That Was The Week Markets Surged in a 2 track economy.

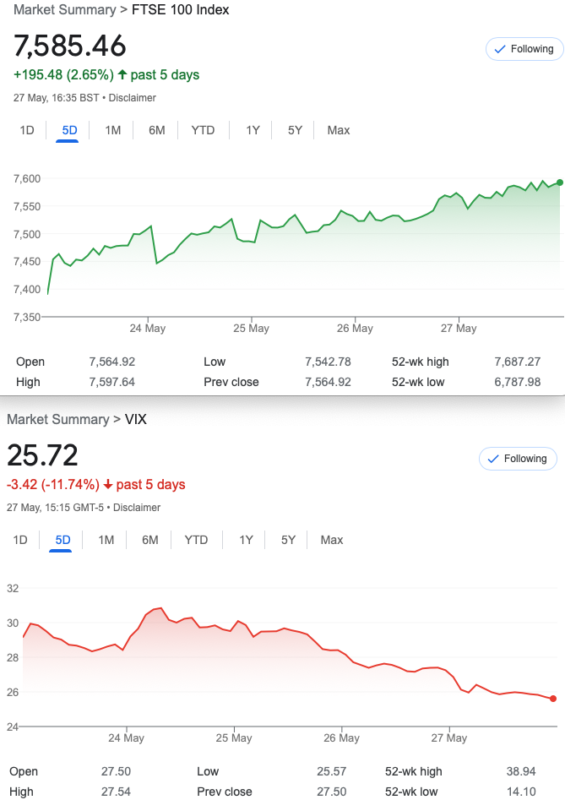

Crisis, what crisis? We are told many have to choose between heating and eating, while stock markets enjoy more upside. The indifference and bearish posts and Tweets evaporated. Fund managers are enjoying juicy returns and inflows of cash, in the US at least. Our own FTSE seems to be challenging the previous tops as it broke through the 7500 barrier. Windfall taxes aside it’s hard to know what is going on ‘under the bonnet’ of the UK economy. Headwinds such as the Ukraine invasion, inflation, food shortages, and lingering Covid effects are not very much in evidence. We seem to have limitless funds, and some indicators seem to support this assumption!

VIX,VIX, It’s All About VIX

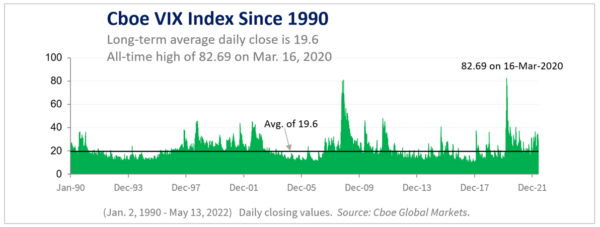

For us as options traders probably the key element in trade entry is volatility. We like to buy cheap and sell expensive premium. So, how do we know vol is low? Here’s the short answer….19.

Flippant commentary aside, we can see the average has been 19.6 over the last 30+ years but clearly it is not as simple as outright selling the farm when VIX is >19.6. It is funny to see how the Twitterati seem to think buying a gazillion calls on XYZ stock is the answer. Without context such as implied vol such trading is crude and unsustainable. The outrage when their calls expire worthless or at a loss despite their underlying stock rising 20% is predictably cringeworthy. We trade our way, managing risk and not taking any particular direction, using strategies, and a stodgy underlying that rewards with lower risk than a single stock. Intelligence is not much of a barrier to trading anything, but it is expected that options trading attracts the more ‘enlightened’.

Distraction Trades

ADA now $0.4554 Bale or stick with it? My own stake is ‘relatively modest’ and I can afford not to cut losses as I have no idea what is going on with crypto. I believe ADA does have useful applications, and if I get my money back in 5 years it’s fine.

XRPUSD now $0.3834

DAX 4 non-starters 1 win 100+, though this is not a momentum play and it seems since 10 May the force is with the upside. Our win was a downside play.

Legacy Trade 267 and 268 That Crazy 3by2

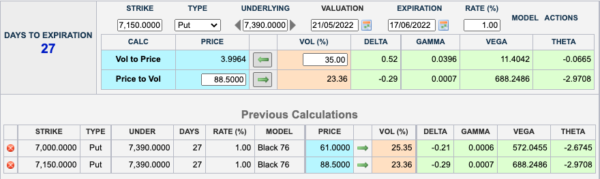

267 We Go Assymetric

So here we see the CME futures options calculator. However for our purposes, the future is not far from the cash. So instead of doing a simple ratio buying one selling 2, (OK sometimes we sell 3!) We buy 2(two) and sell 3(three).

Hopefully you will see the prices make this a tiny credit trade 88.5×2 -61×3= 6. Our real point of interest is how the Greeks stack up,and this could do very well if the market carries on down. Bear in mind that to date the S&P500 is down 18.66% Nasdaq down 28.28% FTSE is flat, but since when were we immune from the US? Hence this trade to capture a gentle down market in the next few weeks. Zero upside risk, downside 6900 …. But with many possible adjustments

Prices now 24 and 15.5 so.. 48 and 46.5 We can afford to sit on this it’s a freebie-tiny credit, so it’s only costing us a modest amount of margin.

268 -About 3 weeks to Expiry

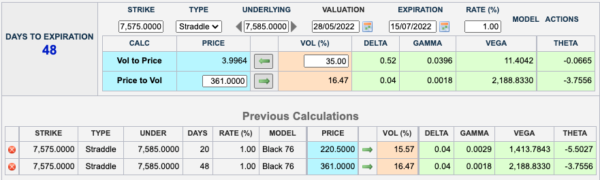

Much to mull over and so many potential trades, let’s go with an old but quirky friend- the ‘bonkers’ calendar straddle 2×3. I have had fun trying to place this with my broker, but when it works……. so what is it? We buy 3 near month straddles and sell 2 next month straddles. Logic of the trade, we have an extra straddle with greater gamma and delta primed for a big move. NB I have used the CME calculator in ‘straddle’ mode, rather than inputting individual legs.

What could go wrong? Time decay and inertia are our enemies. This is not a well researched strategy as the entry rules are a bit of a secret, but hey, we don’t learn unless we break stuff, right? Oh and by selling 2 and buying 3 we still get a credit 60.5 (361×2=722, 220.5 =661.5 )

You all know a straddle is same strikes,put and call ATM or as near as.