That Was The Week Big Up Big Down

The unrelenting comedy of FED announcements continues to amuse. So any claims by market pundits can safely be filed under’ hopeful but rubbish’! Of course these commentators have a job to do and fund managers also have a job. Neither seem to be particularly good, but that’s not the point. Thus claiming to know the future is a fatuous occupation. Managing other people’s money is a thankless occupation. So, when people tell you, following a sharp intake of breath that “options are risky”, let them enjoy the moment while we enrich ourselves. We manage risk, we do not make predictions. However we do make an estimate based on mathematical probability, based on real data.

Yours truly has been enjoying the delightful island of Crete and hence no missive last week. Seemingly I was not missed so much! However I am again reminded of the value of holidays, and being able to step back and audit one’s situation. Cretans are lovely and the lifestyle with 300 days of sunshine, is conducive to a long healthy life. We are fortunate to be able to make life choices outside of our income generation. Options, as if it needs be said, are not adversely affected by weather. No reliance on custom, nor subject to political or legal interference( for now) or so many of the factors of a regular business. We need not tolerate the great ‘unwashed’ but we do tend to operate in isolation. We can choose to involve ourselves in the ‘affairs of men’.

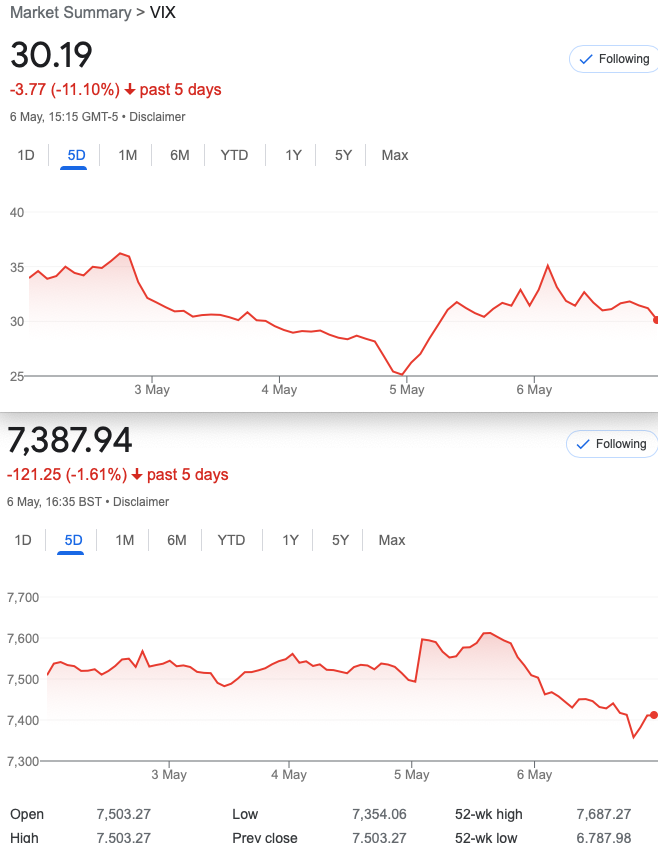

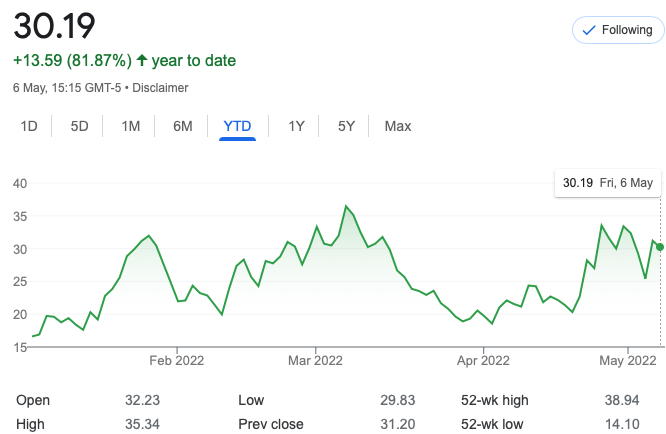

Here’s A Shocker For 2022

January seems a distant memory. FTSE was 7384. Say Whaaaaaaat??? My own personal ISA is down a staggering 10%. Before you say ‘serves you right’. This idiot couldn’t resist. I am now certain that pretty much anything tax free is not worth having. Making profits should attract tax, but these clowns mismanaging my ISA should be clawing back my losses from the taxman. 2020 saw me incur losses. HMRC are still apologising for not managing to get around to my own tax return. For the avoidance of doubt I managed my own risk very badly, and like many I could not see the ‘wood for the trees’ and there were monster opportunities. Here on this site!

Distraction Trades:

ADA Cardano $0.783 Cannot remember entry price but we are down >50%

XRPUSD $0.5985 down >50%

Crypto continues to disappoint but were they ever more than a punt based on FOMO?

DAX No trade entries possible, in retrospect

264 and Legacy Trade 263 May Expiry

7550 /7700 call ratio buying one 7550(155) and selling two 7700(73) calls. Debit 155-(73×2) =9.

Risky? Not in the way you think it might be. Max profit 150-9=141 Risk at 7850

Rationale of this trade- market seems to be inching higher despite the headwinds so we could do very well here and the downside risk is maximum of our cost= 9.

2 weeks ago: 99 minus 37×2= 25

Now….it’s 21

264 Is the Downside Already Being Overstated?

Arguably the top is in-and the worst thing one can do is make a prediction! Hey let’s just take a view and protect the upside by revisiting our old friend the Jade Lizard. It gives a fair bit of downside risk protection, and it’s rock solid to the upside.

Sell : 7600 call 74.5 buy: 7650call 54 gives us 20.5 and sell 7075 put 30.5 Total credit 51

So we have risk at 7025 but no upside risk as our premium = the value of the spread.(OK we get 1 !)

Remember we don’t include commissions as these are pure demonstration trades. We have no interest in bragging rights.

However, there will be no missive next week.(29 Apr)

Here we are again and it’s 66!

265 Double Down, Twice The Fun

So while this may merit some criticism, the logic of the trade and reasons therein have not changed. So we go in again

7600 call 35.5 7650 23.5 7075 put 44 Gives us 66

Alternatively(and alongside for fun) we could also try 7500 call 70.5 7550 call 51 and 6950 put 30 = 49.5