That Was The Week, The Meltup Continues Apace.

S&P500 up to 4000 again, as the market is now saying inflation has gone, recession risk is nil, it’s all peachy. We understand the media needs to sell advertising space and misery loves company, but many of us have been seriously wrong-footed. Liz Truss sparked this rally with her own demise. 25 October until now has seen a 12% rise. FTSE watchers, like yours truly would be hard pressed to find a whole year where the index went up that much. We remain unconvinced, but the chart does not lie, while the stats show my own bias. https://www.1stock1.com/1stock1_764.htm

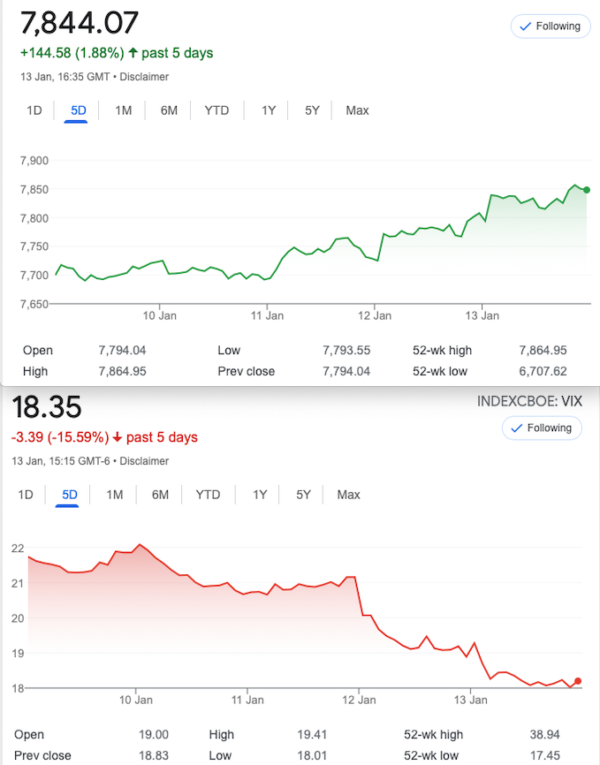

Pride comes before a fall, it is said. I must have been prouder than a muster of peacocks (Ok, I looked up the collective noun!) I have been maintaining an aversion to downside risk for some time, at the expense of the upside, and currently in a world of hurt. We should be thankful indeed for the panoply of strategies available to us. Volatility is our guide and right now is not a good time to sell puts. Holding out for better opportunities sometimes means inaction. Price Headley, as I have oft quoted says ‘you often make more money sitting on your hands’. Personally I wish I’d done that and taken a break in December. Hindsight is a wondrous thing. So, where are we?

Distraction Trades

ADA $0.3510

XRP $0.39377

DAX 4 no entries and one loser(-30) Worst trading week in ages- hard to know what else to find but will dig around for something more engaging.

Legay Trades and 299 Let’s Try not to break anything

Trade 297 The Widest Butterfly in The Village

So as above we now have banked 4.5 and we will chart the progress of the butterfly. A 400 point wide spread butterfly (7400/7000/6600) we own for free has to make ££££more. Anyone NOT noticing the power of options yet?

Those prices were: 67.5 13.5 and 6 So our butterfly is worth 67.5+6 minus 13.5×2= 46.5

Was: 54.5 8.5 and 3.5 =41

Now? Almost zero. However we run it as there is nothing to lose. We have nothing to win now, but it cost us nothing.

Trade 298 Is This a New Bull or simply BS?

Calls -our least favourite options! So- let’s try a ratio spread 7600/7700 132.5 and 66.5 x2=133 We are buying one 7600 call and selling two 7700 calls which would benefit from a drop as well as theta working for us, and it ‘only’ costs margin. risk at 7800. What could go wrong?

What could go wrong indeed? Those prices: 255.5 and 158 x2= 316, so our trade is 60.5 underwater

Choices(options)

1. We convert our ratio spread into a butterfly by buying the 7800 call at 72. On its own that makes it an expensive butterfly, but it’s a choice.

2. We pay for the 7800 call by selling something else, more calls at 7850 40.5 7900 20. We then have risk above 7900 and a cost of 11.5

3. We do a calendar spread buying the Jan 7800 call and sell the Feb 8000 call at 75.5 Kicking the can into the long grass. What would a central banker do?

4. Close out the 7600/7700 spread for 100 buy back the 7700 at 158 and sell the 7800 at 72 So we take in 100-(158-72)=24

This is an unhappy trade given our record of reasonable, though quick selection. However it gives us a chance to look at adjustments, and we give up our money very dearly.

Trade299 Getting our Revenge( Tip of the day: Never ever revenge trade)

We want to have some long exposure to puts as vol is ‘at a low’ but we never buy outright. We buy a put spread, buying the Feb 7900 put selling the 7750 put those prices :180.5 – 117.5 = 63. Then sell the Feb 8100 call at 45.5 to help pay for it. Thus, we have a fair bit of wiggle room if this takes off against us to the upside. Oh, and that Vix chart: