That Was The Week a Canal Was Unplugged Non Farms in a Vacuum

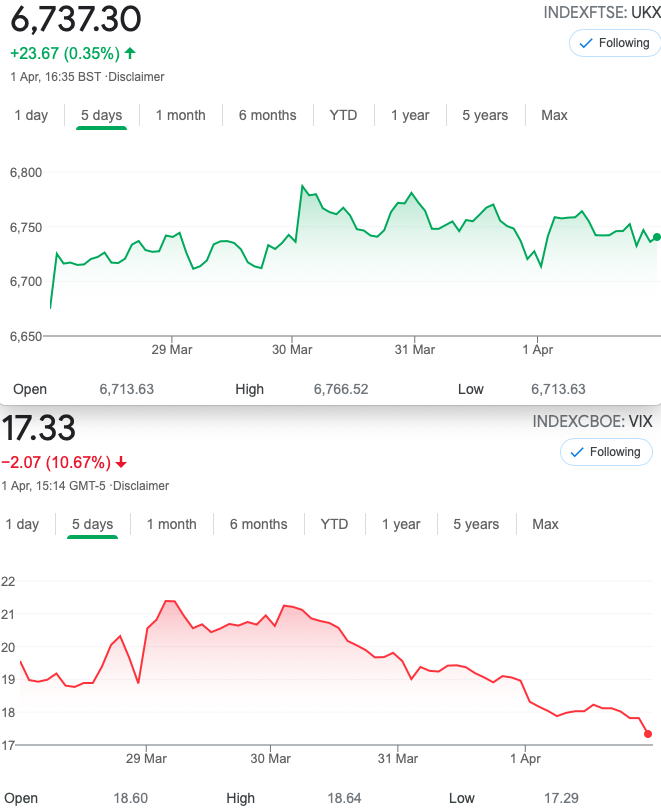

So, FTSE went pretty much nowhere, but it may be worth noting https://www.thetechnicaltraders.com/support-near-14358-on-transportation-index-suggests-rally-will-continue/ Transport is busy, goods are moving, money is flowing so goes the concept from a time when money was not literally plucked out of thin air. We saw allegedly good job numbers, though the unemployment claims failed to garner much attention. Unemployment(weekly) 719k against 916k for(monthly) non farms, if any of these numbers are credible. Data freely given has no value if it’s not half decent. Government data may be a tad on the ‘gentle side’. Like having your mum mark your homework!

Meanwhile here’s a stonking great hunk of metal. Sounds suspiciously like an Elon Musk name for a ship…..

So, I found myself talking of credibility, as this week saw the controversial https://youtu.be/1Q5CXN7soQg Seaspiracy on Netflix. Skeptic that I am, I was interested in the veracity of the ‘facts’ in this modern era of fake news and general chicanery. We like to fit facts to support our version of the truth. I suggest this film has integrity, but await a riposte. I contend that we start from a fixed position and in my case I’m always suspicious of good news. The stockmarket wants our money. Brokers want our business. I just want half decent information. So, I expect my money decisions to be based on cold hard facts. We do at least have reliable FTSE option prices. Exchange traded products to my mind are preferable to that ethereal world of digital. So NFTs are the new buzzword in this arena: https://twitter.com/opensea/status/1362656792405282817?s=20

Non Fungible Tokens -is this more tulip mania?

Distraction trades

DAX again provided the barest of entries this week, Wed and Thurs a couple of longs for 100 points. This method keeps us out of ugly trades, that is the aim.

Thwarted at previous attempts, baffled by new tech, I have finally opened a B*****e account to trade DOGEGBP. Having missed out on buying at 0.038, it briefly hit 0.050, and now rests at about 0.042. I have yet to pull the trigger while funding the account proved equally weird. Again how does one value a digital ‘asset’? My trusty Mac would not even allow be to open a DOGE coin account, having no verifiable certificate and requiring a piece of legacy software. I remain sceptical of the whole thing, but then I prevaricated with Bitcoin at <$20. Wonder how BTC is doing?

212 April Expiry -Movin’ On

We went with Liz and Jennys’ Jade Lizard. We sold a call spread and a put, but the premium taken in must equal the upside risk. Thus we sold the 6750/6800 call spread( 86-63.5) =22.5 and the 6300 put= 25.5 Total credit 48

Last week 6750/6800 call spread 74.5-51= 23.5 6300 put 13.5 = 37 total. 11 in credit

Now 22 and 8 =30 total -I’d close out taking 18 profit

Remember- Risk at 6252

Trade 213 Call of The Wild- Terrible Pun!

20 days to go to April expiry, we look at selling 2x April 6900 calls and buying 1xMay 6950 call for a debit 5 (46- (20.5×2) )

It’s a big theta play we are thus short gamma and delta, more or less neutral with vega but huge theta. This would get ugly at 7000

Now those prices, 12.5×2 37.5 = 12.5 credit (paid 5)

We run it to expiry 16th april

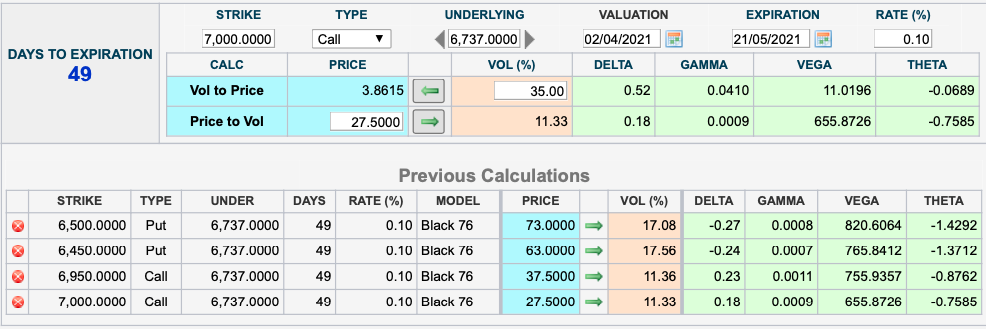

Trade 214 Iron Condor Credibility

Hope the graphic is easy to read -both sides give us a credit of 10– but would you risk 30 to get 20 with 49 days to go?

We will monitor that but let’s go crazy with a variant of the ratio calendar: We will sell 3, yes three 6750 April calls and buy 2 May 6750 calls. Nuts in May? Probably but we like to put things out there sometimes. Here are the numbers 108.5 x2 =217 minus 58×3 = 174, debit 43.

This is new territory* based on the 3×2 calendar straddle we have pinched in the past. No promises, it’s a fun trade.

*er, no it’s not we are already in a calendar trade, but hey it’s that time in the expiry cycle.