That Was The Week- Non Farms, Facebook Fail, Bof E Goes Nuts Gas goes Nuclear

Non event is how we should greet non farm payrolls-this idiot thinks it’s a bit of a dinosaur. Mark Zuckerburg dropped $29 billion, but it’s only 1/3 of his pot, so….. Interest rates in the UK doubled! Will we ever recover from negative interest rates while inflation is north of 6%? Fuelled,in part, (pun intended) by the monster rise of gas prices. We have to ponder whether they have heard of derivatives. It’s fairly well known that one might use them to hedge positions and protect against price shocks. Naive, moi?

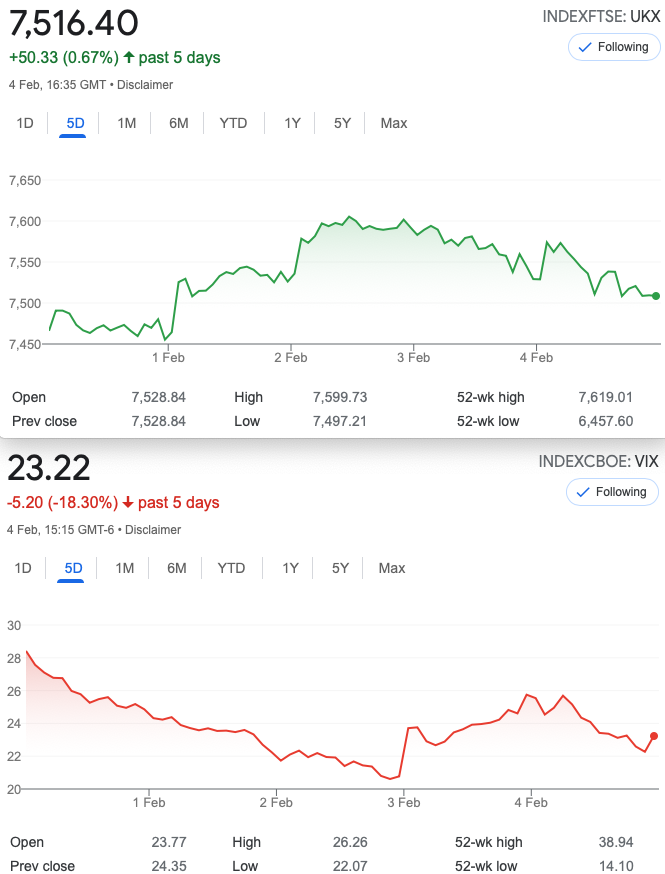

Our own FTSE ended the week 50 points higher as oils and banks add some juice to the index, of which they are a substantial part. Bizarre really that so many of us perceive them as enemies of the planet. For now we need them to ply their dismal trades.

The Wisdom of Sheldon

No, not that Sheldon, but the esteemed Mr Natenburg, author of the ‘workshop manual’ that we ALL own, or should.

So https://www.cboe.com/education

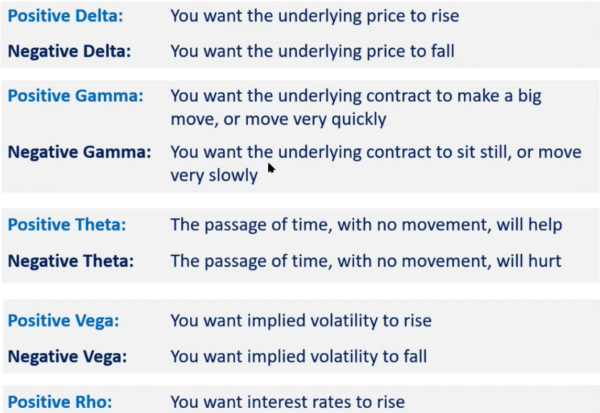

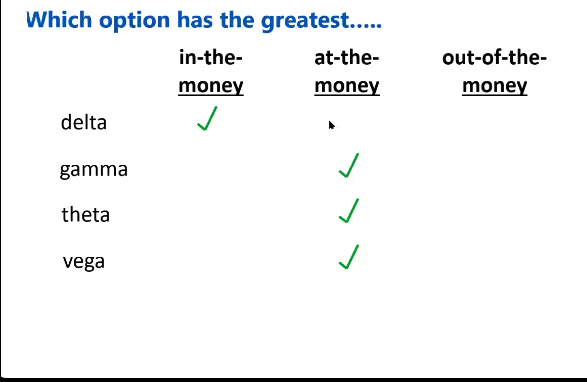

Very kindly started a series of webinars hosted by Sheldon and here’s a taster- a couple of slides you may find useful:

While we always trade with the Greeks in mind, they are of course dynamic and in my world I have a pretty good idea of my overall positions I have to do the maths having already placed the trade. Yes I do advance calcs but you get to know ± where you are in terms of Deltas simply by constant use of similar positions. I recommend our readers sign up via CBOE.

Distraction Trades

ADA Cardano now a sizzling $1.1550 -I have to state I timidly bought some more at $1.07 ( my average open $1.7049 )

I was motivated to buy ADA as it was so highly rated by Tom Gentile -my options tutor at Optionetics from2 decades ago!

XRPUSD $.6750 so, in line with other crypto’s we have seen some buying.

Apologies cannot acces DAX trades currently- So ‘publish and be damned’, to quote

Legacy 251, new Expiry cycle and 252 The Fork of Destiny!

So, let’s trade with the market’s money and use the Feb 7300 put that we own. Simple choice- the market may take a tumble on Monday based on the futures close, so we could wait, but lets do a put ratio spread at 7500(long) 7400 shortx2

Thus we have the following prices: 137 and 100.5×2. We are now the proud owners of a butterfly. We are bulletproof. Our credit on this trade is 64. We could have sold the 7300 put for 74.(We still bank 64 and buy a pizza!) However this way we could make another 100

Last week: the butterfly is worth only 10 but we run of course to expiry.

NOW: 13– but that is the way with ‘flies until the day before expiry really.

252 a game of forks- we used March expiry

Hopefully you can see puts and calls at the 7150 strike for March expiry, whereby we sell the call and 3xputs at the same strike roughly below the index minus the straddle- but with some wiggle room. We like have roughly level premium either side 382 for the call and 122×3 (366) for the puts.

We can use the premium to do something interesting too -we take in a whopping 748.

Now? 644– but on Tuesday it was 652. Either way- we’d take a profit of ± 100. In %age terms this is not huge compared to margin required but it is a peach of a trade again. WIN!

253 Vol has shrunk- what’s to do?

It may be that given the mild moves we’ve seen, that vol is shrinking and the market going nowhere- just an opinion, but what’s to do? It’s a double ratio, buying the straddle and then we ratio the wings of a short iron butterfly. Say WHAAAT??

We buy the 7500 straddle and sell the wingsx2( 7600 calls and 7350 puts ) February prices

Note those prices – we pay 91.5 for the 7500 call and take in 44×2= 88 for selling 2x 7600 calls = 3.5

And the puts -we pay 98 for the 7500 and take in 50.5×2 for selling the 7350 puts = Credit 3.

We have risk at 7200 and 7700 but probably going to make more than the cost of 0.5