That Was The Week The Doom Mongers Got Spanked

So the massive 0.75% rise in FED fund rates created a contrarian massive rise in the markets. Traders like us need to know, for useful economic updates, though mainly for forex as it’s name implies: https://www.forexfactory.com/calendar

Some announcements are real market movers so it’s helpful to know what’s coming up. Non farm payrolls for example, first Friday of the month. We do not aim to provide predictions and you may recall last week’s missive. We showed a few Armageddon charts, and of course the market did the opposite. Populist views are often wrong, like the financial pundits. So what happened? Company profits are on a tear, people are spending savings accrued in lockdown. Rate rise signals were overt and so pretty much baked in. Covid didn’t go away, 1 in 20 of us in the UK has it but it’s no longer news.

We digress, we naturally have a weather eye on the news but mostly it is not very helpful. Ignorance is not blissful, however, when you have skin in the game.

On topic: Van Tharp’s team on vertical spreads https://www.youtube.com/watch?v=NQYD1jaWruM

Off Topic: Like wet paint, you simply HAVE to try it:

Collatz Conjecture https://www.youtube.com/watch?v=094y1Z2wpJg

On The Money Carbon footprint calculator https://www.wren.co/calculator (and yes I signed up to have 200% negative footprint)

Distraction Trades

ADA $0.5278 A rise from the low of $0.42-ish

XRP $0.36836 In concert with the other cryptos it has recovered a little

DAX 1 loser 1 no entry 1 b/e 1 loser 1 win 150 A somewhat erinaceous* week’s chart

* I didn’t know this word either -it means ‘hedgehog like’ so a spikey chart is worthy of this descriptive word

Trade 275 An old Chestnut

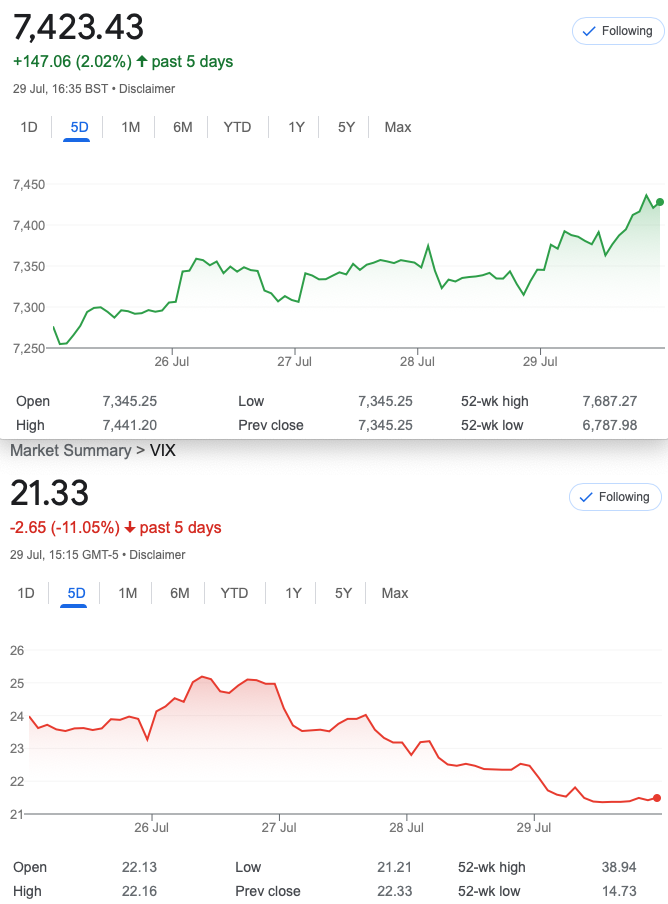

For those with a limited account the iron condor having no naked element keeps margin limited to the width of strikes employed. Here it’s 50 and- a reminder of what the iron condor is. We sell a call spread and a put spread, our view is that the market will stay in a limited range 6875-7425

We sell the call spread, thus: sell Aug 7400 call for 49, we buy the protective Aug 7450 call for 36. Gives us 13

We sell the Aug 6900 put for 99.5 and buy the protective Aug 6850 put for 88 Gives us 11.5

We thus take in 24.5 and our risk is……. the 50 spread minus our credit= 25.5

The call spread was 16 the put side 6.5. Gives us 22.5- the optimists will point to the 10% + gain!

Now call prices 93.5 and 69 put prices 14.5 and 12.5 Put spread is now worth 2, but the call spread got ugly at 24.5 Currently underwater a tad.

Trade 276 We are Bullish/Bearish, or whatever

We always aim to buy and sell in combinations and this week’s offering is a call ratio spread, with a moderately bullish bias. However we don’t mind the market going south either. In fact we cannot lose unless the market hits >7600 in a big way. We buy the August 7400 call and sell two of the 7500 calls. Those prices 56.5 and 28.5(x2)=57. So you see we have a credit of 0.5 if we ignore commissions. We ignore commissions- as all our trades are for educational purposes. This trade attracts a fair chunk of margin given the risk to the upside is infinite.

Now 93.5 and 49×2= small loss 4.5 Time to panic? Who knows what clownish antics we’ll see next week?

Trade 277 Balancing Out An Ugly Call Trade (Is there any other kind of call trade?)

We take the opposite position to Trade 276 with a put ratio spread, but take in some premium: We buy the 7200 put and sell 2x 7100 put

Those prices: 47 and 31 (x2) gives us a credit of 15 We have risk below 7000 and 3 weeks to expiry