That Was The Week Turmoil Became Normal

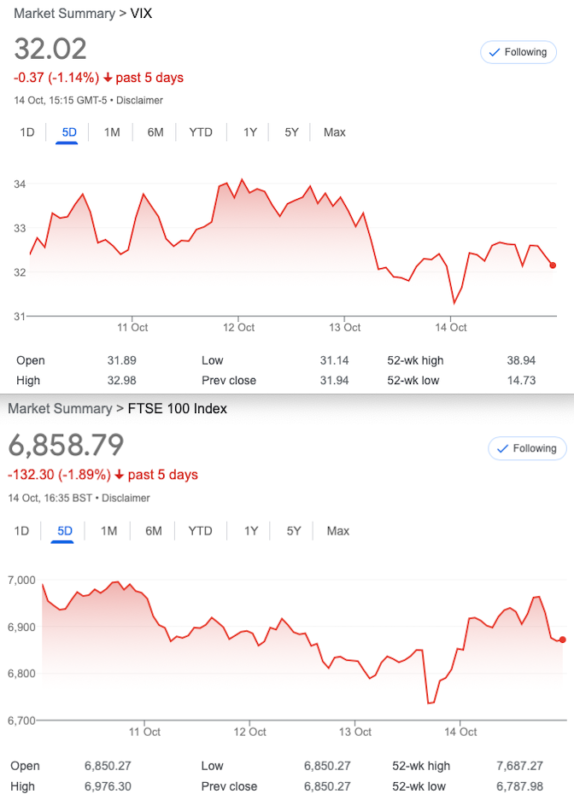

We saw the S&P500 swing wildly ±8% from high to low. Normally we would not pay much attention to CPI, and Thursday’s number was a nothing, but the markets went nuts. As if we need evidence the stockmarket is far from a weighing machine. It’s a headless chicken! Other opinions are available. Pension funds, you’d think would be pretty staid, but as the saying goes ‘ when the tide goes out we see who is swimming naked’. How on earth can they be run so badly? Personally speaking my margin has never ever exceeded 50% of cash in my account. Margin calls should be in the hedge fund domain, where risk is tested daily. Margin, as most of you know is the required amount of cash on hand to cover risk. When you own bonds and their value tanks you should not be batting an eyelid. there’s the divi, remember!

Trade Your Own Money, Don’t Let The Pro’s Do Their Worst.

I dare not look at my ISA with the legends that are JP Morgan and I can’t look at another ISA as their security keeps locking me out. I despair of our financial services, and their smug atttitude to the people who pay their wages. Though, I have nothing but praise for my broker, and also Degiro, where my comedy portfolio of well researched stocks continues to sink. In fairness to those funds that can only buy shares, it is not easy and there will be bear markets along with the bull- QE, or ‘growth’ as it is sometimes called.Meanwhile this from CME from Thursday https://view.the.cmegroup.com/?qs=6de943d16ba8c7a0c30b8883c888d38973e54523bd2f1c4e25f01405360a0610b8159964d1d771e782d8b4338ea05b2aaeb00ea39db74c2c3cfc6e62f30ad1b0ace13dcc54158368bec3a6ae42717a79

Followers of our offerings will be pleased to note ALL trades in rude health, but we don’t learn from our wins. We’re gonna break something, so it’s not all doom and gloom.

Distraction Trades

ADA $0.3667 drifting lower

XRP $0.48407 drifting sideways

DAX 2 no entries 2 losers one win 100 – Clearly the news driven moves are not captured as our entry is at 08:00am -08:30 am.

Legacy Trades- All Going Well, So Let’s Break It with 288

Trade 284 One near-the -money, two further out

Let’s take a look at an old staple- the ratio spread. We buy a higher strike put then sell two or more further out-of-the-money puts. As we have a legacy 7200 put from Trade 283 let’s use that and so we have 2 scenarios: We carry on with our free put, and sell 2 of the 6950 puts or we just open this as a new trade 144.5 – (2×73.5) A tiny credit to enter, or we are banking 177 as a continuation of trade 283.

Where’s the risk? We’d get a bit fidgety at 6700 and if the market lifts off again we may bank only a modest profit, but we have 2 lots of time decay versus one.

Last week. Yowser!!!!!

The 6950 puts were now 140 , the 7200 put is 268.5 . So, a loss currently (140×2= 280) Gives a debit 11.5

Cut losses and move on? The eternal question- whither the market? We don’t know but let’s take a pragmatic look, bring on the Greeks:

The Greeks!

Those Deltas 41×2- 64= 18. So at £10 a point for every 1 point the FTSE moves against us, costs £1.80, but that is an oversimplification, gamma, theta and vega will all need to be factored in, so by close of play on monday we may see a little buying coming in. Thus, we may see our position go positive. Rho can chill for the time being! ( Yes I got the interest rate wrong but it’s really academic) Calculator from CME https://www.cmegroup.com/tools-information/quikstrike/options-calculator.html?utm_source=LINKEDIN_COMPANY

Previous week: our short 6950 puts were 174 x2, and our long 7200 put is 330. Still seeing a small loss of 18 but we soldier on, and look at how we morphed into 285, and did it fare any better?

