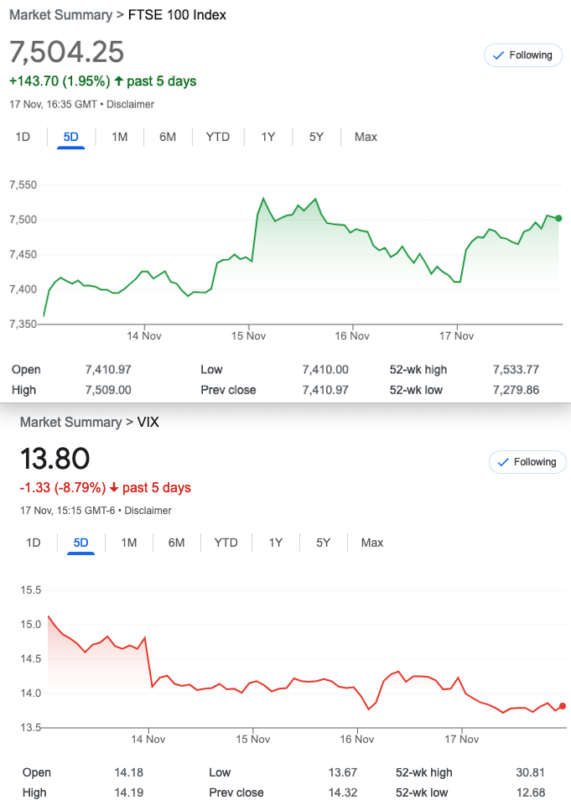

That Was The Week Vol got Crushed Again FTSE Took Off

Where in the world are we? By where are we, I mean in the disconnect between the financial world and ‘our version’ of reality. Actually I mean the FTSE, and where it is positioned relative to its larger cousin the S&P500. We have the relative P/E ratios 10.44(depending on whose data you use) for FTSE and 24.59 for the S&P 500. Many pundits say FTSE is out of favour, yet it’s cheap. FTSE is 7% off its all time high, the S&P ? A mere 4%. The Santa rally may well be on, and the US Presidential cycle says the 3rd year is generally the best for the stockmarket. What’s the catch?

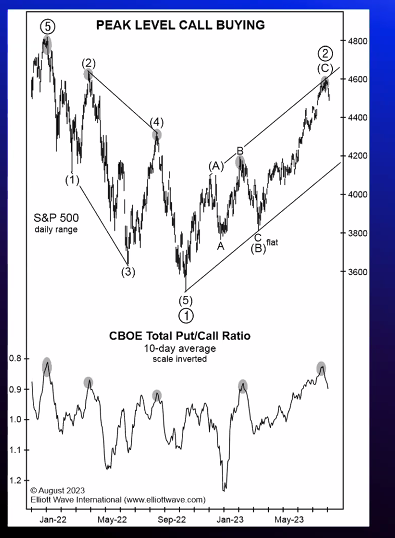

The excellent STA presentation by Robert Prechter makes ‘sense’ of a number of metrics aside from Elliott Wave. I know many of us are cynics about EW but Mr Prechter is highly credible and the presentation can be seen here: https://youtu.be/KeN_BDuGKHY?si=Hyx_bDcF_ZcFIaKk

I will spare you the extensive array of charts but one of them leapt off the screen. Peak Level Call Buying and the CBOE put/call ratio.

This is the kind of information we don’t have in the UK or if we do, I have never found it*. However for every call buyer there’s a call seller, of course. When you sell a call you need to hedge by buying the underlying. The film ‘Dumb Money’ makes this point, (not well), but it shows the power of leverage using options.

* Happy to be corrected

Distraction Trades

ADA was $0.3794 Now $0.3603 Bit of a fade

XRP was $0.66746 now $0.60772 Another leg down after the recent exuberance?

DAX 2 no entries but…. 3 wins+350! We are missing some big moves but the rules are the rules. None too shabby, however.

UK Gilts were £16.36 now £16.66 What does this mean, who knows? Certainly not yours truly!

