That Was The Week, Crazy Times

Well, if anyone has any insights into the week’s action we’d love to know. Watchers of the US market will have seen Friday’s rampant price ‘movement’ and of course options expiry is a massive event. We might cynically speculate that the moves helped people out of their short calls, and then their short puts. However with more money than the UK economy at stake it’s no surprise-in fact a quiet US expiry is a surprise. So, to confirm US expiry a quick Google search gave this:

[ What is Expiration Time (in Options)?

Expiration time in options trading occurs on the third Saturday of the expiration month at 11:59 a.m. EST.

The expiration time is not to be confused with the last day to trade options, which is the third Friday of the expiration month.]

And then this:

[Why does option trading exist?

For speculators, options can offer lower-cost ways to go long or short the market with limited downside risk.

Options also give traders and investors more flexible and complex strategies such as spread and combinations that can be potentially profitable under any market scenario.]

I’m guessing the questioner was one annoyed losing trader! However that is the best explanation I’ve seen.

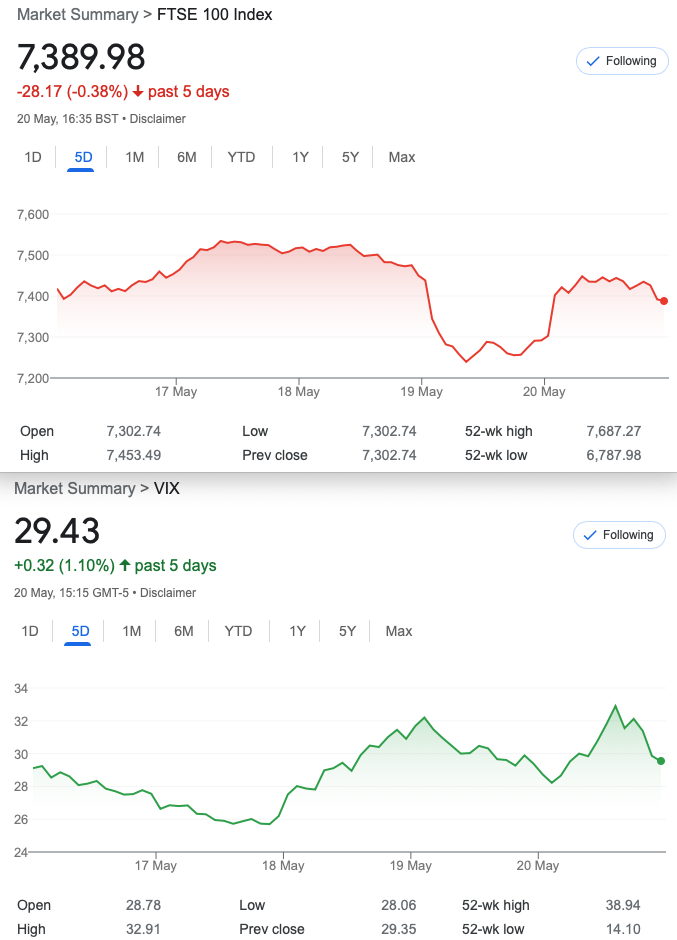

We hope our readers, like us, had a healthy expiry with short options going out worthless. Incidentally we hope you remember FTSE expires at the level determined by the auction at 10:00 am. So we can trade up until that time, but it’s edge of the seat stuff.

Portfolio Hedge

So last week we started to monitor a proposed hedge, selling 1 near month put buying 2-3 Nov puts with same gamma.

Prices were 207(Nov) and 66(jun)yet something weird happened this week and the Nov 6500 put is now 170 with 6800 jun put 38.5.

However, we continue to monitor, and hope to understand better how this variant, new to us, proves its worth.

Distraction Trades

Crypto…….. ADA $0.52 XRP $0.41 So, this is not what anyone wants to see. And for folk like me who have no way to value these things, it’s a disappointment. However it is nothing like as rotten as trusting one’s hard earned in a ‘managed fund’ ISA.

DAX 1 loser one b/e+30 2 wins 120, 90. A productive week.

Legacy Trades, Wins,and New Expiry Month

263, 264 and 265 May Expiry. 266 3×1.

263 Call Ratio Spread

7550 /7700 call ratio buying one 7550(155) and selling two 7700(73) calls. Debit 155-(73×2) =9.

Risky? Not in the way you think it might be. Max profit 150-9=141 Risk at 7850

Rationale of this trade- market seems to be inching higher despite the headwinds so we could do very well here and the downside risk is maximum of our cost= 9.

2 weeks ago: 99 minus 37×2= 25

Now….it’s 21

Those premiums now 22 and 3.5×2 it’s still in profit but are we convinced? We run of course to expiry

Running to expiry would not have worked well. We book this as a non winner but plenty of chances to close out for >100% return on stake.

264 Is the Downside Already Being Overstated?

Arguably the top is in-and the worst thing one can do is make a prediction! Hey let’s just take a view and protect the upside by revisiting our old friend the Jade Lizard. It gives a fair bit of downside risk protection, and it’s rock solid to the upside.

Sell : 7600 call 74.5 buy: 7650call 54 gives us 20.5 and sell 7075 put 30.5 Total credit 51

So we have risk at 7025 but no upside risk as our premium = the value of the spread.(OK we get 1 !)

Remember we don’t include commissions as these are pure demonstration trades. We have no interest in bragging rights.

Was 66!

Now 12.5-7= 5.5 for the call spread, and 13.5 for the put = 19 CLOSE OUT– run for fun- WIN 100%

265 Double Down, Twice The Fun

So while this may merit some criticism, the logic of the trade and reasons therein have not changed. So we go in again

7600 call 35.5 7650 23.5 7075 put 44 Gave us 66, now as above it’s 19 CLOSE OUT! We take 44 and reduce risk going into expiry WIN!

Alternatively(and alongside for fun) we could also try 7500 call 70.5 7550 call 51 and 6950 put 30 = 49.5 Now ( 36.5-22=14.5 and 7.5) =22. WIN!

266 Calendar Ratio? Expiry on 20th

Hard to resist given the track record. so, we sell 3x May 7200 puts and buy 1 Jun 7200 put. Thus we have 25.5×3 credit and our cost 117 for jun put. We pay 41.5 and watch this like a hawk. Risk is big, theta is huge-would you take this on?

Credit 100 -41.5 debit= 58.5 WIN!

267 We Go Assymetric

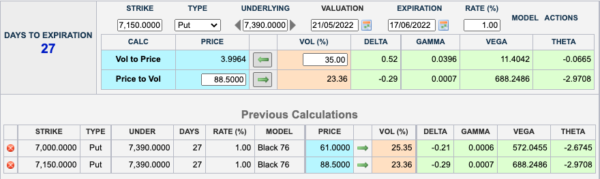

So here we see the CME futures options calculator. However for our purposes, the future is not far from the cash. So instead of doing a simple ratio buying one selling 2, (OK sometimes we sell 3!) We buy 2(two) and sell 3(three).

Hopefully you will see the prices make this a tiny credit trade 88.5×2 -61×3= 6. Our real point of interest is how the Greeks stack up,and this could do very well if the market carries on down. Bear in mind that to date the S&P500 is down 18.66% Nasdaq down 28.28% FTSE is flat, but since when were we immune from the US? Hence this trade to capture a gentle down market in the next few weeks. Zero upside risk, downside 6900 …. But with many possible adjustments