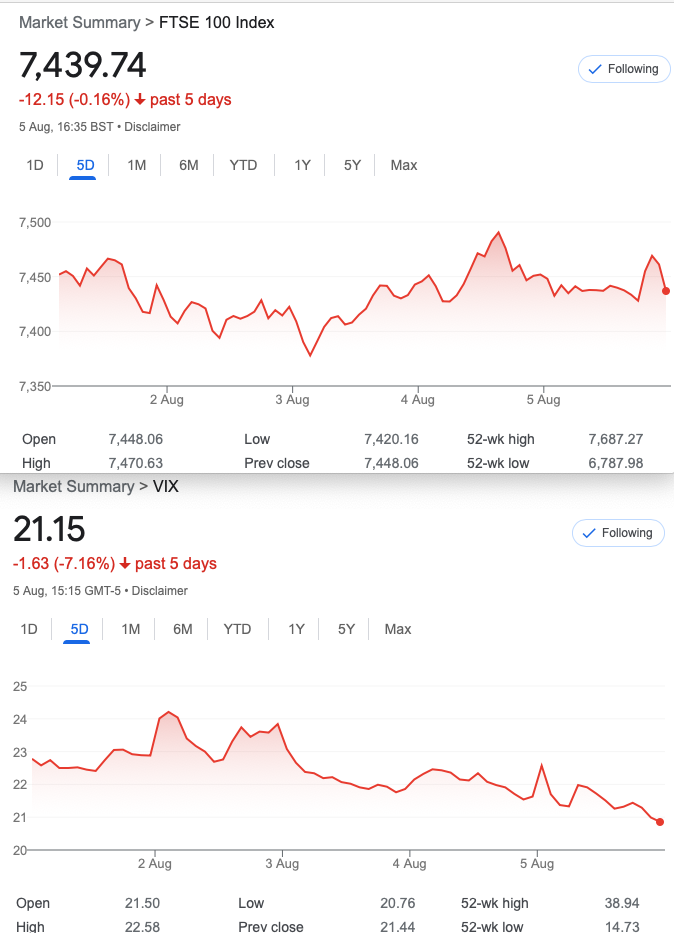

That Was The Week Nothing Happened

So- an octagenarian lady visited some islands and a bully went ballistic, with missiles. What a ridiculous world. Meanwhile we had the big one- non farm payrolls, which came in with a monster number 528k against expected 250k. Biden may have detractors but undeniably the economy has fared pretty well since taking office. Remember what a clown- led disaster he inherited.( No bias here!) However things may be taking a downturn as the recession looms. Bank of England is pretty confident of their dismal prediction. Oh, and nothing happened when the interest rate was bumped up by a paltry 0.5% to 1.75% Some of us had cash on deposit at 19% with a high street bank in 1989! (I’d sold a property, and waiting to buy another)

The Lonely Greek

So we have not been troubled by Rho- in fact the calculator we use from CME does not even bother with calculating Rho. What’s that you say? Rho? Sensitiviy of an options price, to a change in interest rates. Here’s the thing- it barely made a difference for our positions, but for years we’ve had NIRP. Rates so low as to be effectively negative. How interest rates will peak is anyone’s guess but inflation is not ‘transitory’. And if it’s 10% this year, well who knows? And to answer in full- yes I did do a calcuation based on current positions and Rho’s effect <0.1% The risk free rate changed, that’s all.

Top Traders- Do They Help Us?

This dropped in to my emails this week: https://kagels-trading.com/trading-performance/

Interesting list and I have to say I have read 2 Trader Vic books and found them helpful. Of course for me the game changer was the simple pithy phrase from the late Van Tharp: We trade our beliefs No matter the trading instrument there is a commonality- we manage risk to make profits. It is easy to get dispirited when things seem to go against you at every turn and you cannot see anything worth trading. The trades we choose here are aimed to show with a modicum of thought you can and will be profitable. Ignore the noise- the Twitterati and the trader forums. Don’t gamble, always look first at the risk.

