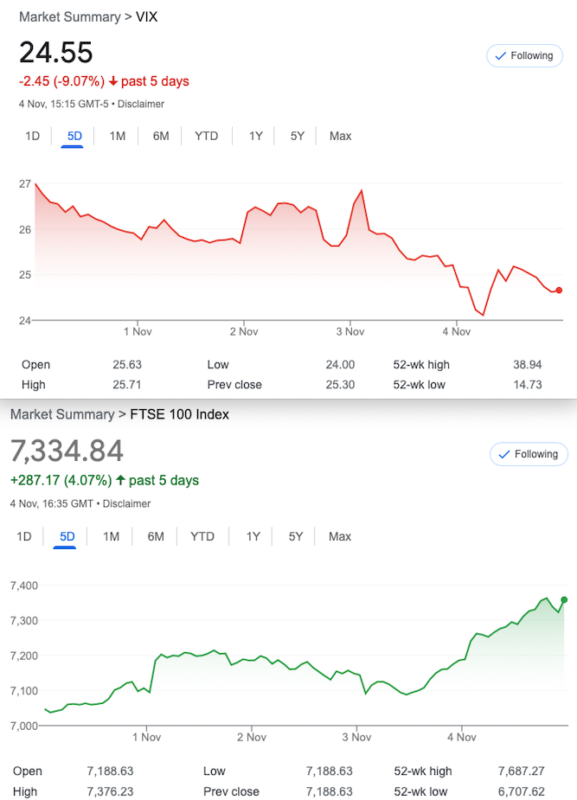

That Was The Week, FTSE Meltup. We are in the Metaverse

Ouch and thrice ouch! FTSE took seventeen trading days to go from 6700 to 7350.+ 9.7%. Pension funds minutes away from collapse,chaos in government, interest rate rise, and yet here we are. The market is always right, or always wrong, given that it never settles. However, the only news item found to support this monster rise seems to be the lifting of Covid restrictions in China. Quite how that affects FTSE100 companies seems to be limited to the miners and banks.(Rising tide raised all but a few boats). We, however quit trying to rationalise such moves as it’s the preserve of those who don’t trade. Analysts are always right, after the fact.

Traders, that we are, we try to ignore all the noise. Predictions are for fortune tellers or those magical trading systems. Controlling our emotions and calmly taking decisions is, of course, always preferable to a knee jerk reaction. Nassim Taleb says ‘ Stoicism is about the ‘domestication’ of our emotions, not their elimination. He’s always right! So, worth paying attention to. However time for business:

Distraction Trades

ADA $0.4299 6% rise today- is the tide turning for cryptos?

XRP $0.49671 holding steady….

Dax 2 wins 60 and 90, one loser -30, one b/even +30. Friday the signal was unclear and missed 400!

Trade 289, 290 A new Strategy, sort of and 291

Again let’s try and break something! We will have a slow burn, an iron butterfly. We buy protective call at 7050 (105) and protective put (102) at 6850- because we are selling the 6950 call and put 156 and 139.5 gives us 88.5, max profit, max possible loss 100-88.5= 11.5

Last week- those prices at 6950 159+75, then the put at 6850 48, the call at 7050 99.5 gives us 86.5

This week – yikes- the 6950 straddle 409.5 and 9.5 the 7050 call 315.5 and the 6850 put 6 -so 97.5 – Losing big.(9)

Trade 290 That ‘New’ Strategy We claim no authorship of this but we will have fun seeing how it pans out.

This trade is a call spread risk reversal. Now a ‘risk reversal’ is a synthetic ie it mimics a future or another underlying instrument. You would sell a put to buy a call. In our example we sell a put to buy a call spread

Here’s the trade. We buy Nov 7000 call for 127.5 and sell the 7050 call for 99.5. This therefore, costs us 28. To pay for this we sell the 6725 put for 27.5.

As you can see we had zero risk to the upside but a max profit of 49.5 -nice! However, we have a naked put which may need to be adjusted.

This week 7000 call362 7050 call 315.5 6725 put 4 Gives us 46.5, the value of the call spread, minus 4 for the short put= 42.5. Close out and WIN!

Trade 291 Is this Meltup Sustainable?-This idiot hopes not.

We are placing a ratio spread buying one7450 call,(41) selling two 7500 calls. (27) ( November expiry)

So, the logic of the trade- we take in a credit (27×2)-41 =13 with zero downside risk. However, a possible max gain from the spread if FTSE hits 7500 at expiry of a further 50. Risk at 7550.