343, and our Closed, Winning Legacy Trades

Trade 339

It’s simple, it’s spicy it’s got more front than Blackpool….. The good old Put Ratio Spread. But, this is wider than the Thames at Putney, it’s 200 points wide. Logic of the trade? It is very low cost, at 3.5 and could make 200. Here we go, we BUY one 7350 put for 101.5 and SELL 2 7150 puts for 49. Risk therefore at 6950 no upside risk and this may be a quick turn around if volatility drops like a stone, as it is wont to do.

Last week- 132 and 53×2 gives us a credit of 26, we paid 3.5. Close out? NO

Now those prices: 48, and 12×2=24 We watched this during the week and it did much better, well 30+ intraday.

Closed out for 48 WIN! intraday highest price, when the FTSE took a dive. Expiry saw this got to zero.

Trade 340 Bull Call Spread+

Watching yet another rather basic webinar, it occurred to me that the language is not really helpful, and I allude to bull and bear. This is a trade that would do OK in a flat market or moderate’ bull’ market. Losses potentially small. We buy a Nov 7250 call, for 126.5. We sell a 7350 call for 74.5. And then we sell a 7450 call for 39.5. Thus our trade cost is 126.5-(74.5+39.5)= 12.5. Our hope is that we make more than 12.5 and our max profit is 100- 12.5= 87.5 should the market roar to the upside we can adjust above the problem level of 7550. Twenty days to expiry…..It’s Witchcraft.

Ooer, missus! didn’t see that coming. Prices last week 165.5, 90.5, 39.5 = 35.5 a nice profit, and yes, we’d probably close out, but we always run to expiry

Last week 124,- 50.5, 13.5 = 60 WIN! At expiry 7485 we have 235, -135, and -35 = 65 -We’d take a win and not have to sweat expiry every time, that is not advice, it’s our choice.

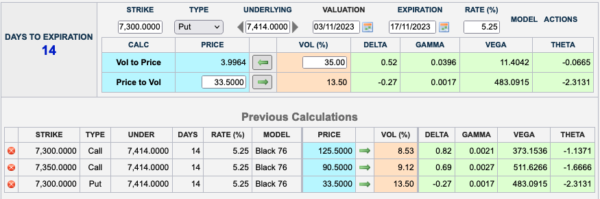

Trade 341 Neither a Jade Lizard, nor a Twisted Sister

While it irks yours truly to sell cheap puts, this looked ok in light of the major market moving events now out of the way. We buy a call spread and sell a naked (!) put. And yes, you’re right, eagle-eyed readers, Tuesday was 45 DTE for the December expiry and Tasty Trade would be looking for the 1 sigma strangle. We’re not! Here’s the calculation for our trade: So, those prices last week : We pay 125.5 for the 7300 call, we sell the 7350 call for 90.5, and sell the 7300 put for 33.5. Our cost therefore, is 1.5 our maximum reward is 50-1.5=48.5. We have theta on our side and Delta is miniscule but the spread that we own is in the money. Is the Santa rally on? The telly adverts are already annoying!

So, those prices last week : We pay 125.5 for the 7300 call, we sell the 7350 call for 90.5, and sell the 7300 put for 33.5. Our cost therefore, is 1.5 our maximum reward is 50-1.5=48.5. We have theta on our side and Delta is miniscule but the spread that we own is in the money. Is the Santa rally on? The telly adverts are already annoying!

Was : 83.5, 50.5 and the put 23.5 gives us a modest 9.5 running to expiry gives us our Max 50-1.5= 48.5 WIN!

Trade 342 Time Spread? Calendar we say, but with a twist

Calendar time? A cheeky short Nov 7350 put at 40, BUY the Dec 7450 put 146 and SELL the Dec 7350 put 94.5. So we buy the December spread and pay for it almost fully by selling the November put, for a small debit of 11.5 We make serious coin so long as the FTSE stays moderately below or above 7350 Our cost of 11.5 gave us 55.5= 31.5 =24, minus our cost 11.5, gives us a tiny win 12.5.

Trade 343, December, The New Expiry Month

As we inherit the long spread Dec 7450/7350, from trade 342 we could close out or do something more interesting. So, we can sell another 7350 put for 31.5 on its own or as a short spread 7350/7250, as we can buy the 7250 put for 19. So we’d have either a put ratio spread, or the latter, a butterfly with zero risk.

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.