That Was The Last Week of 2021

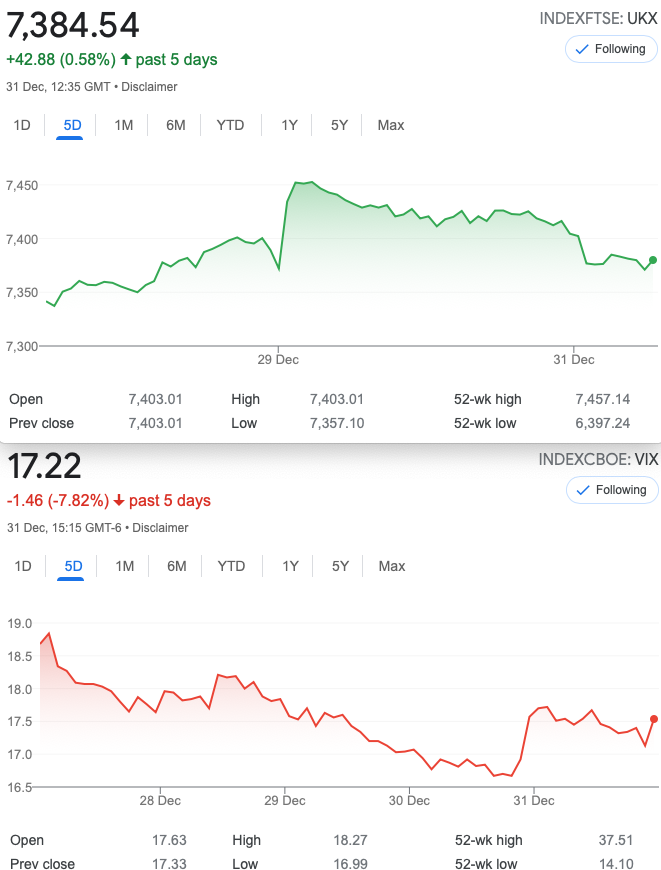

So, our first order of business- to wish all our readers a happy new year. 2021 was not a bad year for the stock market-the US roared +29% EU Stoxx did +23%, FTSE did……………13.6% . Traders, should we care? GBP is our base currency and bang for buck it makes little difference if trading FTSE or SPX. Despite dealing with HMRC there is a certain comfort in trading our own nation’s flagship index. Trading the stodgy old pudding is not as fraught as supporting our national football team. Thus rewards are hard won, but on familiar ground. American traders may enjoy fantastic data,andgreat platforms, but their rules seem to be far more complex than ours. Day traders have no problems here, AFAIK, with options. However we have our own bewildering margin rules. £3k for a short put. £6k for a short call.

I must declare this is my own personal rule of thumb. I ensure I never run my account to anything like 100%

Spreadbet platforms have their own margin rules I know but trade busts may surprise, and not in a good way. Check the small print then read it aloud to ensure it makes sense. Profitable trading is managing the tedium of the details. Being awesome for a month and then blowing up is an all too familiar tale. Manage the risk, collect the rewards. Pilots epitomise this approach, especially in the use of a checklist.

Distraction Trades

No DAX this week due to lack of trading days and low volume

Crypto’s continue to disappoint

XRPUSD $0.84

ADAUSD $1.33

Confession time here: I would not normally stick dogmatically to a strategy when the reuslts continue to disappoint, and with DAX this has been the case. However it has been an interesting experiment and overall boredom was the winner with tiny profits overall

Round Up of The Year

Most funds would be bragging, boasting about win rates but that is not our modus operandi. Suffice to say we had a few small losers, and those trades came with a caveat: We placed the trade fully expecting a bad outcome. Again this is not a boast, it is just that we don’t like some strategies. Placing 50 trades a year is no easy task. Winning is a reflection of how risk has been managed from the outset. Trade selection has been based on a ‘wet finger in the air’, using a vague feel for the market.(Note: I have a bearish outlook on the market but bullish on the human race)

I have no interest in totting up wins- readers here know how well the trades do, despite the author’s general incompetence. A couple of things came to light in 2021. There were no corrections, just the odd intra-day knee jerk. The market ignored the plight of the world, companies somehow booked profits. Somehow there were 138 up days against 117 down days. Governments doled out great wadges of cash. Can it continue in 2022?

Legacy Trade and 248

We morphed 247 into a huge butterfly 7150/7300/7450. This is already worth 30 and it’s what we would have to pay in normal circumstances. This is a kind of cheat but we need to show how options trading is ongoing and we cannot afford to miss entire trade entries, though sometimes finding a trade every single week is a big ask.

This week- it’s worth 36, not enough to get us interested -and remember we are playing with profits

248 Jan Expiry still has some juice in it

7200 put (32.5) and 7450/7500 call spread (43-25.5) -Can you tell what it is yet? (poor taste joke!)………………. Cheeky plagiarism from Tasty Trade, it’s the Jade Lizard. Selling the put and selling the call spread- We sell the 7450 and buy the 7500. This gives us zero risk to the upside. We take in 51 and our downside risk level is 7150. Hope the link works:

https://optioncreator.com/stnybbl