Last week, those prices the 6950 puts are 95 (x2)= 190 and the 7200 put is 238. Giving us a healthy 48 WIN! (but we’ll run it too)

Now 128×2 and 333 Gives us a bigger WIN 77

Trade 285, Ladder Time

Juicy premiums, yes, but again let calmer heads prevail and we can connect with Trade 284 by buying the 6700 put which creates a 7200/6950/6700 butterfly. But we don’t want to pay 69.5 for that 6700 put so we will finance it by selling 2x 6500 puts. We take in 80, giving us 11.5 credit. Now our risk is lowered to 6500 but we are in a 2×1 ratio, we are short 2 puts. We could also have looked at a strangle: selling a 7350 call (35.5)and a 6700 put (40) We would have upside risk >7350 but if the market did shoot up again, we could take some profits from the put position. This is going to be fun running to expiry with updates along the way. Hope everyone’s keeping up, but to summarise:

Long 7200 put and 6700 put. Last week: 330 and 88.5 = 418.5 Ouch! shorts were 452 or 5.5 in credit if we had sold a call

Short 6950 put x2,174×2 = 348 6500 putx2 = 52×2 or (or 6500 putx1, 7350callx1) ( 52 and 13 )=65

Losses turned around and now outlongs:7200 put 238 and 6700 put 34.5= 272.5

Shorts: 6950 puts at 95×2 6500 puts at 16.5 x2 = 223 Gives us a credit 48.5 Again we run it but it’s a WIN

This week:

Longs 7200 put 333 6700 put 30 gives us…………………363

Shorts: 6950 puts 128×2, 6500 puts 9×2 =256+18= 274

Can you say 87? WIN

Trade286 Playing Safe, FTSE =6893

Assuming margin is an issue then using regular spreads is the way to go. Regular followers will know where this is going. Iron……. Condor! We sell the near month options with strikes nearer the money(the index) and we buy a protective put and call

Here we go: we sell the 7250 call for 25.5 and buy the 7300 call for 18.5 AND we sell the 6700 put 88.5 and buy the 6650 put for 77.5 Mental arithmeticians will know how this pans out. 25.5- 18.5= 7 and 88.5-77.5= 11. 11 plus 7= 18. Our risk therefore is 50-18= 32.

Where is the risk? 7268 and 6682 Anywhere in between gives our max profit 18. There are 14.2 trading days in which to be wrong!

Was: 22, 15 (calls) and 34.5, 28.5(puts) so we have 7, 6 =13. We sold those spreads for 18, we’re on the right side of the crazy.

Now: Call spread 3-2= 1 Put spread 30-22=8 So, we are in profit to the tune of 18-9=9.

Trade 287 Stepping up the Volume

Let’s go spicy with a big old calendar spread, selling Oct options, buying Nov options. What can we find?

We’ll do a 2 speed trade -a ratio calendar selling 3 front month buying 1 far month, and…….. doing 2×1

The 6700 put for Oct= 34.5 for Nov= 103.5

a) 3×1 – is zero cost ( there’s alway margin)

b) 2×1 more conservative but it costs us- can you see it? 34.5

It will be informative seeing how the trade unfolds.Typically these have done very well in the past, and we may have the challenge of needing to adjust.

Oct 6700 put 30 Nov 6700 put 120.5

Thus a) gives us a profit of 30.5

b) gives us a profit of 120.5 – (30×2+34.5)= 94.5. Profit 26

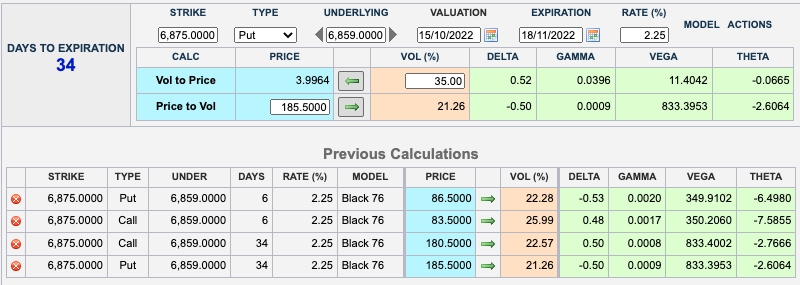

Trade 288 Let’s Go Bonkers

We are going to ratio a calendar straddle! FTSE cash 6859 We are using the 6875 strike and selling 2x Oct straddles( a call and a put at-the-money) and buying 1 of the Nov equivalent. It is at-the-money, so don’t like that much, then there’s the issue that we need the expiry at 6875-what are the chances this will make money? It may be a great way to show effective adjustment. Our cost- 366-( 170×2)= 26 Here’s the Calculator, and just look at that theta!

Note: Gamma is greatly increased near expiry, and so is theta. Deltas? Puts are always quoted as negative delta, but if you sell, you have a double negative or positive. Call delta is positive but if we sell it, the delta becomes negative. When Deltas are opposite and the same value it’s known as Delta neutral.

All clear now? Let’s sit back and watch the fireworks, this could get really spicy.