Distraction Trades

ADA $0.5183 a blip up yesterday

XRP $0.3746 whiffling around is Crypto dead? Nigel Farage seems to suggest otherwise- make up your own min, I don’t know!

DAX One trade +70 4 days with no trade entries. Boring but then it has only one specific entry with rigid criteria.

Legacy Trades Trade 275, 276, 277 and

For those with a limited account the iron condor having no naked element. This keeps margin limited to the width of strikes employed. Here it’s 50 and- a reminder of what the iron condor is. We sell a call spread and a put spread, our view is that the market will stay in a limited range 6875-7425

We sell the call spread, thus: sell Aug 7400 call for 49, we buy the protective Aug 7450 call for 36. Gives us 13

We sell the Aug 6900 put for 99.5 and buy the protective Aug 6850 put for 88 Gives us 11.5

We thus take in 24.5 and our risk is……. the 50 spread minus our credit= 25.5

The call spread was 16 the put side 6.5. Gives us 22.5- the optimists will point to the 10% + gain!

Then: call prices 93.5 and 69 put prices 14.5 and 12.5 Put spread is now worth 2, but the call spread got ugly at 24.5 Currently underwater a tad.

Call prices 78.5 and 53 put prices 7 and 5.5 total 27 Like watching paint dry except now, you no longer like the colour!

Trade 276 We are Bullish/Bearish, or whatever

We always aim to buy and sell in combinations and this week’s offering is a call ratio spread, with a moderately bullish bias. However we don’t mind the market going south either. In fact we cannot lose unless the market hits >7600 in a big way. We buy the August 7400 call and sell two of the 7500 calls. Those prices 56.5 and 28.5(x2)=57. So you see we have a credit of 0.5 if we ignore commissions. We ignore commissions- as all our trades are for educational purposes. This trade attracts a fair chunk of margin given the risk to the upside is infinite.

Last week: 93.5 and 49×2= small loss 4.5

Now 78.5 and 33.5 (x2) = 11.5 WIN? We will run it some more but another good return even closing out now.

Trade 277 Balancing Out An Ugly Call Trade (Is there any other kind of call trade?)

We take the opposite position to Trade 276 with a put ratio spread, but take in some premium: We buy the 7200 put and sell 2x 7100 put

Those prices: 47 and 31 (x2) gives us a credit of 15 We have risk below 7000 and 3 weeks to expiry

Now 27.5, 16.5 we took in 15 and now it’s 5.5 WIN! We run it again to expiry, but it’s a nice return.

Trade 278 Bonkers 3×2 Calendar Straddles

That’s a combination of words you don’t see every day! It’s fun it looks nuts but there is a rationale: We just need a big move one day this coming week. We have not seen a sensible 1% drop in ages, Vix has been quiet for a while….

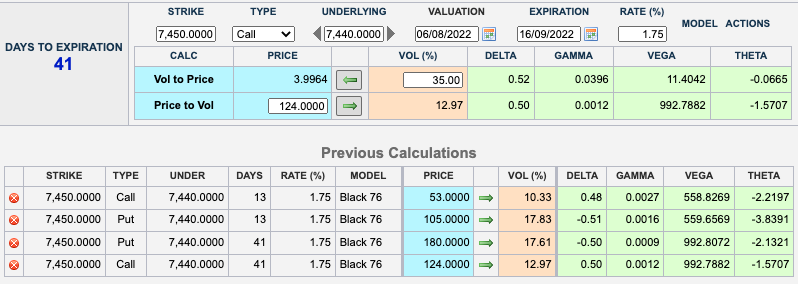

So what’s all this then? We are buying 3 August straddles and selling 2 September straddles. The long and the short? Theta is mighty ugly, so we need a quick turnaround. The Aug straddle is 53 and 105= 158, we buy 3 =474. The Sep straddle 124 and 180=304 we sell 2 = 608. Now we take in 134 but that is not important. Theta = 6.5×3 against 3.7×2. It is horrible so…..

Just for fun let’s do 3×3 at great expense 304×3= 912 158×3=474. Our cost 438-ouch! It’s not anything we’d do but let’s see what transpires.