That Was The Week- Not So Bad Considering……….

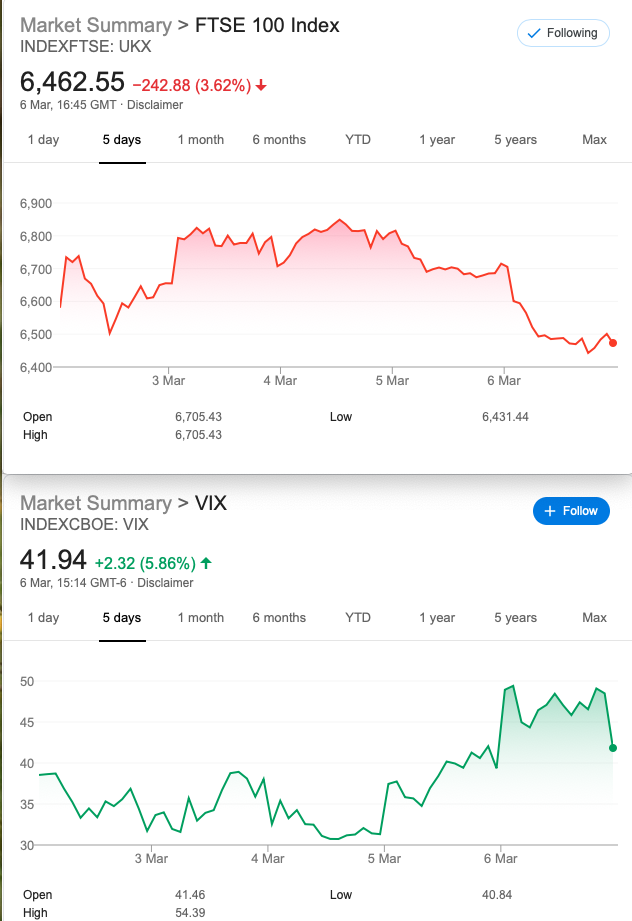

Previously FTSE had lost >11% in one week and there seemed to be no bottom in sight. No change there, as nobody is making predictions. Of course the crazies are out saying buy buy buy. They do not know anything, they are just people desperately talking their own book. One of my many and various emails this week talked about the 3 stages of trade identification. 1. Determine direction 2. Determine support and resistance. 3. Have some sort of timeline, or position in a cycle. Sage advice indeed in a normal market.

Tempted To Trade?

When we see index options trading at 50% volatility, in normal times you’d be tripping over your feet trying to hit the sell button. Reason being https://uk.investing.com/indices/volatility-s-p-500-historical-data

Nearly always a spike up is quickly followed by a much more prolonged drop -also these spikes mostly come from a low base <10. Armed with such information as options traders we have had a tradeable ‘edge’. Until now-and if anyone says this time it’s different I think they are probably right. We have an entire generation of money managers who only know to ‘buy the dip’, as this has been their edge. Fuelled by easy money-how long have we been saying “this will not end well” ?

Feel The Need For a Cheap Little Trade?

Butterflies, butterflies. Never forget they cannot punish you any more than the debit paid. Pay 10, you can only lose 10 there is no early exercise with FTSE options. Fancy a dabble?

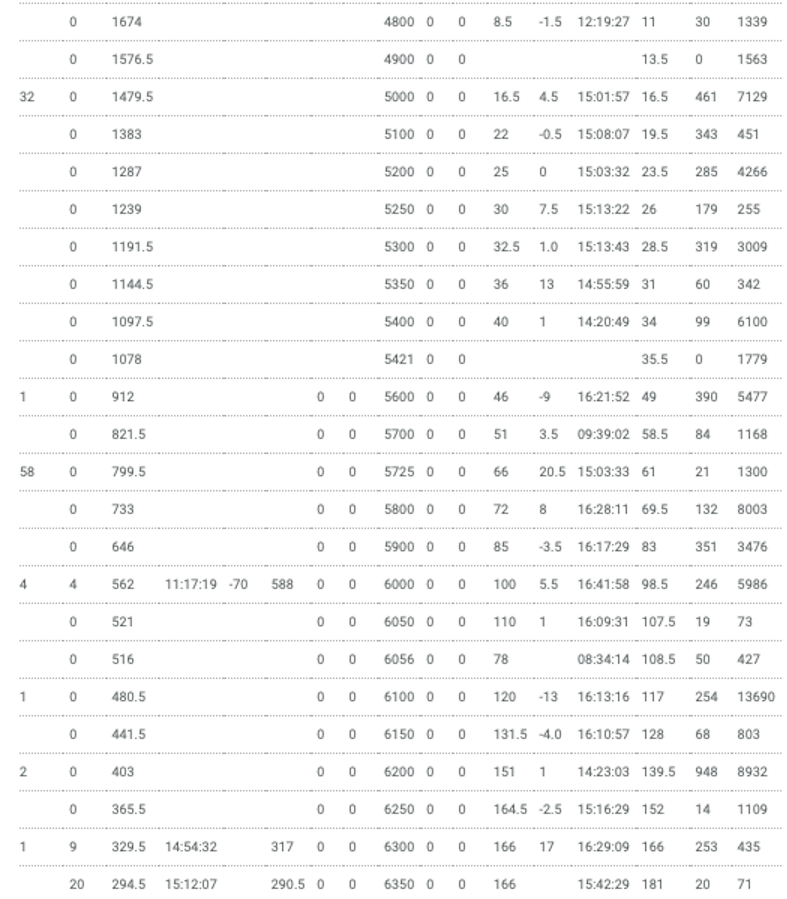

Look at those insane prices, strikes in the middle, don’t worry about the other numbers ↑

![]()

Thought you might like a quick look at the Greeks. I will not spoonfeed you- so let’s look at a 6300/6150/XXXX put butterfly. In the normal scheme of things we’d know the strike for that other wing. Here’s the prices: 166,128, 98.5. Fail to get the third strike? Pour that beer down the sink and consider yourself banished from the OIUK kingdom. So, as you all know with a butterfly we sell the body and buy the wings. We need a total of 4 options to do this so we sell the body twice. We now have a long spread and a short spread*, if FTSE goes anywhere outside our range we just lose our premium 166+98.5 -(128×2)=8.5. Now if FTSE were to close at expiry from 6290 – 6010, we’d make from break even to maximum £150 minus our stake of £8.50.

That’s about 20 to 1, and as the odds suggest this is not likely to make that full 150– but who knows? However, there is quite a good chance that you could double your money. Remember you may close out all or part of the trade any time.

*of course the third strike is 6000, those spreads are each worth 150.

Logic of The Trade?

This could make a profit if FTSE drops further but as always make up your own mind. What are the realistic odds of these strikes hitting the ‘sweet spot’? Other strikes and strategies may be available. Rumour has it you can use calls too!

Sorry! Omitted a key phrase with the profit potential of our butterfly. I would advise anyone who has allocated time to trading and is sidelined for now to do some research. How long until some genius comes up with a vaccine for cover-19? We have some major computing power now with several quantum computers online. Money will not even be relevant.

We will return to normality, I believe, but for now, trading is gambling as we have no edge.

Take a look back at some of the links to free education or you can message us here

prices for the butterfly: 6300:427-445 6150:335.5-353.5 6000: 261-277

mid prices 436, 346.5 x2= 693, 269. 705-693= 12. Not a trade to set the world alight but as it’s cheap as chips it has to run.

Not sure what to say as the butterfly is still worth about 11 but it’s 1,000 points in the money. Cannot see FTSE jumping that much next week, so personally I’d close out and keep my few pence in the purse. Others may let it run,and the Devil take the hindmost!