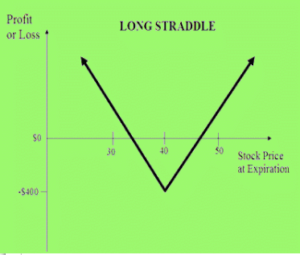

Straddle -Long, Defined Risk

This is not a hopeful trade given the woeful performance of VIX( 9.36) and VFTSE (10.13) . History may therefore not be a helpful guide here. I just thought it possibly looked cheap at 61.5 for the Call and 76.5 for the Put at 7450 strike. A buy at 138. How did this straddle thus compare to previous years? Using the 3rd Friday of July and August expiries.

2014 140 (VFTSE= 12.2) 2015 190 (VFTSE=12.165 ) 2016 230.5 (VFTSE= 15.7).

A Straddle is A straddle is A straddle etc

The trade is the same-we are buying calls and puts ATM (at the money). Curiously the pricing this year, (138) given the background of ‘stupid low’ VFTSE is a bit expensive. At least that’s how it seems to me after some reflection.

A Debit Trade Again- bit is it Worth it?

I don’t like straddles, but I’d target a max 25% gain here. Low volatility is a perception. August is the oncoming silly season, anything could happen, but not necessarily to our benefit. The logic therefore would be to plan for a move rather than pay up big in the hope of one.

How Best To Manage This Trade

This is a kind of ‘set and forget’, where you place ‘limit’ orders to buy and then sell. This is not what a smart trader should to be married to!

A Winner! Yay, vol kicked up a little but the market drop was the key, on Friday. Yes, we’d close out for a nice 25%