That Was The Week, Another Rise Despite………. Everything

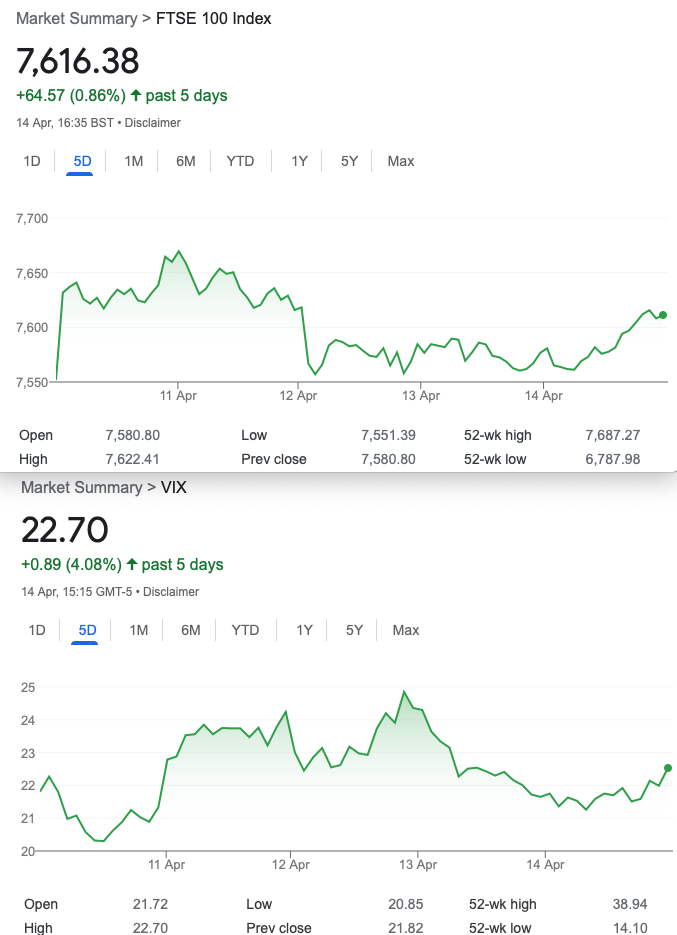

So, FTSE yet again seems to be brimming with optimism. Curiously we are told, in response to February contraction: The ONS also said that the UK economy is 1.5% above its pre-coronavirus pandemic level in February 2020. Hard to know what to think but they are the team with the numbers. However, I’m pretty sure we don’t need to mention the parlous state we are in, and as always we hark back to: The stock market is not the economy, it’s not even the real world.

The expiry at 7582 was, as usual, a dog’s breakfast -here’s a look at what happened:

It’s a 5 minute chart, and correct me if I’m wrong but I believe the ‘auction’ takes place at 10:00-10:10 am. I guess if you understand the formula( I don’t) you’ll know how to get a better outcome. Wonder what would happen if trading was halted during that time?

We’re light on newsworthy stuff this week but heartened by this: https://ir.theice.com/press/news-details/2022/Intercontinental-Exchange-and-McLaren-Racing-Launch-New-Partnership-With-Amplified-Focus-on-Sustainability-and-Diversity/default.aspx

Maybe they will be interested in raising the profile of trading UK options…..

Distraction Trades

DAX One loser– 30, no other trades! Well- we had a good run for a few weeks.

ADA Cardano $0.96 Still rubbish!

XRPSUD $0.776 Also rubbish

Legacy Trades now closed, and 263 -May Expiry

259

We chose something moderately conservative(with a small c)

6825 put 36 7600/7650 callspread 50.5 and 36 =14.5,plus 36=50.5 CREDIT

So, what is it you ask? Zero upside risk and downside risk at 6775? correct, it’s a……… Jade Lizard.

Was 19 for the put and 18 for the call spread.

Then it was 5.5 for the put, 18.5 for the call spread=24 -we could close out at 50% of max profit, but we will run it too.

That daft melt up gave us 33.5+1 =34.5 Still ahead.

WIN full premium 50.5

260

Let’s say we see the next few weeks of calm heads prevailing, but optimism sagging. We look at a wide call butterfly, with huge risk/reward.

We are buying the 7300 call (243) selling 2x 7450 calls (134 x2) 268 and buy the upper 7600 wing (54.5). And thus we have a debit of 29.5. Keen eyed followers will note the max profit is 150- 29.5=120.5 or 400%. (We can do without the hyperbole, we’d take 100% )

Now as expected 33.5 – some would declare this the trade of the century, making 13.5% in a week or >650% annualised!

It’s 15.5 and frankly a bit ugly

A rubbish week for this trade and we could only se at best about 22 to close out. Small LOSER!

261

Though we are loathe to get directional in a big way, Vol has dropped so much maybe there are some cheap puts……

A fun trade we’re going to buy (spend money….I know I know…) buying a put spread, buying the 7450 put 51.5 and sell the 7350 put 32 so our debit is 19.5. We can sell something else to fund this in full or partially, and here we sell a 7100 put for 12

Lat week- risk at 7000 but a debit(max loss) of only 7.5 and max possible profit 100-7.5= 92.5

It’s worth 2

Best we could do? Break even

262

We buy a 7700 May Call and 7600 May put. then, we sell 3x Apr 7700 Call and…. sell 3x Apr7600 puts

Here’s the crazy -we pay 113.5 and 142( 255.5) for the May options and we get 3x 29.5 and 31.5. =183 for the Apr shorts. This trade is expensive and risky -what could go right? Here’s the risk graph https://optioncreator.com/stqv6t8

The point of this trade is: can we get options worth more than the debit, given the crazy risk?

We are paying for this garbage remember! 72.5

WIIIIIIIIN!!!!! 211 considering the folly of this trade but we’d hoped to show risk management, from a trade that went wrong.

263 Gathering nuts in May

7550 /7700 call ratio buying one 7550(155) and selling two 7700(73) calls. Debit 155-(73×2) =9.

Risky? Not in the way you think it might be. Max profit 150-9=141 Risk at 7850

Rationale of this trade- market seems to be inching higher despite the headwinds so we could do very well here and the downside risk is maximum of our cost= 9. So, while everyone and his horse is so bearish we should not be surprised to see more upside.And…. it’s cheap.