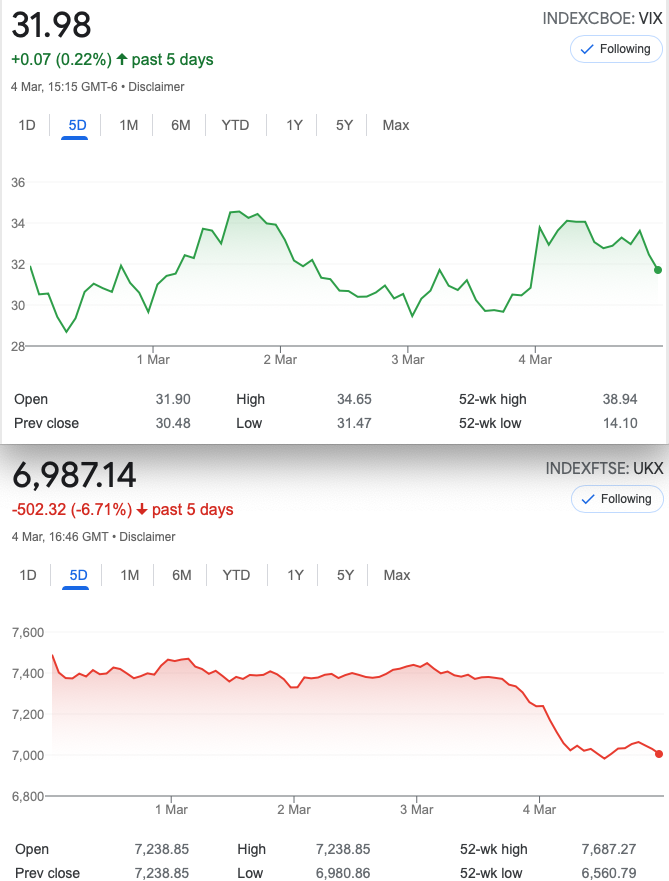

A Horrible Week All Round

https://www.thetechnicaltraders.com/sp-500-at-tipping-point-to-start-a-bear-market/

Sticking to the knitting it’s not looking good, and it may be appropriate to take a break from offering a trade. Realistically we cannot form any kind of view on the state of the market. Nothing is doing well apart from the obvious commodities. We trade the index because it does offer some diversification.

This idiot would rather not be trading but at March expiry I hope to be able to give a blow by blow account of my own initial trade entries and the reasons for them. Secondly the adjustments and the reasons there. Yes, some of the weekly trades here are my own but I always trade monthly expiries with anything from 2- 45 days to expiry. We remain very concerned about the bigger picture, our trading is trivial.

While I heartily recommend being on the sidelines in cash, it maybe a time to get further education from our chums at :

https://www.cboe.com/education/

There is some brilliant research, some good presentations, and a goldmine of articles. Our American cousins are richly served by this noble institution.

More institutional players fewer retail but numbers are up. An exchange is a great business -but sadly, they choose to ignore UK retail. LIFFE used to run events that were fairly well attended and useful. Maybe The ICE.com will thaw in our favour.

Distraction Trades

ADA Cordano $0.87 drop of 10%

XRPUSD $0.75 a slight gain

DAX 3 no entries one b/e +30, one loser -30. It’s a dismal performance

Legacy Trade 255, and 256 -Sometimes You make more by Sitting on Your Hands

255 After 4 big wins, what’s to do? GUTS that’s what!

Remember I mentioned being ITM is not as scary as you think? Well I DID say that! Time and again I have been in that position due to rubbish trading. And yet, here we are every month coming up with the goods. As I also said I was hoping to place this trade intra day with dynamic prices but the power grid denied me.

This trade is called a GUTS -sounds like stepping up to face the Jabberwocky, ballsy and fearless, but is it?

A GUTS is an in the money strangle- so you will always be closing for the minimum debit. Here we are 100 points ITM either side, so this trade can never be cheaper than 200 to close (in theory, I’ve yet to test that). We sell the following March options:

7400 call 197 7600 put 220.5= 417.5 credit

Currently 208.5 and 242 = 450.5 This is due to increased vol and we hold steady for now. We might have looked to close out for a small profit but who knows what’s in store.

256 Same again

In such uncertain times we would prefer to stay on the sidelines, but if push comes to shove -we repeat 255 with that juicer premium. 450.5

257

Friday morning and the FTSE dropped below 7200 which meant that this trade had to be closed out at latest at that stage.

7200 Was the point at which this trade could no longer be profitable. FTSE opened at 7193 Friday morning and already the trade at close of play the trade was 502.5 a loss of 68.5 x2 =137 aggregate trade entry: (417.5+450.5)/2= 434

257 recouping a loss?

At this point it’s worth reiterating: Sometimes you make more by sitting on your hands.

Taking a loss is tough but we’ve had a fantastic run, sometimes pushing the envelope a little too far, with surprising results.

Trade 257 is precisely this : Sitting on our hands.