That Was The Week FTSE Went….Nuts, Against All The Forecasts

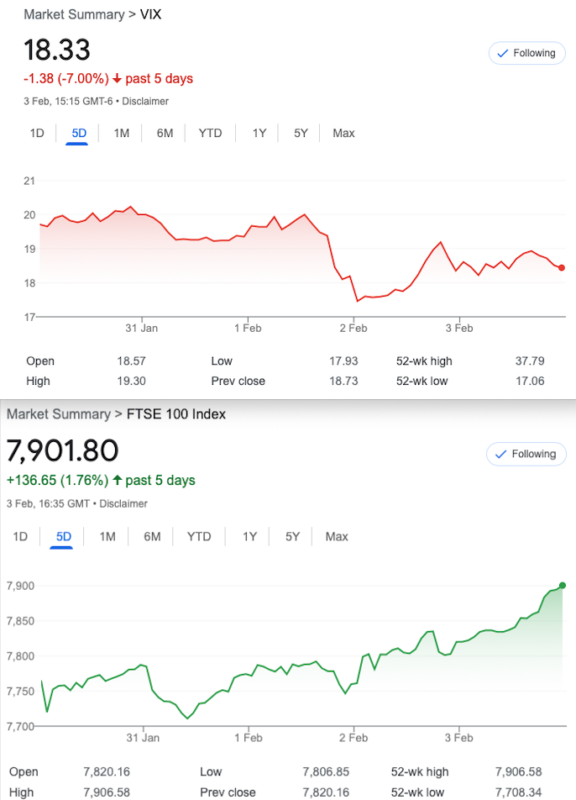

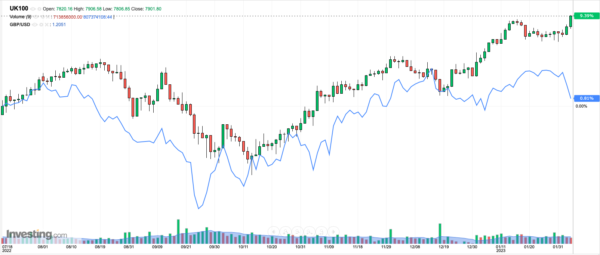

So, the UK is the only nation to go through a period of ‘negative growth’. In actual English that is a contraction. My BS detector says all the clever talk about GBPUSD is simply a retrospective punt as to why this staggering amount of money appeared in the FTSE. The chart shows that the correlation is weak, and as a nett importer, the weakening pound makes imports more expensive. Thus the perverse logic of making our exports cheaper does seem to ring hollow to this rank outsider. However I am, as regular readers know, biased. So maybe they are right, maybe the FTSE at a new high P/E Ratio(17.92) is a bargain. Or maybe there is a far more sinister explanation that might benefit certain ‘non mainstream’ investors. I couldn’t possibly comment.

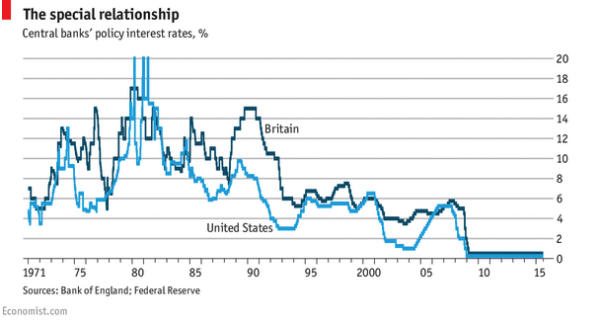

The above chart shows that there is no divergence for the most part and going back further, £ to FTSE seems to run more or less in tandem. The sudden 3% drop in the £ may also be a by-product of an interest rate that really should be 5%. Historically we have always had higher interest rates than the US.

The UK has often been hobbled with higher interest rates, some of us were getting almost 20% ON DEPOSIT at the bank back in ’89. Having no qualification to venture an opinion, I would still say we should have 5% interest rates. Mortgage rates should never ever have been 2%. Plummeting house prices and rising interest rates may well become that toxic mix again. Or maybe yours truly is the prophet of doom and wide of the mark. For all decent people let’s hope the effects are minimal on the real economy. The stockmarkets can take care of themselves. Rant over

Distraction Trades

ADA $0.4038 ( I closed out at $0.44, so maybe it’s creeping back out of the gloom)

XRP $0.41267 A little rise for Ripple too.

DAX worst week ever- 3 losers( 30 x3) 2 no entries. And yet still no niche instrument to trade, that we like. We keep looking. (Gold is too dreary)

Trade 300 A Milestone, Could we match Past Performance?

Yet again, the odd ratio calendar straddle reared its ugly head. Say whaaaat? It’s a multi leg strategy buying cheap near month(Feb) 7775 straddles for 102+97=199 x3 and paying for this by selling 2(two) March 7775 straddles. 149+158.5=307.5. Straddles are the combination of calls and puts ATM -at-the-money. So we pay 199×3= 597 and take in 307.5×2 =615. Our credit therefore is 18 our risk is that the market goes nowhere, but if those put trades are telling us something we have the advantage.

Note the theta (time decay) works against us x3, and time is not on our side (27 days) against the March lower theta x2, and 55 days to expiry. Not clear about this? Email us: surreyhantstraders@gmail.com

The 2 Mar straddles were 243×2= 486, the 3 Feb straddles 150.5×3= 451.5. Losing 17.5 last week.

So where are we now? 150 and 23 x3 = 519 against 173 and 76x= 498. gives us 21. We’d close with a modest 21+ 18(our original credit) 39 profit WIN!

301 That Calendar Theme

In almost oppostion to trade 300 we have calendar ratio strangles -so we sell 2x Feb options and buy the same strikes in March, once. How much trouble can we get into? We are selling the Feb 7500 put 18 x2, and the 7800 call for 58×2. We are buying the Mar 7500 put for 56 and the 7800 call for 91. So the numbers: 36+116= 152 minus our cost 56+91= 147, giving us a credit of 5.

Here’s a link to the options creator which shows risk <7400 and >7600 max profit 200 https://optioncreator.com/st2h4dn

Now? March prices 31.5 plus 155.5 Feb ( 6 + 129.5 ) x2= 271 and 187 for Mar. We are 84 in the hole.

We need to run this to expiry but this massive rise may remain ugly.

302 Dealing with A New Paradigm

It’s 100% certain that the market will be 5% below the all time high. Trouble is we don’t know when. It’s also possible it goes up each week and we don’t know if that trend will end any time soon. There’s not enough premium in the Feb options, so what to do? A cheap trade that most likely will do very little. We will try a put ratio spread buying a Feb 7850,(39.5) and selling 2x7750s (19.5). Gives us a debit of 0.5 and max profit therefore of 99.5. Risk at 7650.

Hard to get inspired in this insipid volatility, but if there’s a big move down, this thing will explode against us, so we need to be nimble.