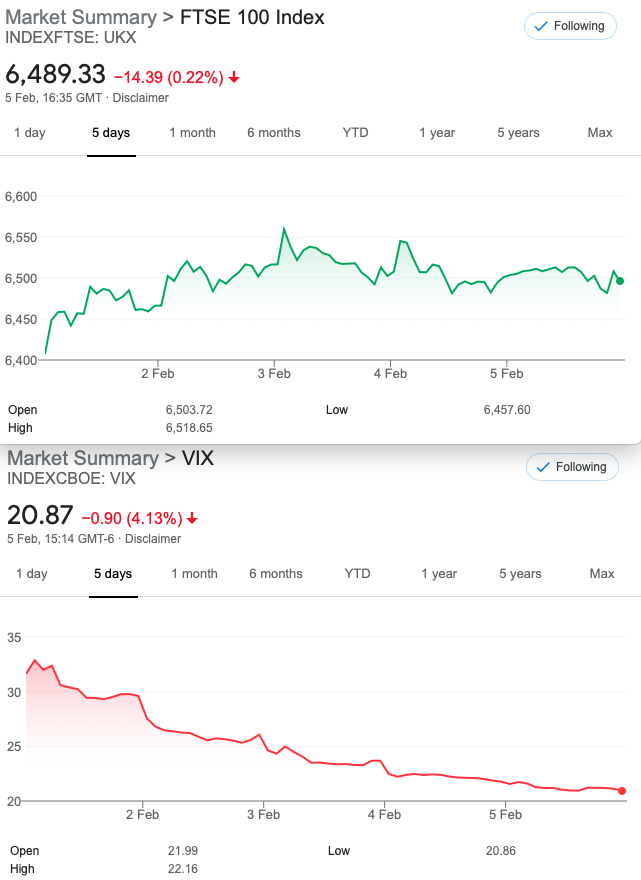

That Was The Week, Up a Bit, VIX Plummets

Vix drops 40% this week that is sending a clear signal that the buyers think it’s all peachy now. However we lack the UK equivalent which may not have been so drastic. So the market is a little undecided about the Gamestock nonsense and silver disappointed, despite the threats of a price ramp. US justice may provide a few fireworks as the impeachment proceedings get under way. Politics, as an old friend says, has a fleeting effect on markets. Politicians are replaceable, apparently money is not.

Negative rates, we’re told could be on the cards for cash on deposit. While inflation remains muted this may be a curious way to accelerate spending. This idiot has been saying for years that inflation was averted by shovelling the loose $trillions into the stock market. That seems to be the only inflationary asset, aided by quirks in the system and the rise of the RobinHood trader. OK beer is more costly, champagne- shop around for 2010 prices.

Distraction Trades

3 possible trades but entries were only 90% ‘legit’, and the outcomes were a miserly max 100 points on DAX. We continue, but wish it could be automated, though it would likely underperform. Sometimes discretion works best. Hence these are a distraction.

Why Are We So Rubbish at Risk?

Masks, distancing, washing hands- all sage advice but we tend to forget the risk of going to a hospital in the first place. Anyone familiar with the world of Nassim Taleb* will know about Iatrogenics: when a treatment causes more harm than benefit. As iatros means healer in Greek, the word means “caused by the healer” or “brought by the healer.”

https://www.theguardian.com/books/2012/nov/21/antifragile-how-to-live-nassim-nicholas-taleb-review

*Caveat again- not everyone is a fan- see the link.

Only recently did trauma staff realise that if a patient is bleeding, you don’t pump them full of fluid, you let the blood do its work. Somewhat curious example. Survival rates were thus, much improved. This is not the place to discuss Covid but clearly there are people who have no idea about managing risk, by holding large gatherings. I’d rather have normality restored a few months earlier, and not put others at risk. Eeeew politics- sorry.

Options help us manage risk in that we have so many variables, though by particiapting in the market we do put ourselves in ‘harm’s way’. However a recent tv show about homebuilding projects was an eye opener, as the comfortable looking older couple who had bought a wreck of a building, turned out to be skydivers. The show’s host said that they were risk takers. ‘Risk managers’ they replied, as stats show for their sport, tandem jumping, tell us. Their project was of course a risk like all the other venutures but as they pointed out without taking risks you achieve nothing. They achieved their goal, of course. By managing risks even when they looked troubling.

Trade204 In a Stagnant Market

Let’s look at a low risk trade- the Iron Butterfly. This means we buy the wings and sell the body: wing 6800 call 61, body:( 6700call 108, 6700 put 128), lower wing:6600 put 90. Thus we have 108+128= 236- (90+61)= 151. Which gives 77. Risk therefore 100-77=23

Horrible- right now 87.5 to close- will we see 6700 again this cycle? LOSER

NB I commented that my delta calculations were wrong- who spotted it? Butterflies are generally ±Delta neutral

We will run these some more,for fun- still horrible! Honestly I’d close out take a hit of 10 and tell myself well done for taking the trade.

Trade205 Strangle versus ratio

Selling Vol. I was once told that in a big volatility expansion it pays to sell both sides as the contraction can often make the trade a win regardless of direction. VIX is up from 24 to 33. So how would one do this? Sell a strangle? What if you bought lower vol and sold more and higher vol?

Compare and contrast Strangle: 1 ∑( one standard deviation) typically 0.16 delta gives us Call: 6700 @21.5 Put: 6000@44 total premium 65.5 risk at 6765.5 and 5934.5. Now 9.5 for the call and 7.5 for the put HUGE WIN (65.5-17 )= 48.5 Close that puppy!

Ratio that: Puts 6200 and 6050×2 give us 78.5 and 51×2.= 23.5 Calls 6650 @ 32, 6700 @ 21.5×2 = 11 Total premium taken in 34.5. Risk at 5855 and 6795

16. 5 and 9×2 for the put ratio = debit 1.5 to close 16.5 9.5 x2 for the call ratio thus 2.5 debit to close. Total premium at entry 34.5- 4= 30.5 WIN

OK, I grudgingly admit the strangle did better for now…..

Trade 206 A Recent Happy Butterfly Variation

We recently used the far month’s put option as the lower leg of the put butterfly to mitigate theta. Volatility has been smashed to bits for Feb, so we will buy a put spread for March 6350/6250 (111.5, 83.5). We also sell the Feb 6250 put for 21.5. Now our trade costs us 111.5-( 83.5+21.5=105 ). It’s a small debit of 6.5 It is a trade I cannot put a name to, other than a sort of calendar ratio.

Caveat -it would have been good to sell more of the Feb but as prices are grim, it’s a risk/reward not worth taking. We do now have risk at 6150, max profit 11-6.5= 93.5.