That Was The Week FTSE Went Nuts

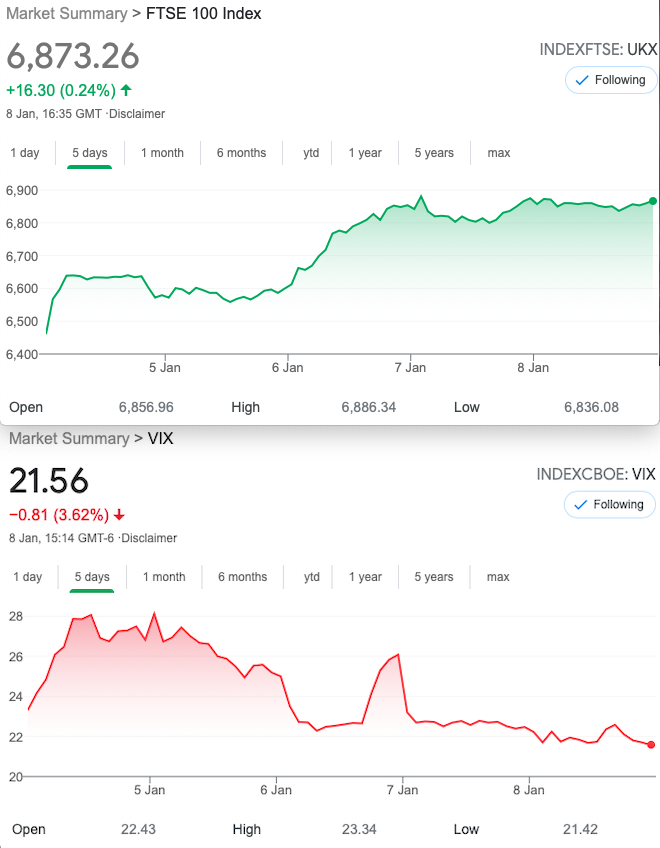

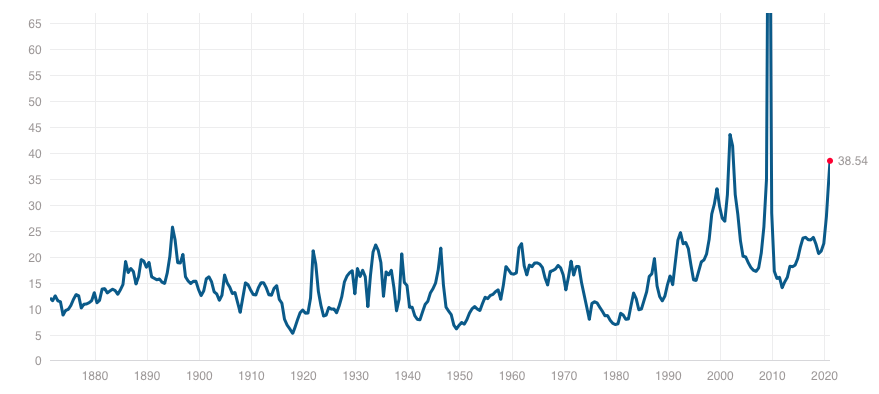

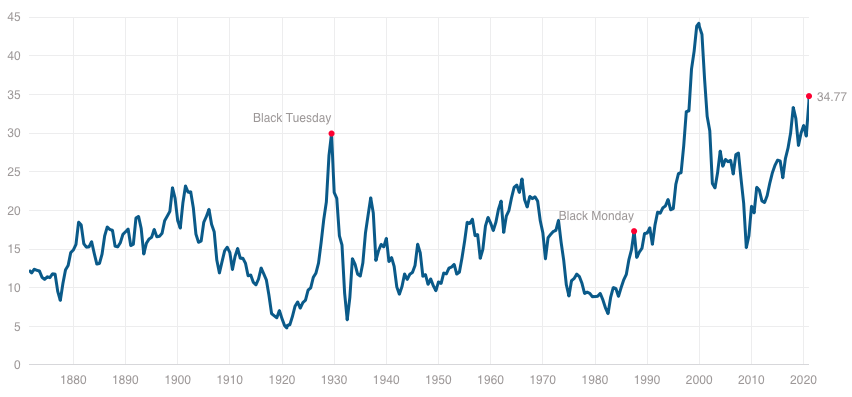

What is going on? FTSE UP 6.4%- because Covid, Brexit, it’s all going so well? Forgive my cynicism, but in a week that saw America lose the plot and Elon Musk become the world’s richest person, nothing seems to add up. Think Tesla is overvalued with a P/E of 1,744? (yes one thousand seven hundred and forty four). Depending on the source Daimler AG, parent company of Mercedes Benz is on a P/E of 1,870(Google finance) And 1,989(Yahoo Finance). However it seems this may be a nonsense. Other large caps on reasonable P/Es Apple 40.32 MSFT 35.43 Pfizer 24 Here’s a look at 2 versions of P/E for the S&P 500

Thanks to Robert Shiller http://www.econ.yale.edu/~shiller/ for chart 2 which is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio, or PE 10 . So, is anything going to stop the endless optimism for stocks? Received wisdom says you will not get your money back for decades, if investing when P/E is so much higher above the historical average. Just a musing, NOT any kind of advice, my own track record is terrible! Considering the massive rise in 2020 anything is possible and the new ‘norm’ may be P/Es in the 50s as the free money needs to find a return.

Distraction Trades

Monday around 08:30 DAX 100+ points, FTSE Wed at 08:20 about 300 points -it seems long trades are the most frequent. Additionally they seem easier to hang on to, as shorts turn rapidly. It’s not easy and vigilance is required for those time sensitive entries. Hard work to get 2-4 trades a week. However, we persevere, and salute those directional traders who make it work.

Legacy Trades and Our Latest Offering

Our combination trade-selling the 6850 call and buying the 6300 put.

So, we chose to close out and take the (60.5-7) 53.5 credit Job done- but that’s not all as they say in the cheesy ads. What if we morphed that trade?

