That Was The Week 5 Consecutive down days?????

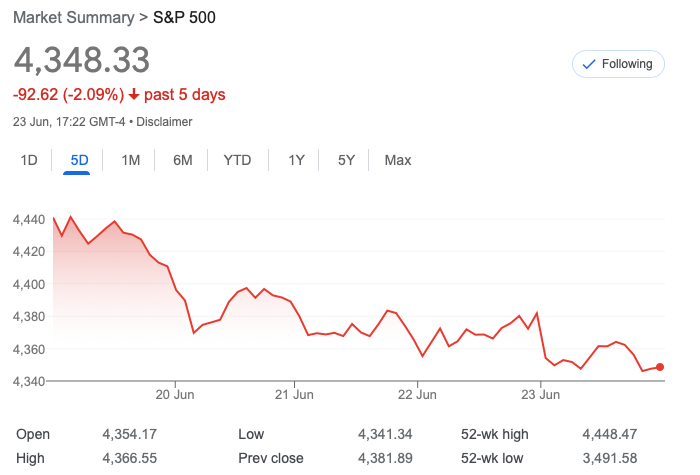

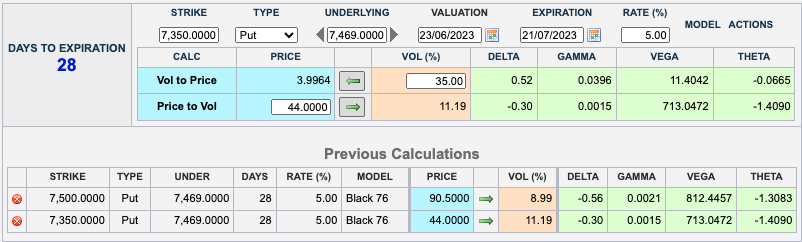

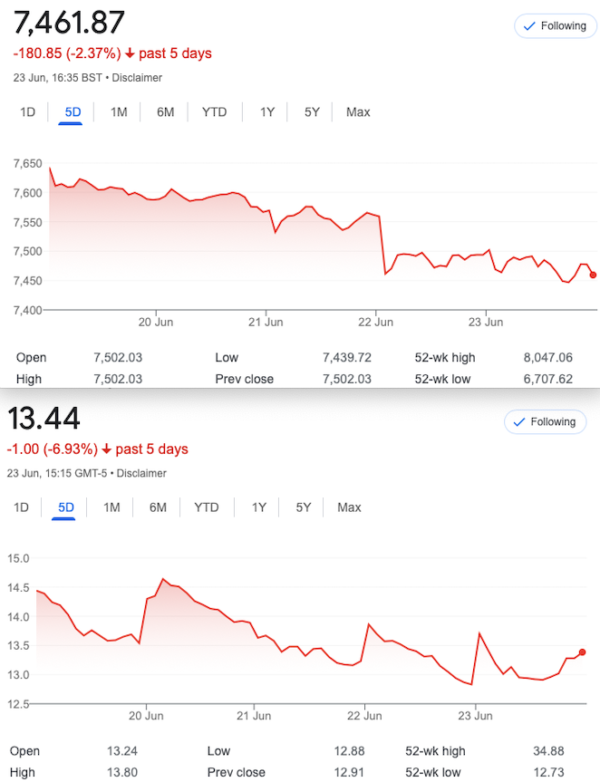

Following 5 up days FTSE dropped 5 days in a row. What is wrong with this (FTSEVIX) picture? Maybe the US has not had a drop? Oh wait…….

So, how do we interpret this contrarian position? I had a great position to adjust for taking in some premium, but by the time my price levels were taken, the FTSE had dropped almost 100 points from Wednesday’s low. However it was plain as day that volatility had not kicked in. Quite why there is this peculiar lack of fear is a mystery.VIX is our guide, our wake up call. So what is going on? My own deadbeat ‘lapsed’ ISA has not shown any rise, being underwater still to the tune of 9.24%. Said ISA is supposed to reflect the US mostly which has seen a big rise this year, by around 14%. My ISA is no market barometer, locally or globally, it seems. Apologies for not stating a case for a dropping VIX in a dropping market.

When The Market Gives You Lemons

That old cliché stands the test of time, and the litmus test is fully red. The other part of the cliché tells us to make lemonade. We are fortunate to be in a world of beautiful complexity, where we don’t have to be ‘bullish’ or ‘bearish’. Let’s hope the blind retail call buyers got a wake up this week, as low vol is consistent with a rising market. There must be some head scratching going on, bless them! You have to ask, are the clouds gathering, and if so how can we prepare?

Apologies for the tardy message re: TastyTrade’s event in London today, but I hope attendance was good. I know many UK traders trade the US for its low costs and good liquidity. I don’t need the added dimension of those S&P frenzied meltups! However the compensations are relative. So, I would not cast aspersions.

Distraction Trades

ADA $0.2955

XRP $0.4926

DAX Say whaaaaaaat???? Not one trade entry this week. I KNOW Not one.

GILTS U.K. Gilt UCITS ETF (VGOV) Was £16.44 now £16.55

Legacy 321(Magic number!) and Trade 232 In this off kilter Market

Trade 321 in a flat low vol market- Yikes!

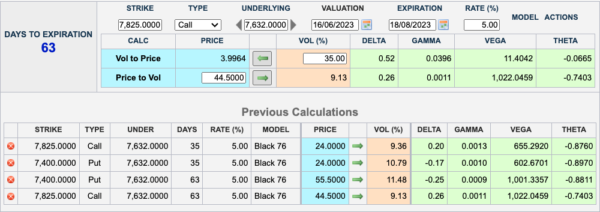

Let’s get spicy in this season of low volumes low volatility and low expectation of actually having a smart trade. Theta is not our friend so we look to take on more risk and sell more options than we buy. Here we sell 2x the near month, July strangle 7400 puts,(24) 7825 calls(24), and we buy one August strangle: 7400 puts (55.5) and 7825 calls (44.5) .Here’s the numbers: 55.5+44.5= 100 and 24+24 (x2)= 96. Our cost therefore is 4

Overall theta was around 1.92 and Deltas, we are not far off neutral. Risk – well it’s going to get ugly outside of our strikes. Hand on heart it’s not ideal but we always remind readers it’s about learning, winning is the cherry on the cake.

July put 7400 56, call 7825 4 August Put 7400 101.5 Call 7825 11.5 Gives us 56+4= 60 x2 =120 for July. August: 101.5+11.5=113. Currently in a loss 7

Trade 232 Some Movement but Volatility Being Supressed

Again we can only use theta in this ludicrously low vol environment. It is a concern but if we take a real plummet, we will at least be able to morph/adjust/roll. The above calculation: https://www.cmegroup.com/tools-information/quikstrike/options-calculator.html?utm_source=LINKEDIN_COMPANY

We are doing another old chestnut, the put ratio spread. Buying the 7500 put and selling the 7350 put twice. Cost:90.5-44×2= 2.5 Logic of the trade? We have risk down at 7200, and we may find this trade in profit quite quickly above that level, even if we have a blip up to 7600 or so. Should the FTSE dip lower than 7200 we will adjust, if the market shoots up we have no risk other than our tiny 2.5 debit

For those new to options:

https://optionsinvesting.co.uk/special-edition-how-options-work-1/

https://optionsinvesting.co.uk/special-edition-how-options-work-2/

https://optionsinvesting.co.uk/how-options-work-page-3/

Contact: surreyhantstraders@gmail.com If there is anything you’d like help with, we all started somewhere and yes, it can be baffling.

Stop Press: I’m told that Ice.com prices are in fact live. This would chime with the fact that I logged in at 08:00 few weeks back and saw bid-ask prices. However I had been having comms with ICE and told them this was just pointless at best at worst, disingenuous. Maybe this had some effect. I stand corrected.