Those choices:

Sell the 6500/6400 put ratio spread(1×2) to create a butterfly that might get us another 100. Prices: 130, 88.5×2 gives us 47 credit, pay 7 to close the call, making us bulletproof. Rubbish result collect 40

Buy the call spread 6750/6850, thus creating a call ratio spread (16-7) cost us 9. Why do this? FTSE may get a little trip up to 6750 or so. Create a put ratio spread by selling 2×6200 puts at 42.5 x2= 85 credit. We had an overall credit of 76, risk at 5.6% below( 6100 )and 7.6% above-( 6950), and a chance to make another 100. Well- the market went postal! The put ratio spread 2 to close, the call ratio? Yikes a credit 3.5. this could make MORE!

Bring on expiry…..

Trade 201 of 2021

I think by necessity this has to be a 2×1 just to keep numerical symmetry. 6350/ 6200 puts buying 1 6350 at 73 and selling 2 of the 6200s at 42.5. January expiry.Thus we have a credit of 12 and risk at…… 6050 (The December low was 6135) Should the market take a big tumble, we can look at adjustment and maybe learn a new trick or two. WIN -we collect the humble 12 more or less, but run to expiry.

Trade 202

So, an old chestnut- the short term strangle, given only a week to expiry and nice premiums. Sell the 7000 call Sell the 6650 put (each priced at 12.5) For credit 25.

Naked, yes. Foolhardy- possibly but with effectively 4 trading days to go and risk at 7025 and 6625 FTSE at 6873 we have some leeway. Also there may be huge scope for adjustment, rolling into the Feb expiry.

Apology and Caveat

Firstly an apology I ran out of time to do this, but may try next month to show up to 20 strategies for one trade, a week out from expiry.

Caveat- my opinions here are from a total outsider’s point of view. I am not privy to the machinations of the hedge funds, the trading houses or indeed market makers in our tiny FTSE world. This site should educate with real trades, anything else is just my jaded opinion on actual events, and information.